Our money laundering training courses for tax consultants - The E-Learning Solution

Annual training on the Money Laundering Act that tax advisors really need. As experienced experts in money laundering prevention, we impart relevant knowledge that you can confidently apply in your practice.

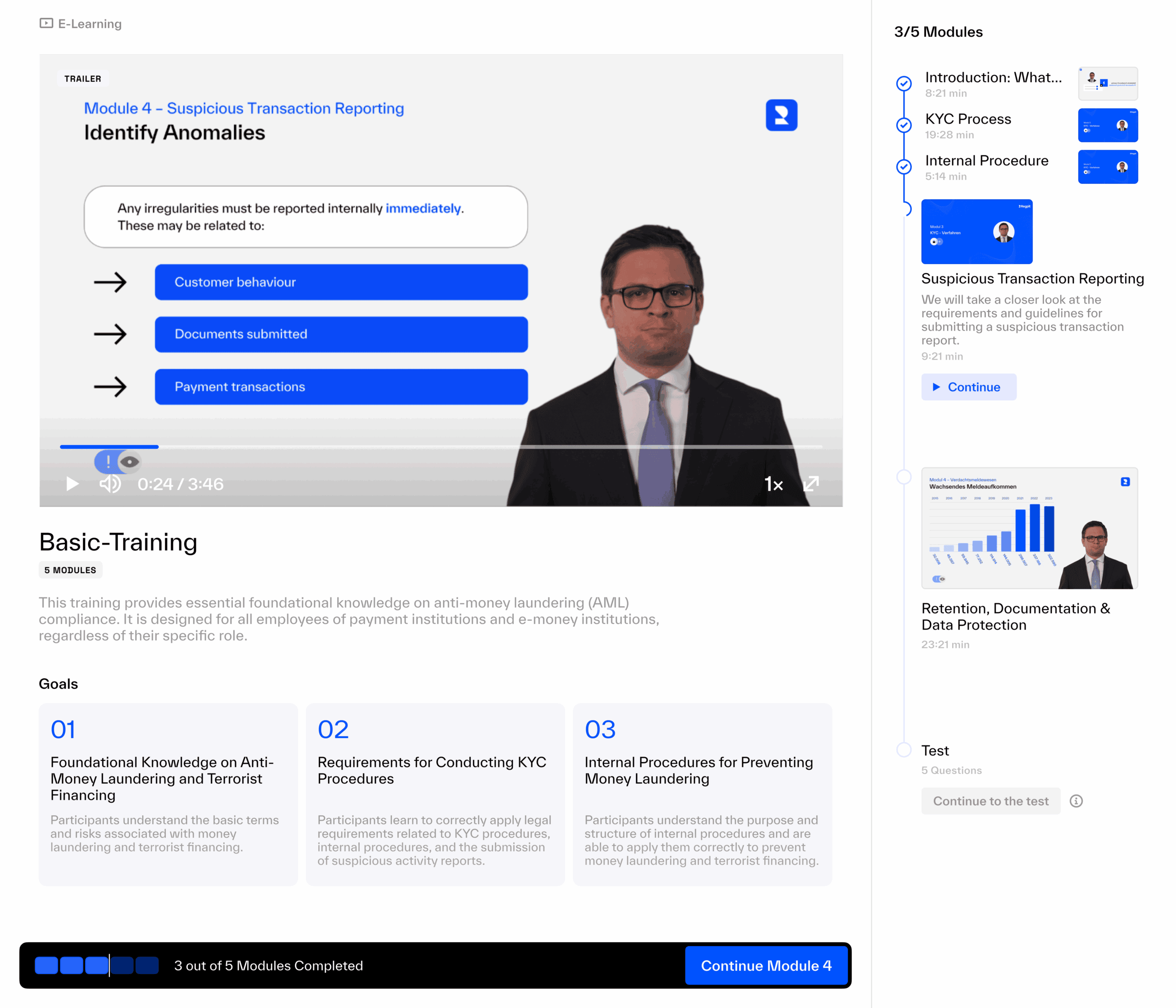

How it works: MLA e-learning

The E-Learning Solution offers MLA-compliant online training courses especially for tax advisory professions: With tests and certificates of attendance. Progress and certificates are easy to manage, allowing you to fulfil your training obligations efficiently and audit-proof.

Annual training for tax advisors

The mandatory training is carried out digitally in just a few clicks. The training covers all the basics: ideal for getting started or as a legally required refresher.

