Stricter Rules in the Fight Against Money Laundering and Terrorist Financing

Obliged Entities

One of the major changes will be the expansion of the scope of obliged entities. Currently, most financial institutions are already covered, as well as certain types of non-financial companies and some crypto-asset service providers. In the future, the following will also be included among the obliged entities:

- All types and categories of crypto-asset service providers

- Crowdfunding platforms and providers of crowdfunding services (falling under the EU Crowdfunding Regulation)

- Dealers in high-value goods, such as vehicles, jewellery, watches, boats, and traders in precious metals and stones

- Professional football clubs, though only in relation to specific types of transactions

These entities will now be counted.

Beneficial Ownership and Access to Registers

There are also changes concerning the declaration of beneficial owners and access to (transparency) registers. Legal persons based outside the EU will be required to register their beneficial owners if they have a connection to the EU (e.g. owning property within the EU). With regard to public access to the registers, the directive establishes that individuals with a legitimate interest will be granted access to the data. This includes, for example, journalists, NGOs, and competent authorities in third countries.

Cash Payment Limits

A general EU-wide cash payment limit of €10,000 will be introduced. Member States may decide to set or maintain lower national thresholds. Additionally, obliged entities will be required to identify and verify the identity of customers for cash transactions exceeding €3,000.

Information-Sharing Partnerships

Under the new rules, obliged entities will be permitted to form partnerships for information exchange to share data related to money laundering, terrorist financing, suspicious activity reports, and suspicious transactions. National FIUs and other authorities, such as law enforcement agencies, may participate in these information-sharing partnerships.

Single Digital Access Point for Real Estate Information

To make it easier for authorities to obtain financial information about real estate (e.g. sale prices or encumbrances), Member States will be required to establish a digital access portal. Details on how the portal will operate and be structured will be left up to the individual Member States.

When Will the Changes Take Effect?

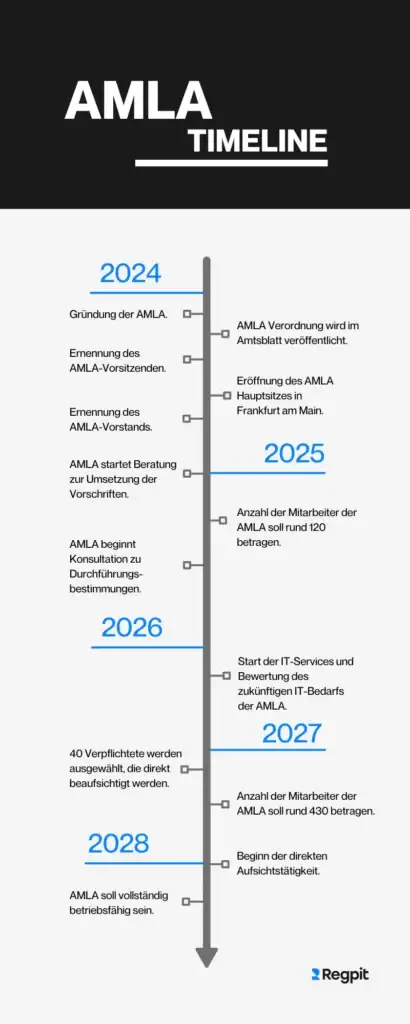

To fully implement the regulation and directive, technical standards will need to be developed to further specify many provisions. However, these standards cannot be finalised until the AMLA (Anti-Money Laundering Authority) is established. AMLA will be created shortly after the formal adoption of the regulation and is expected to become operational within approximately one year. The full regulatory framework, including technical standards, is expected to be ready by mid-2027, at which point it will become binding. However, not all rules will enter into force at the same time — for example, the rules concerning the football sector and the creation of a real estate access portal will only become applicable from 2029.

You can find the European Commission’s Q&A Catalogue here.