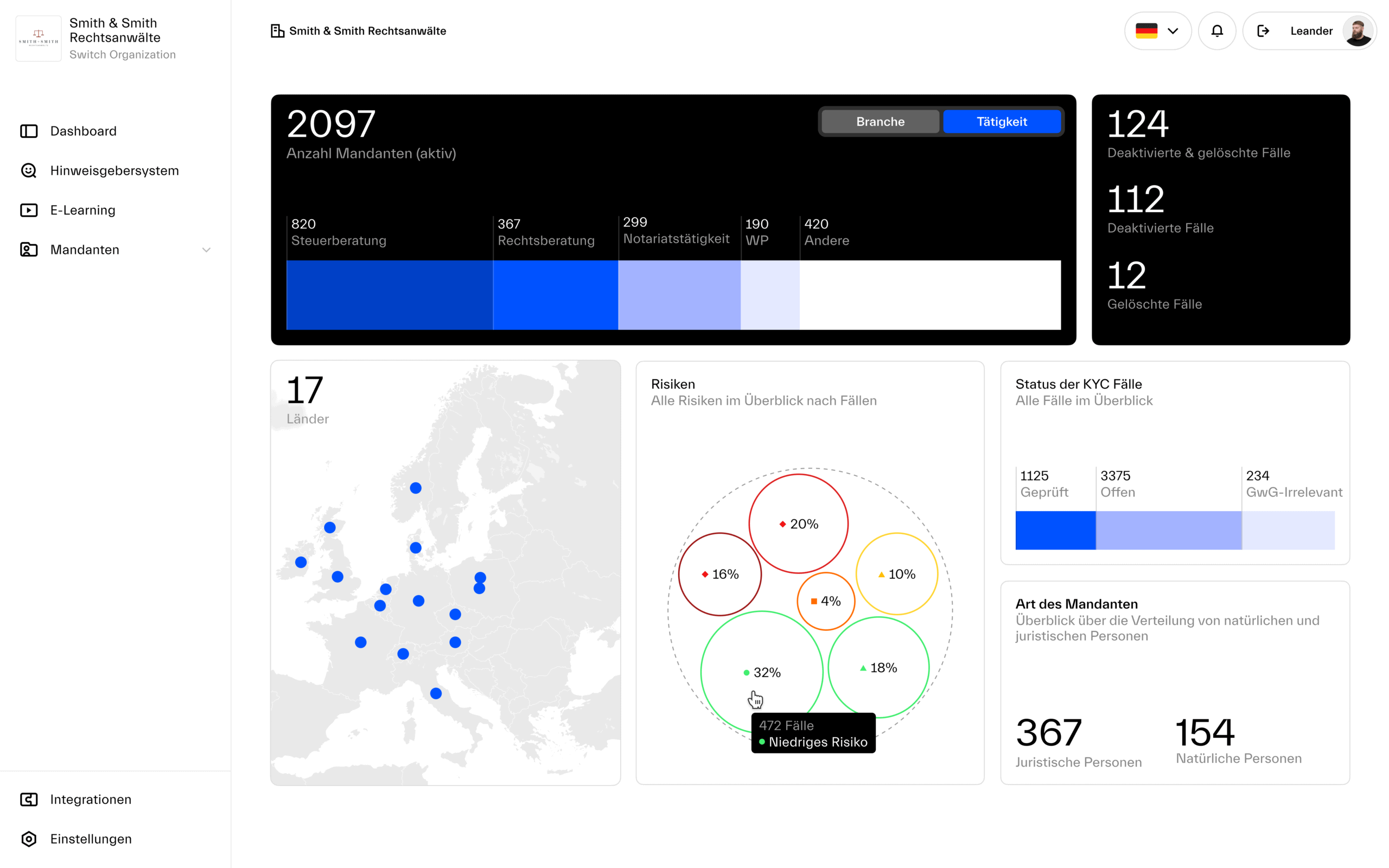

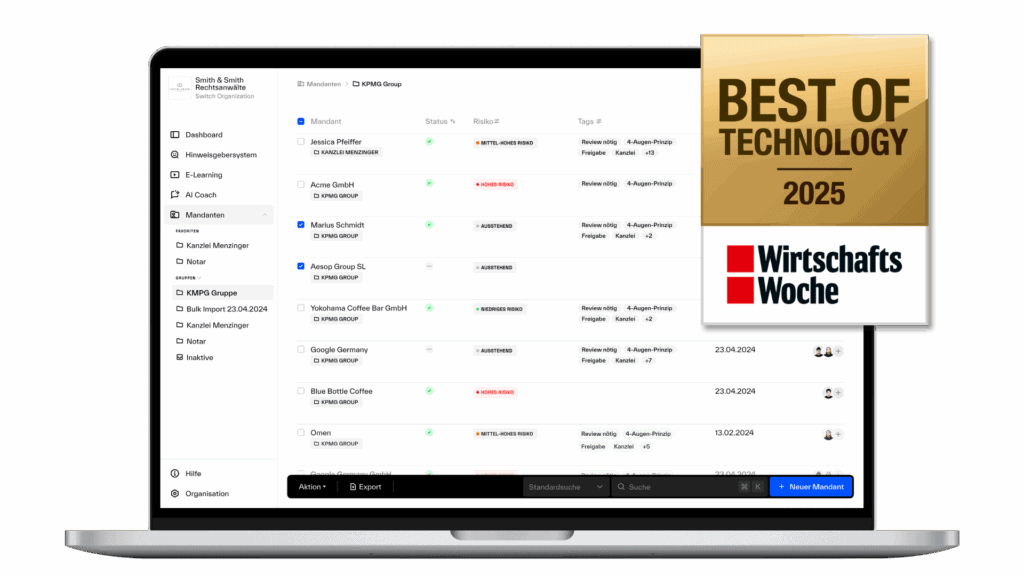

All processes for AML Compliance in one platform

Smart AML software for all your needs: From KYC to e-learning and expert support.

A selection of our clients

What is Regpit?

Regpit ist eine modulare Plattform für Anti-Money-Laundering (AML)-Compliance.