- Fully German Money Laundering Act-compliant basic training courses

- Final test and certificate

- Ready for immediate use and audit-proof

Specialized knowledge for advanced users: In-depth training

For tax advisors with AMLA responsibility, we offer in-depth training on current legal and regulatory requirements.

- Targeted knowledge transfer on specialized topics

- Ideal for tax advisors with experience or a higher risk profile

- Professionally developed by Regpit experts

We provide tax consultants with up-to-date knowledge on money laundering prevention.

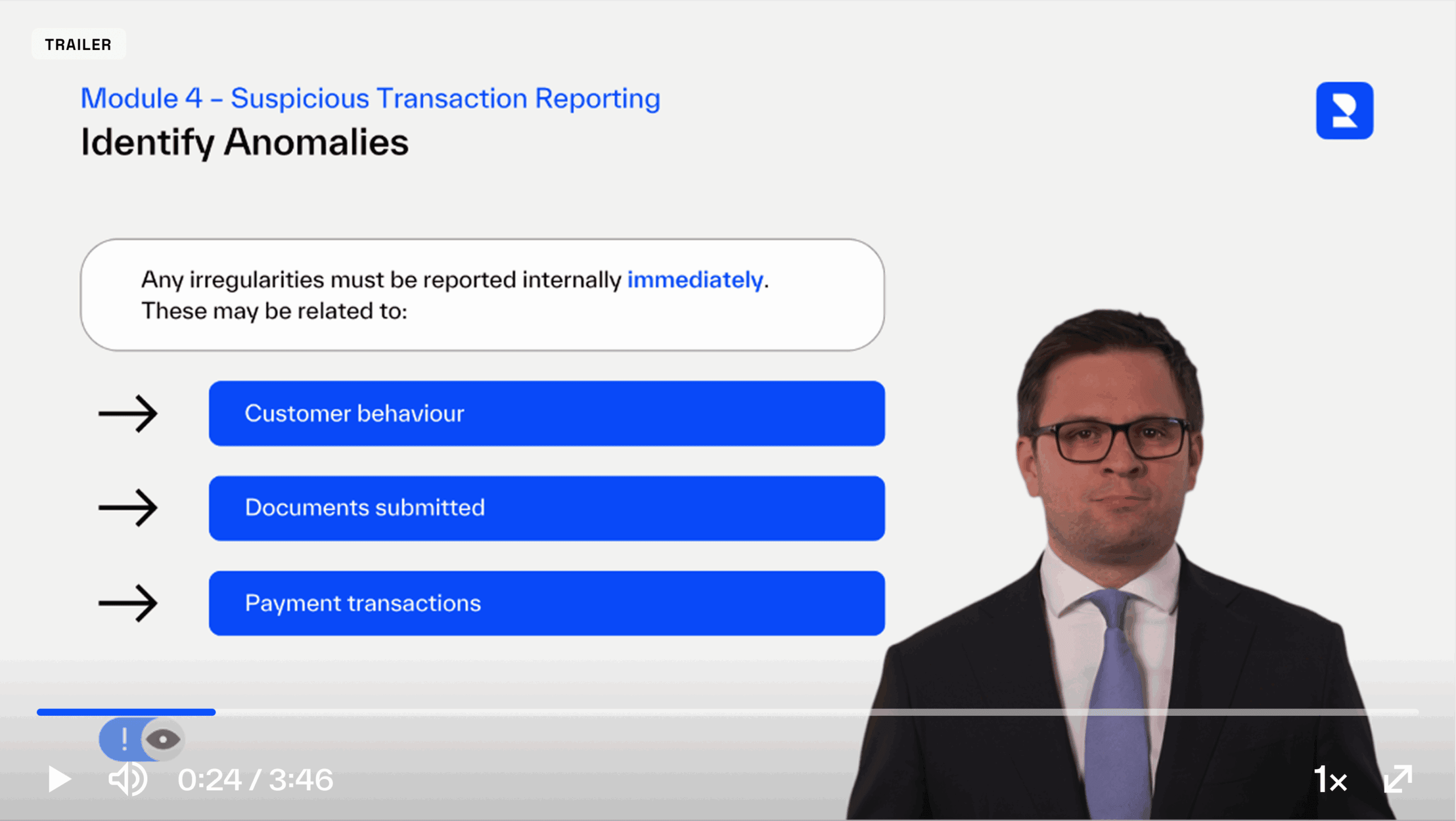

Learning from practice with real case studies

Imagine the Annual money laundering training is also for tax advisors not a compulsory appointment, but a real added value.

