Digital money laundering prevention for credit institutions

Intelligent AML software for banks: KYC, training & expert support from a single source

A selection of our clients

Regpit for credit institutions: your solution for secure AML compliance

Credit institutions face increasing regulatory pressure. Regpit helps you meet your obligations under the german Anti-Money Laundering Act (GwG), the german Banking Act (KWG), and BaFin regulations: efficiently and legally compliant.

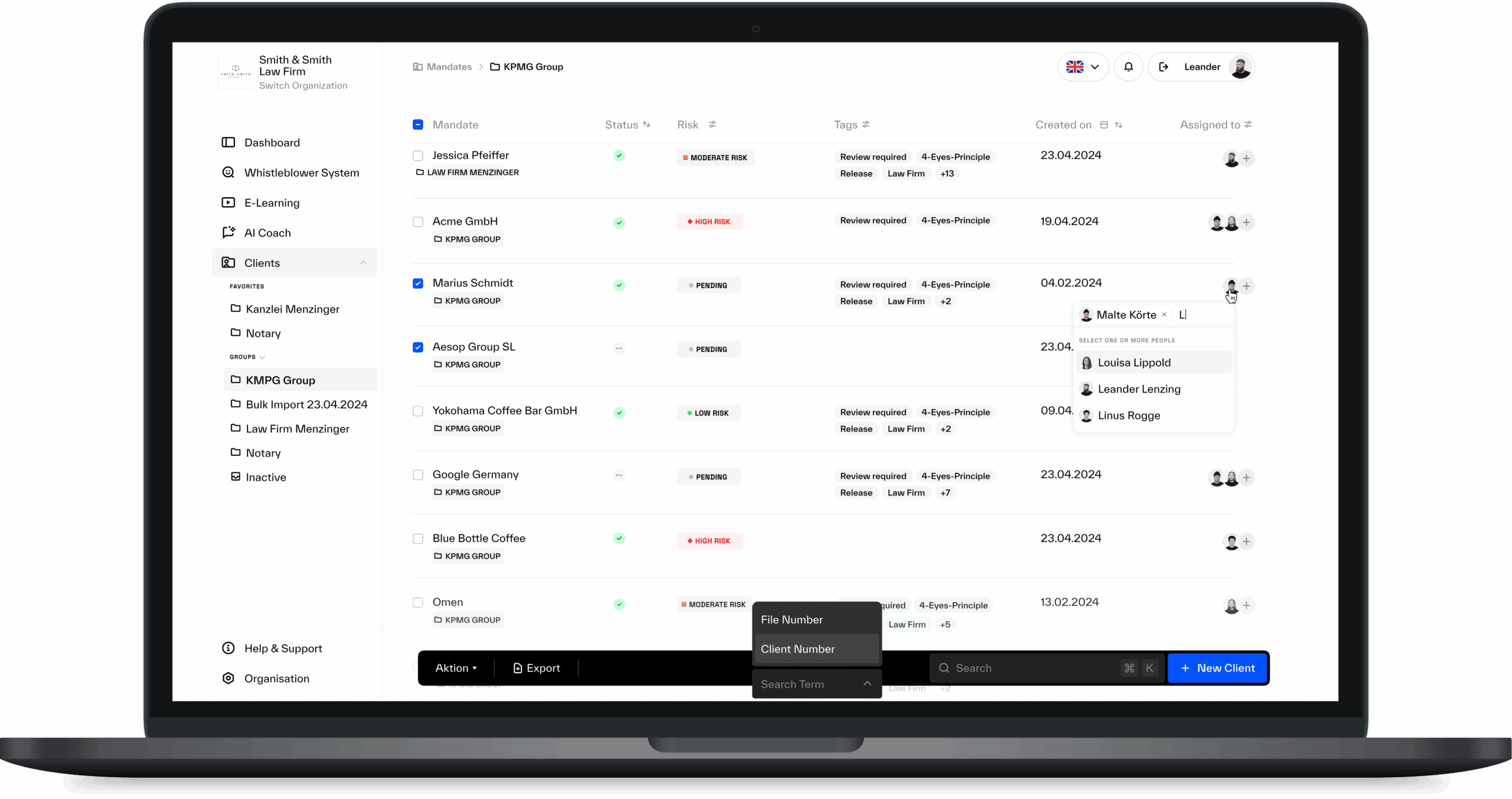

Our AML platform combines all key functions in one system: KYC/KYB verification, digital identification, PEP and sanctions screening, transaction monitoring, AML training, and a compliant whistleblowing system.