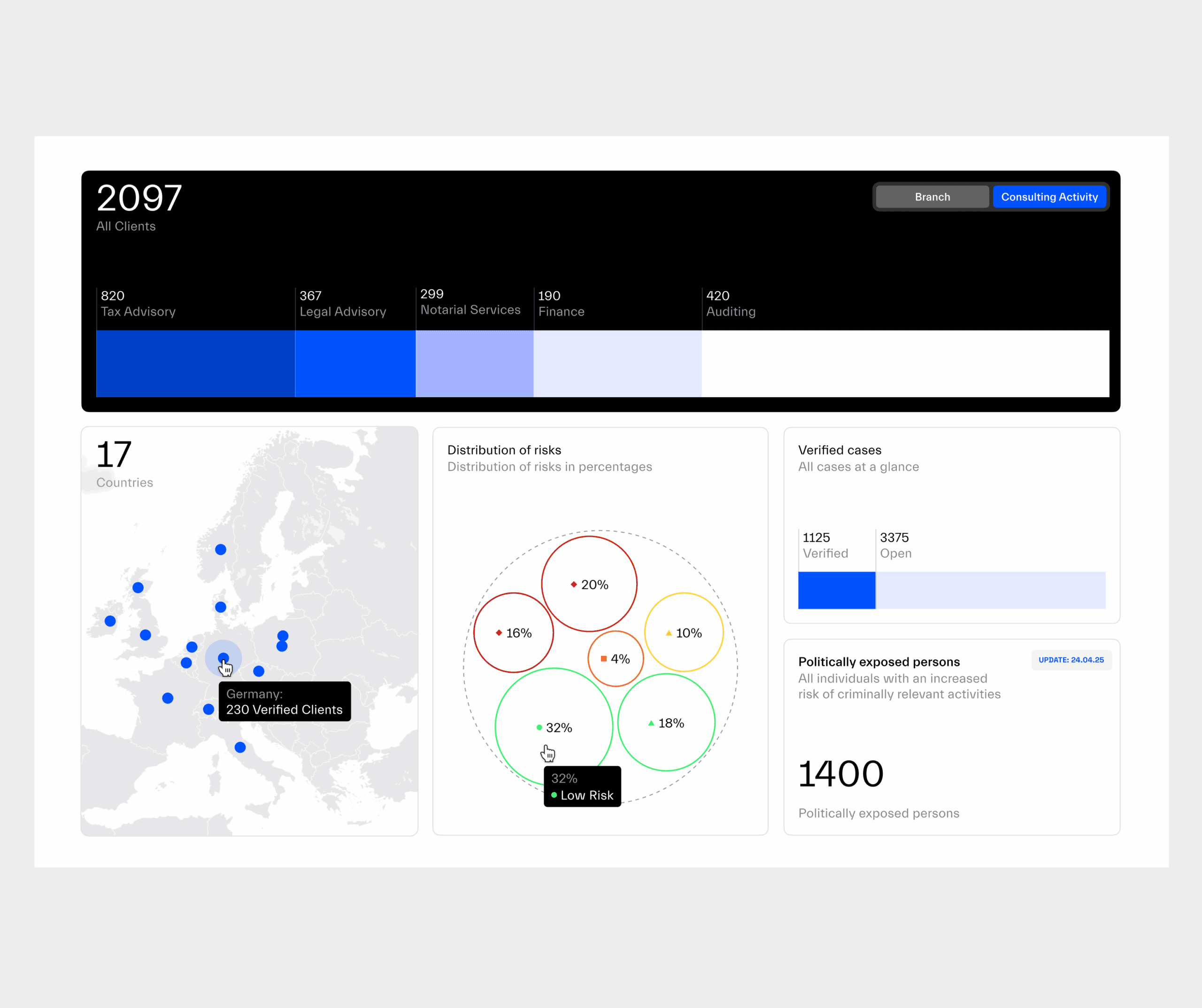

With Regpit, companies implement the requirements of the Money Laundering Act digitally and in a legally compliant manner: With a comprehensive solution for KYC processes, support from external money laundering experts and money laundering prevention training for their employees.

All processes run together automatically in a central dashboard and noticeably relieve your team, completely without IT effort.

Try for free

How Regpit works

Discover our platform in an interactive demo:

All functions for money laundering prevention in one platform

Choose flexibly: Individual modules or customized combinations.

