What’s AML compliance?

And… are you

affected by it?

Money laundering isn’t just a big-bank issue; it can affect various industries. It refers to the process of concealing the true source of illegally acquired funds. Even if you’re not a banking giant, your business might be subject to AML laws. Are you affected? Discover an overview of the main industries and let’s get started.

What is missing

in your compliance

process?

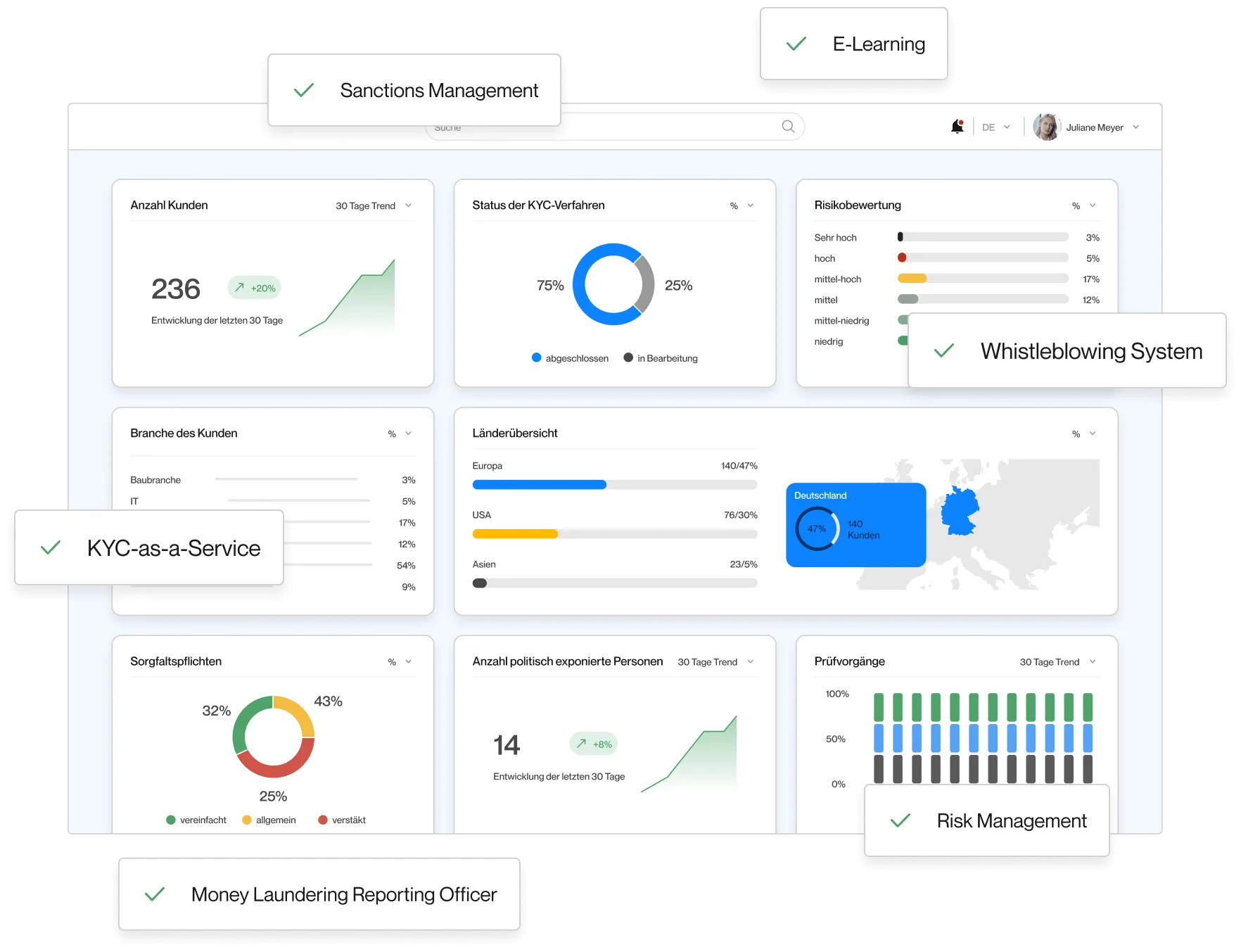

AML isn’t a one-size-fits-all game. While some could face whopping fines up to €5 million, you might wonder if your business is even on the radar. Uncertain about your AML compliance? Our Cockpit has the answers to fill in your gaps – and make sure your company remains fully compliant.

KYC-as-a-Service

We take care of your entire KYC journey from start to finish. Tailored to ensure complete compliance, we manage identity checks, risk ratings, and due diligence so you can focus on your business. Meet compliance the smart way.

E-Learning

Upgrade your team’s AML awareness or transform them into experts with our interactive e-learning platform. We make the complex simple, turning AML regulations and risk mitigation into actionable insights. Start learning effortlessly.

Whistleblower-System

Foster a culture of accountability and protect your company from scandals and breaches of the law. With our secure whistleblower system, you will ensure compliance with the EU Whistleblowing Directive and the German Whistleblower Protection Act. Are you ready to safeguard your operations?

Sanctions Management

Stay ahead of global sanctions with our automated screening tool. Reduce the risk of non-compliance by effortlessly checking customers against international databases. Simplify your sanctions management.

Dedicated Money Laundering Reporting Officer

Navigate the complexities of AML with a dedicated MLRO (Money Laundering Reporting Officer) by your side. We uphold the highest standards so your business remains compliant and secure. Ready for AML excellence?

Risk Management

Identify and evaluate all potential AML risk factors. We help you develop and implement sound principles, procedures and controls, including risk analysis, policies, and processes. Ready to manage your AML risk?

Get to know the law

and how it affects

your work

Essentials to consider

Explore our articles and find out more about compliance obligations and how Regpit can help you manage them.

What is money laundering? What does customer identification (KYC) mean? What is risk management? When must suspicious activity be reported?What’s at stake?

Not staying up-to-date with your compliance can lead to fines and consequences. But don’t worry, we are here to help!

Explore

Visit our

knowledge center

“Regpit assists us with our entire anti-money laundering compliance. Thanks to their solutions, we can fully focus on our daily business, knowing that Regpit ensures security and efficiency in this matter. Reliable and effective!”