For scalable processes, audit-proof documentation, and maximum relief for your compliance teams.

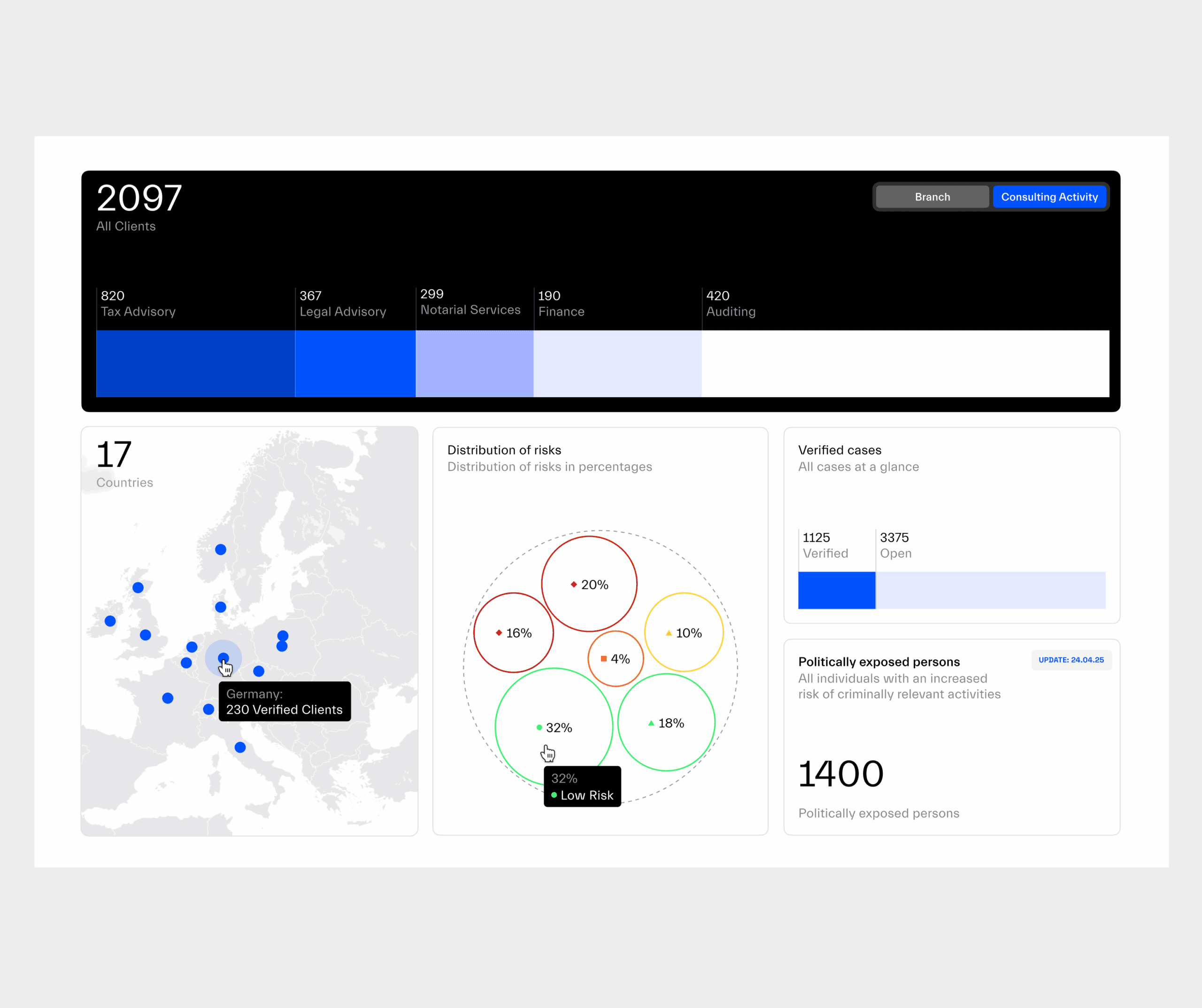

How Regpit works

Discover our platform in an interactive demo:

The real cost of non-compliance

The solution?

Our experts are here to help.