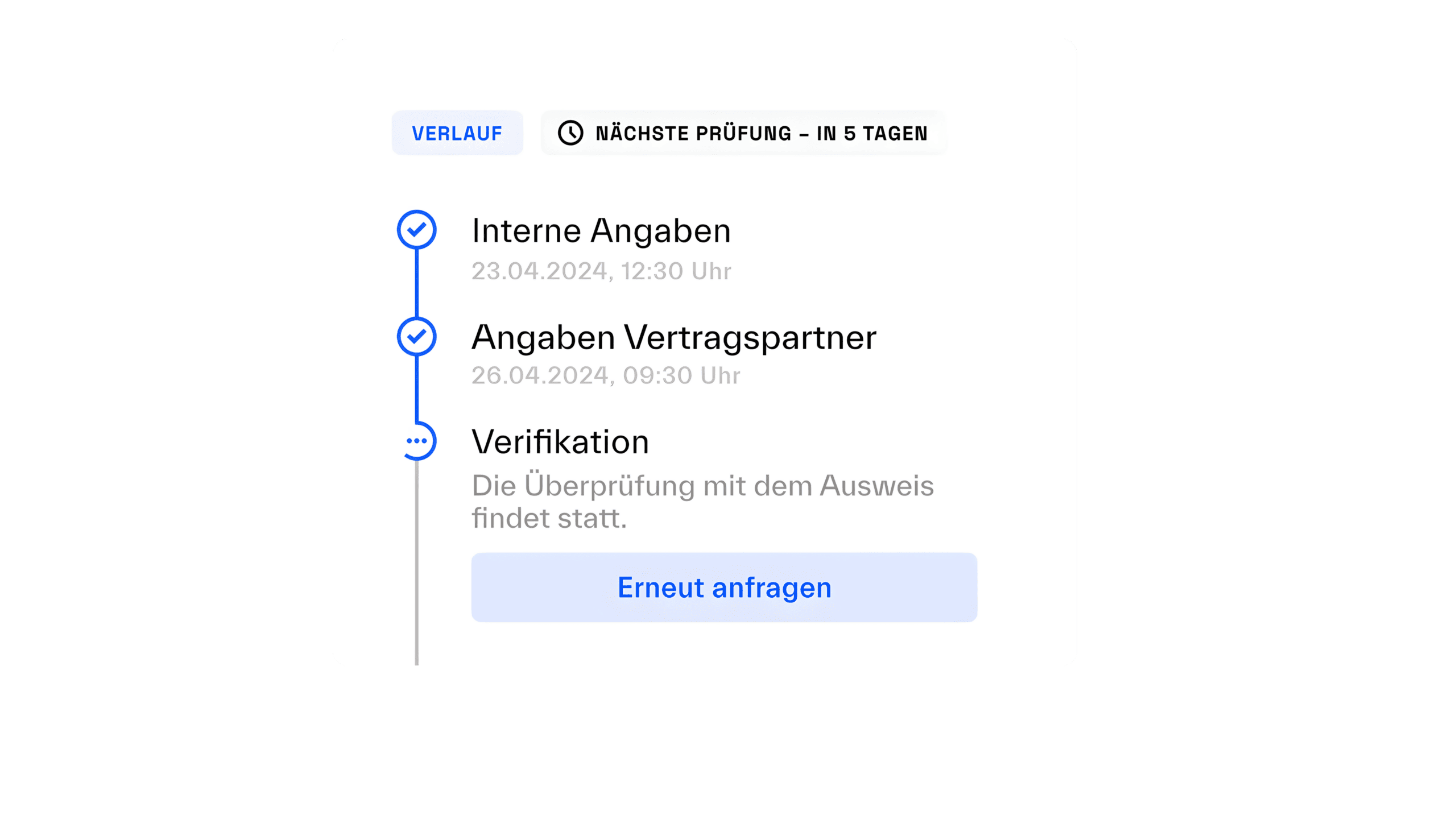

KYC/KYB Solution

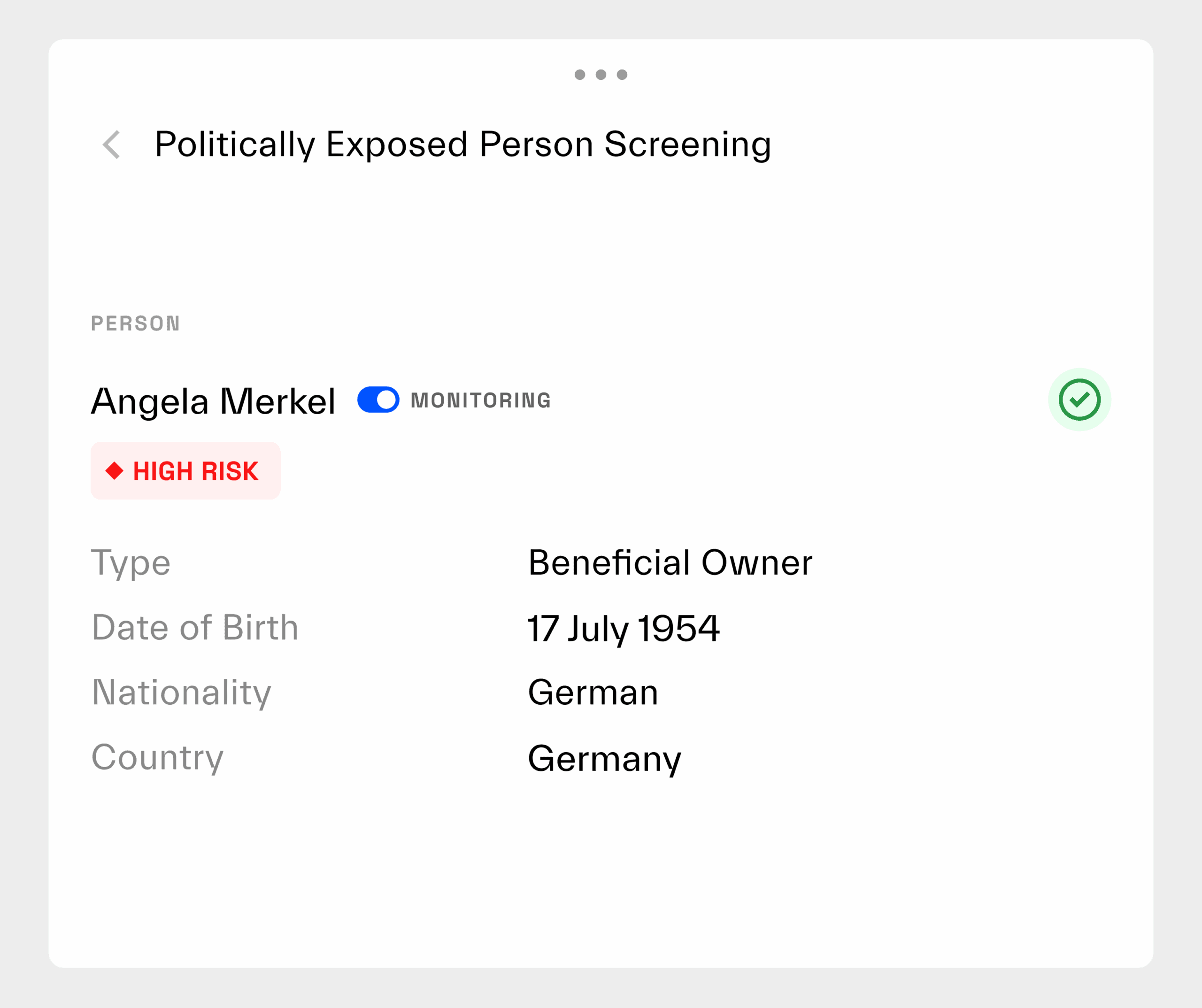

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

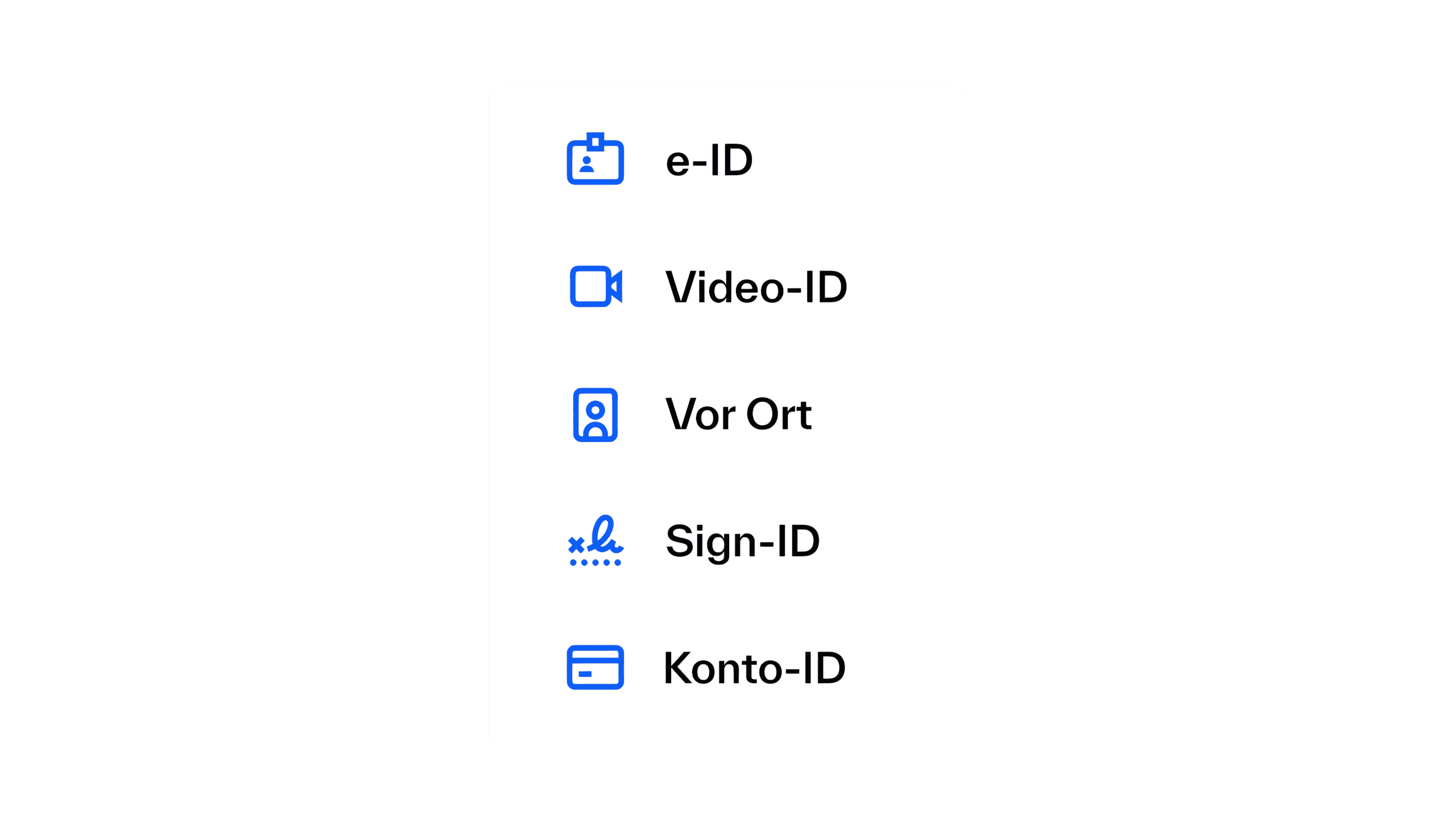

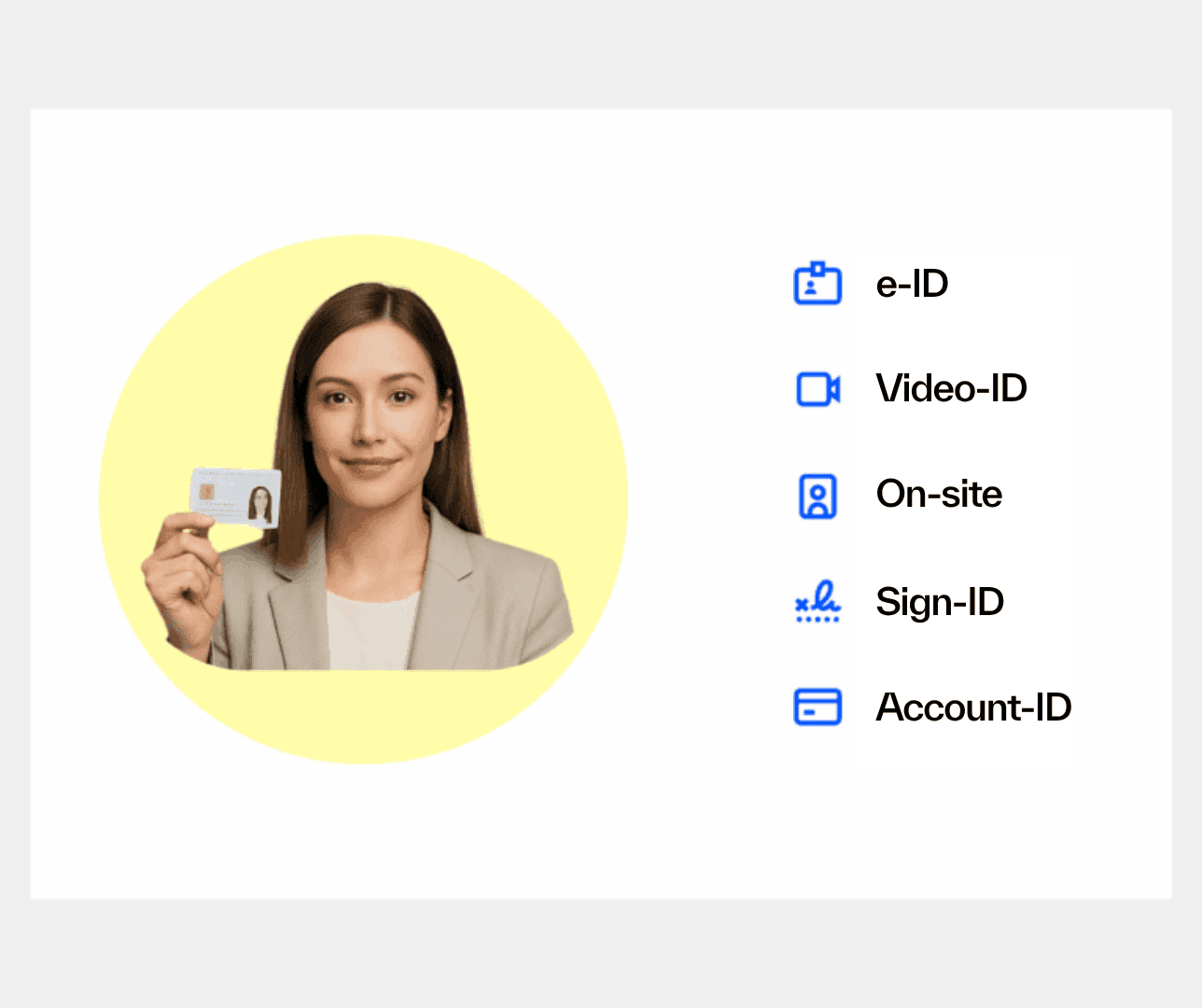

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