Regpit enables your organization to fulfil GwG requirements efficiently and with confidence: Through intelligent workflows, legal certainty, and personal guidance.

The key benefits of Regpit

Ready to go immediately

Regpit is ready to use — no complex setup, no waiting times.

Legally compliant under the German AML Act

All modules meet the latest requirements of the German Anti-Money Laundering Act (GwG). You work in full compliance: Audit-proof and legally secure.

Always audit-ready

With Regpit, you are inspection-ready at any time. All processes are fully documented and can be retrieved instantly.

No IT effort

No installation or integration required. The platform runs directly in your browser: Intuitive and effortless.

Intuitive for your customers

The user interface is easy to understand, even for non-experts. This means that money laundering prevention does not become a hurdle, but a quick routine.

Efficiency meets service

The all-in-one solution

Book individual modules or the complete package

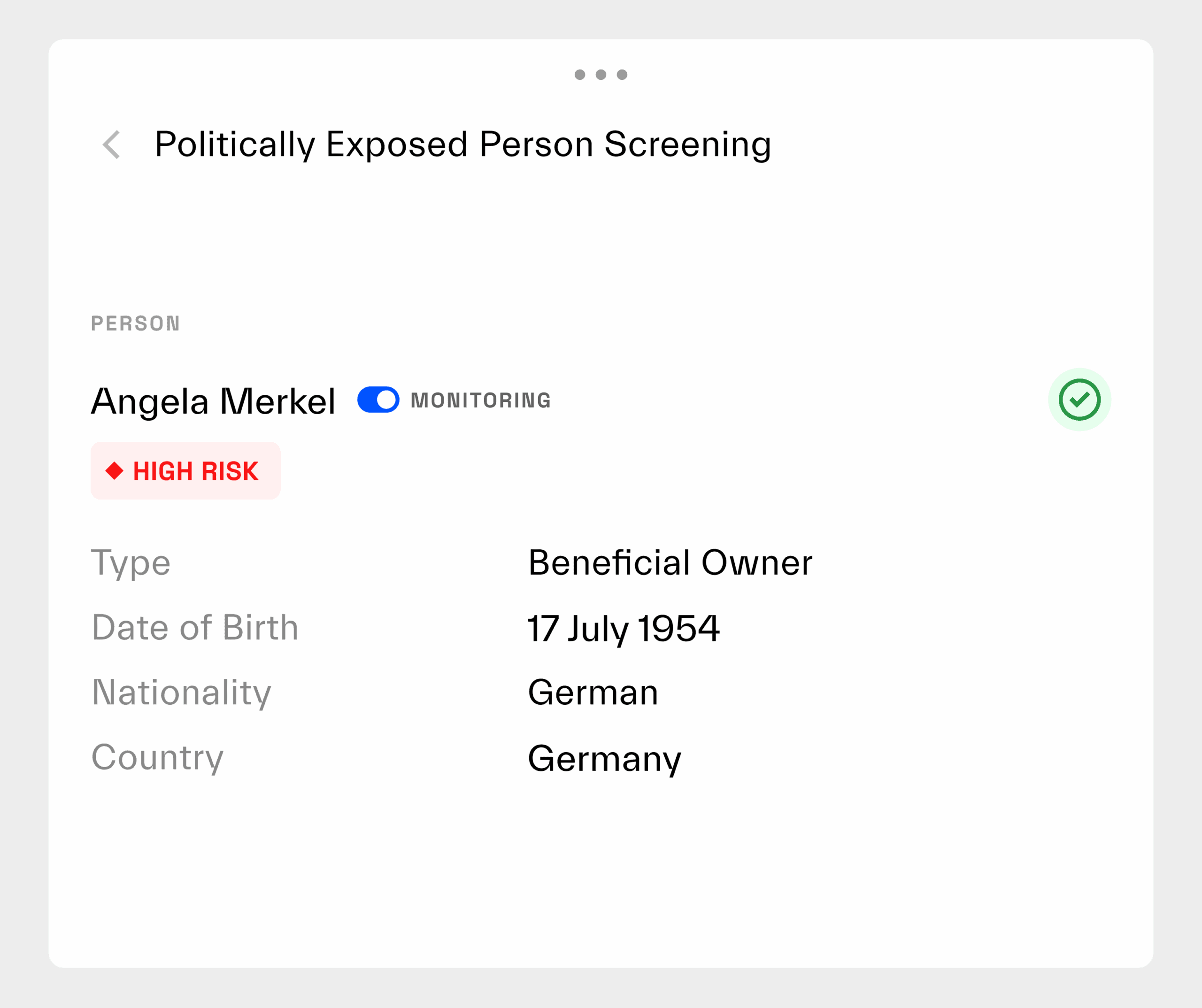

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

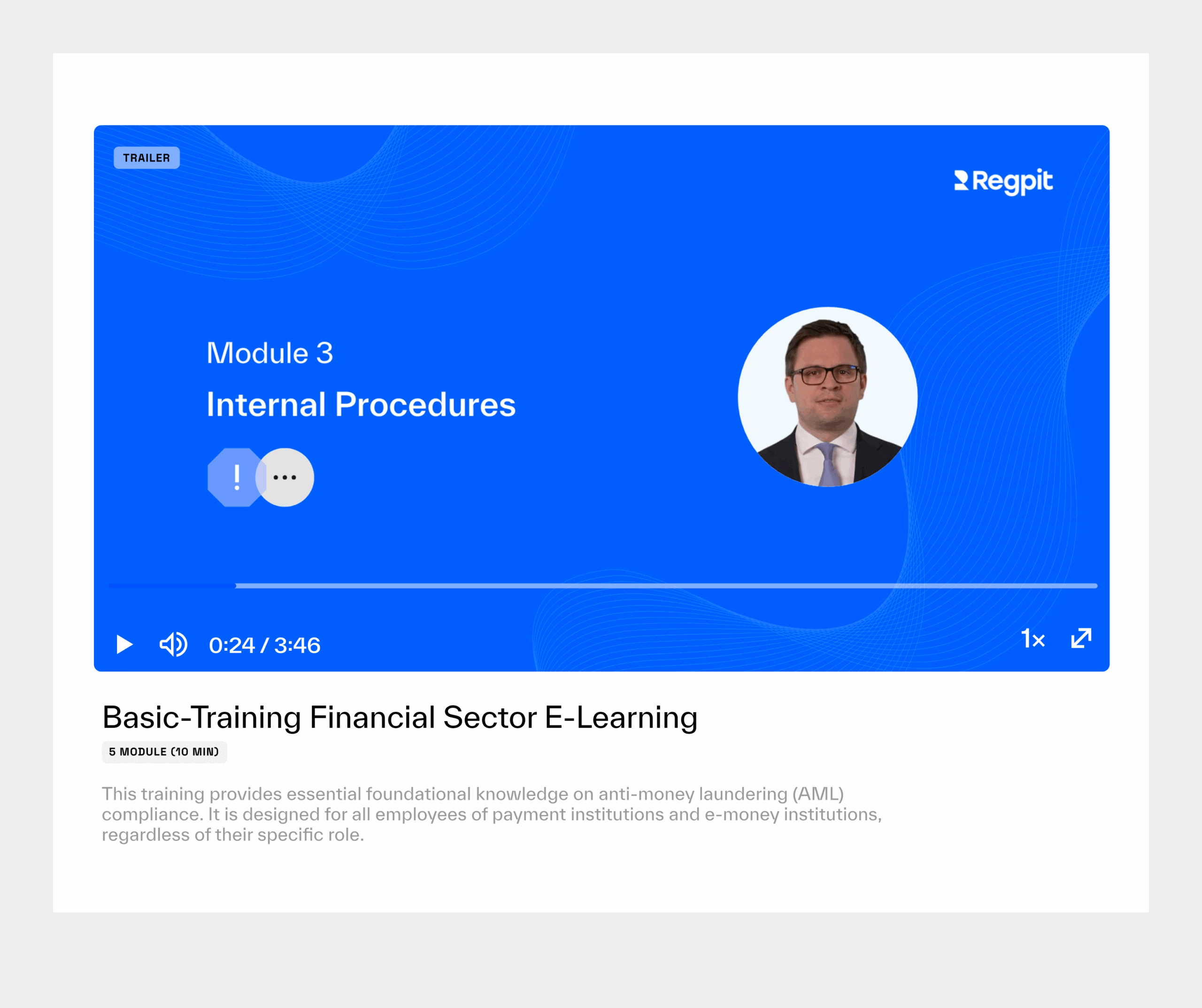

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