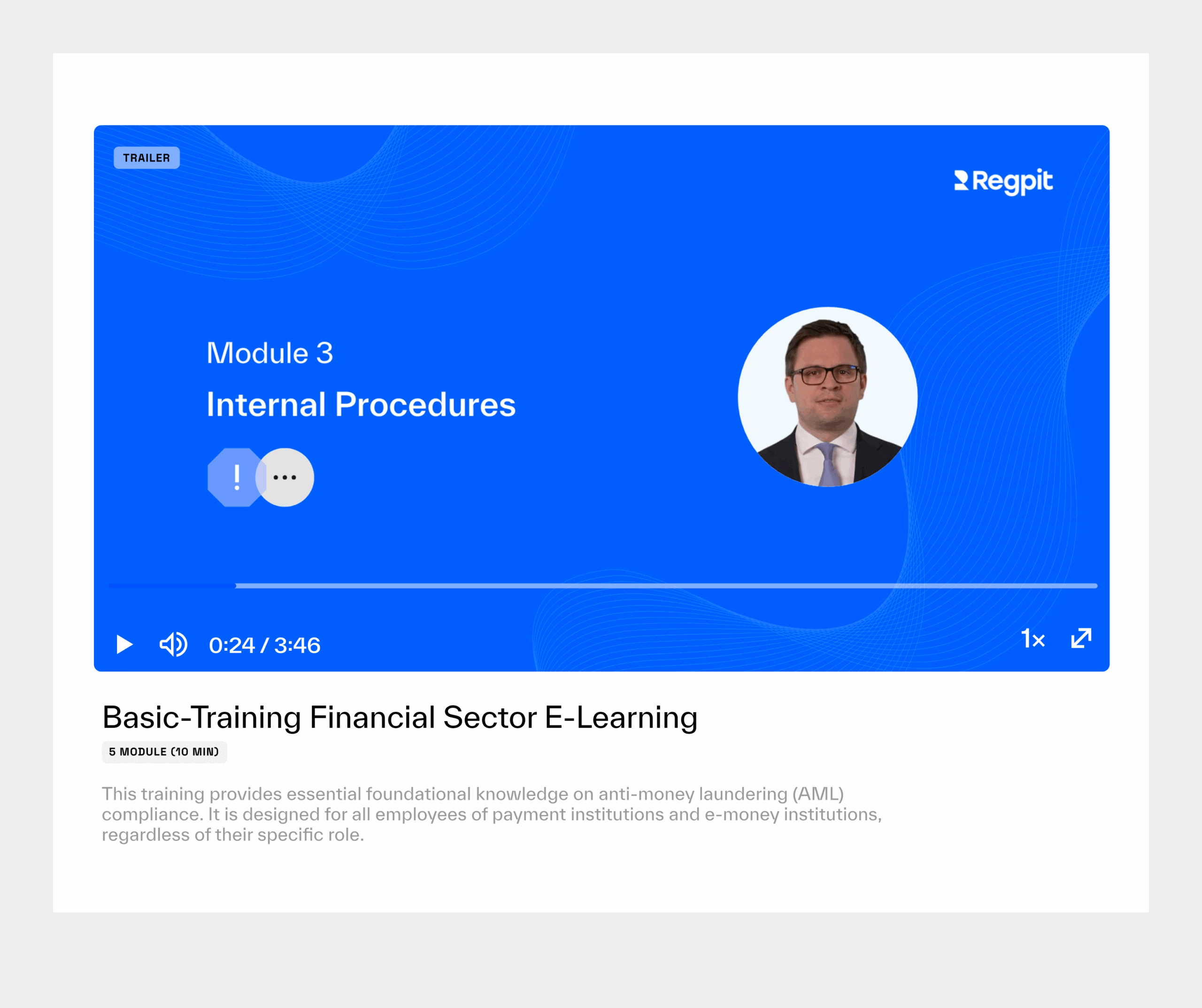

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

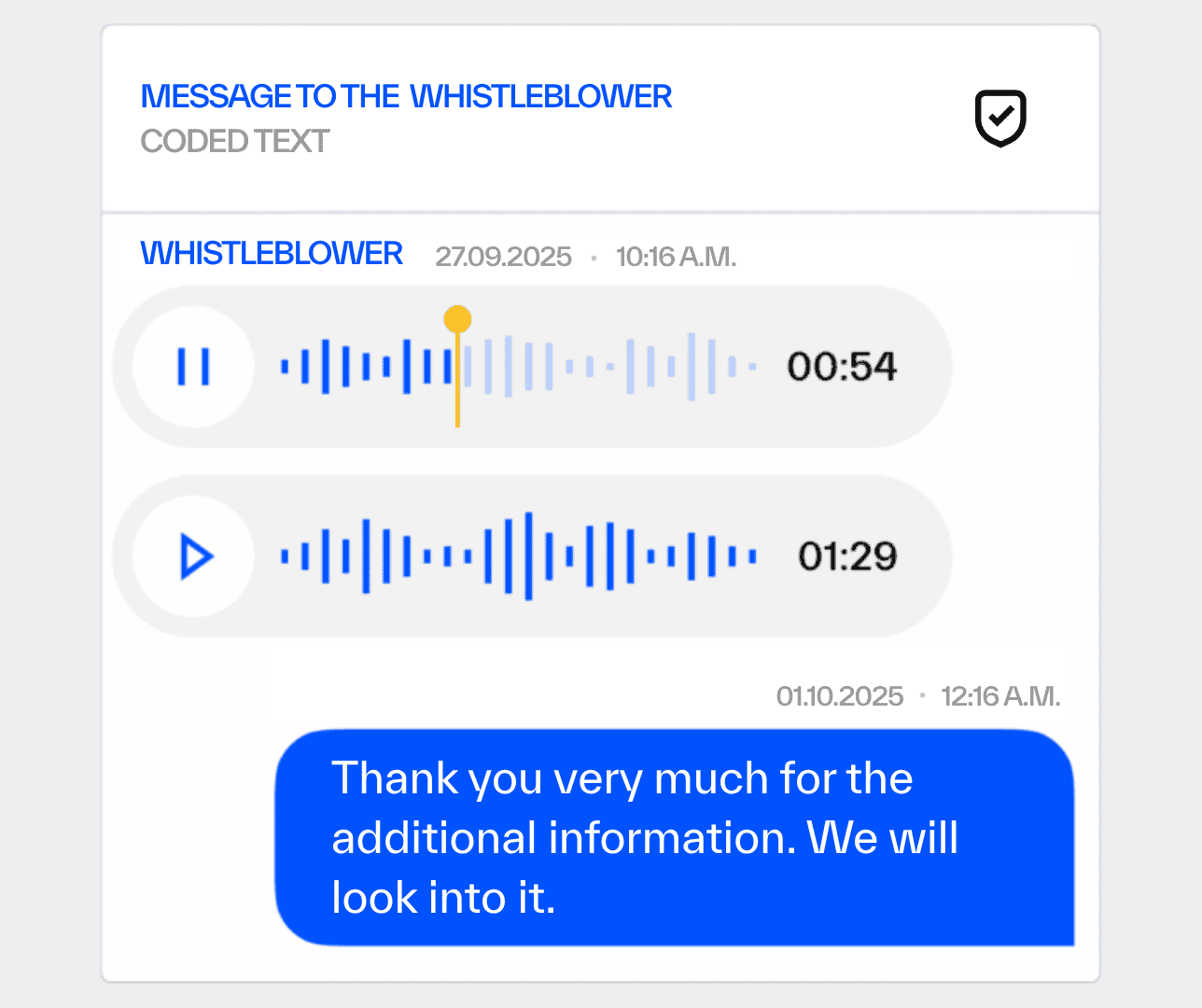

Whistleblowing Solution

The AML compliance solution for:

Financial institutions

For banks, FinTechs and payment services:

Digital KYC and AML processes.

Law firms

For lawyers, notaries and tax consultants:

Legally compliant identification and testing procedures.

Dealers & brokers

For property and art dealers:

Automated risk and sanction checks

Brigitte Zypries about Regpit

What excites the former Federal Minister of Justice about Regpit?

Faster AML compliance. Less effort.

Automated workflows, lightning-fast identification and efficient onboarding: Regpit saves companies time, effort and stress.

Known from

Real success stories

Financial service providers, law firms and compliance teams across Europe already rely on Regpit. See for yourself how other organizations are benefiting from Regpit.

“Thanks to Regpit, we’re able to carry out a customer-friendly onboarding process at the highest level — even in the area of money laundering prevention — simply, securely, and efficiently. That’s extremely important to us as a FinTech!”

"The requirements for law firms in the area of money laundering prevention and sanctions are becoming ever more extensive. We are delighted to have a specialised partner at our side with Regpit!"

Discover our platform

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.