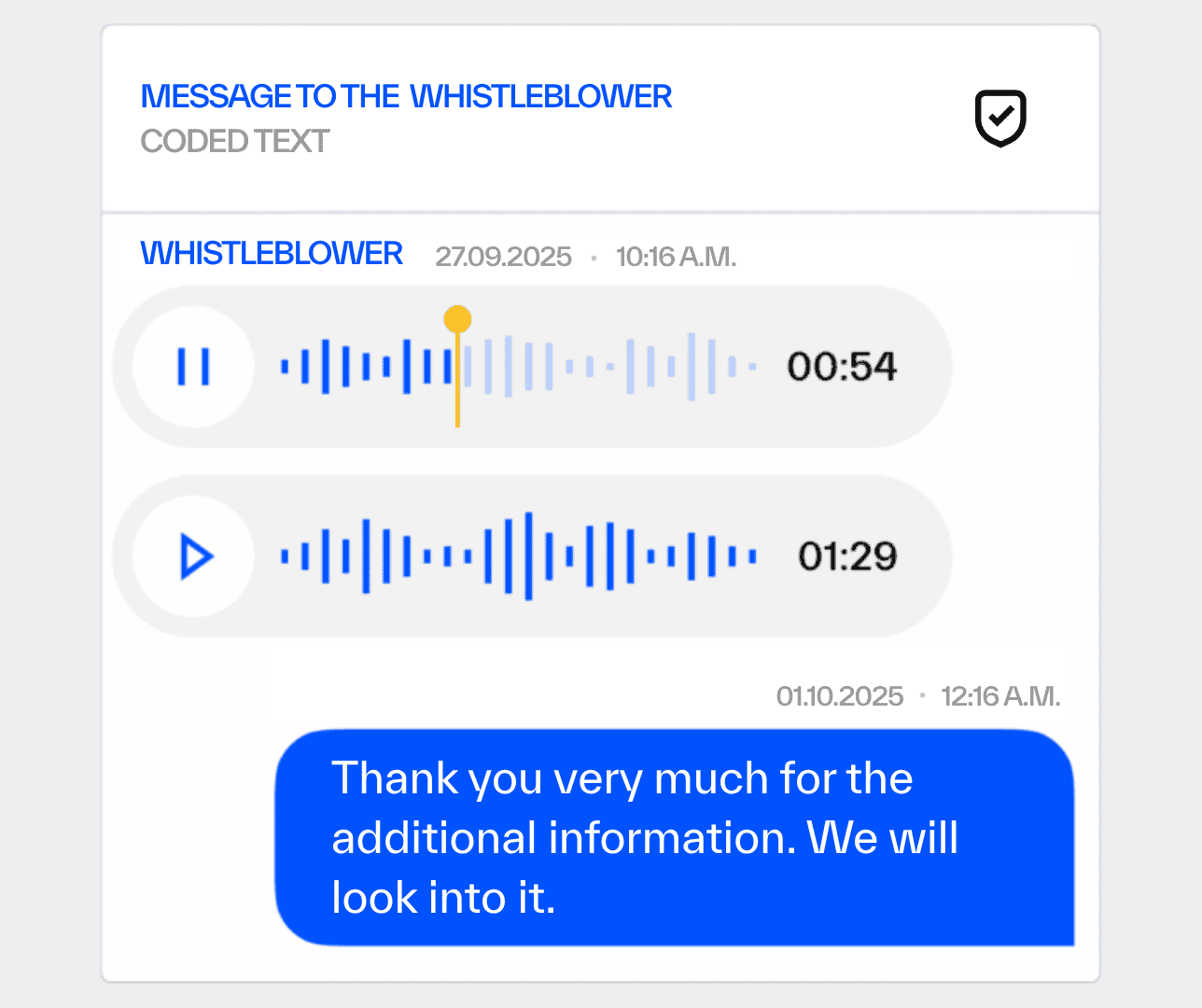

Whistleblowing Solution

Faster AML compliance. Less effort.

Automated workflows, lightning-fast identification and efficient onboarding - Regpit saves companies time, effort and stress.

Known from

Your Regpit experts

More than 20 compliance specialists ready to assist you: Combining legal expertise, practical insight, and personal guidance to strengthen your AML strategy.

Dr. Jacob Wende

Regpit expert

Louisa Lippold

Regpit expert

Ludovica Bölting

Regpit expert

Alexander Ebel

Regpit expert

Discover the Regpit platform.

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.