Our e-learning makes it possible! It conveys the necessary specialised knowledge and at the same time is comprehensible, up-to-date and practical.

- What is money laundering?

- Terrorist financing

- Customer due diligence obligations (KYC)

- Risk management & internal security measures

- Duty to report suspicions

- Documentation & data protection

Final test and certificate

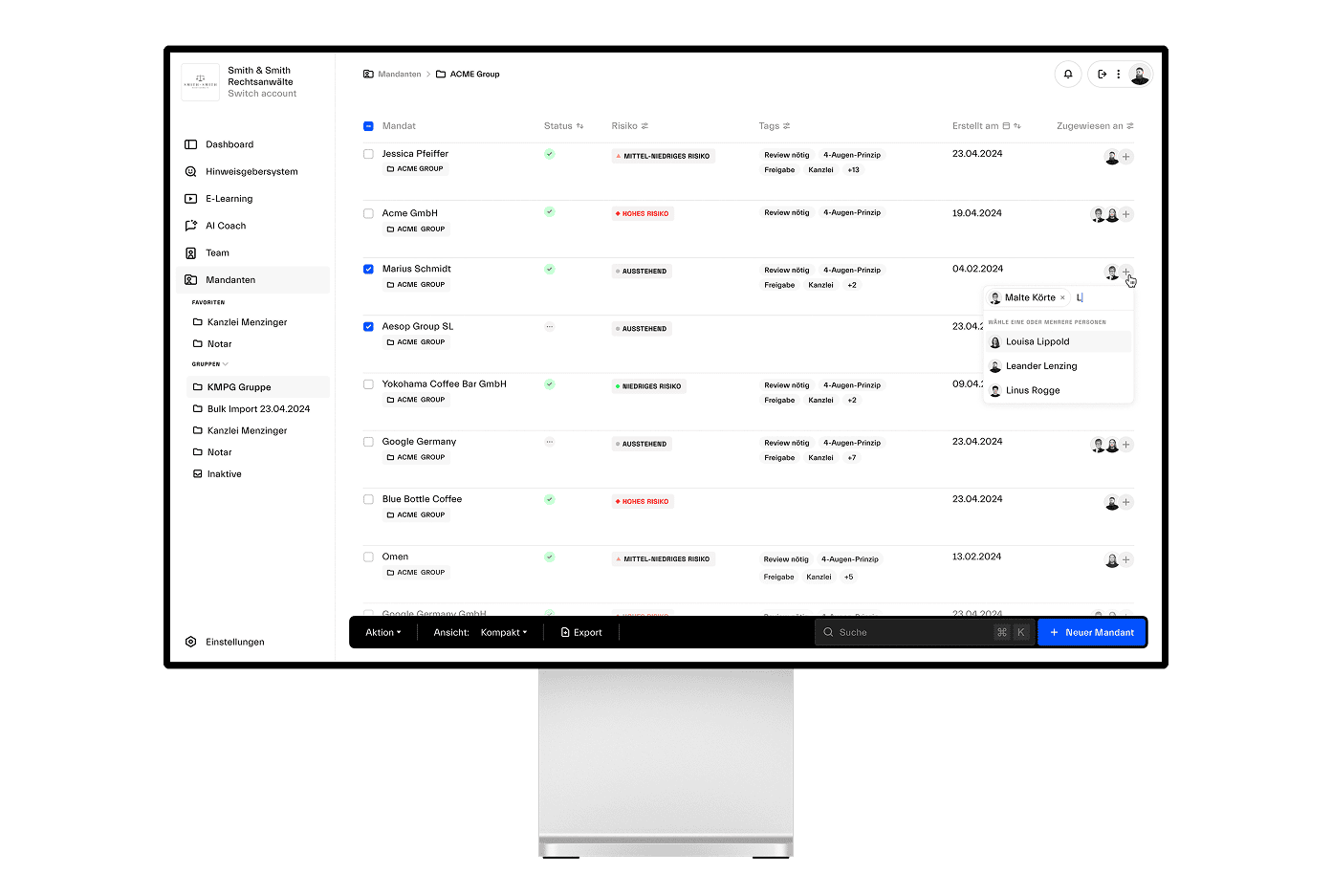

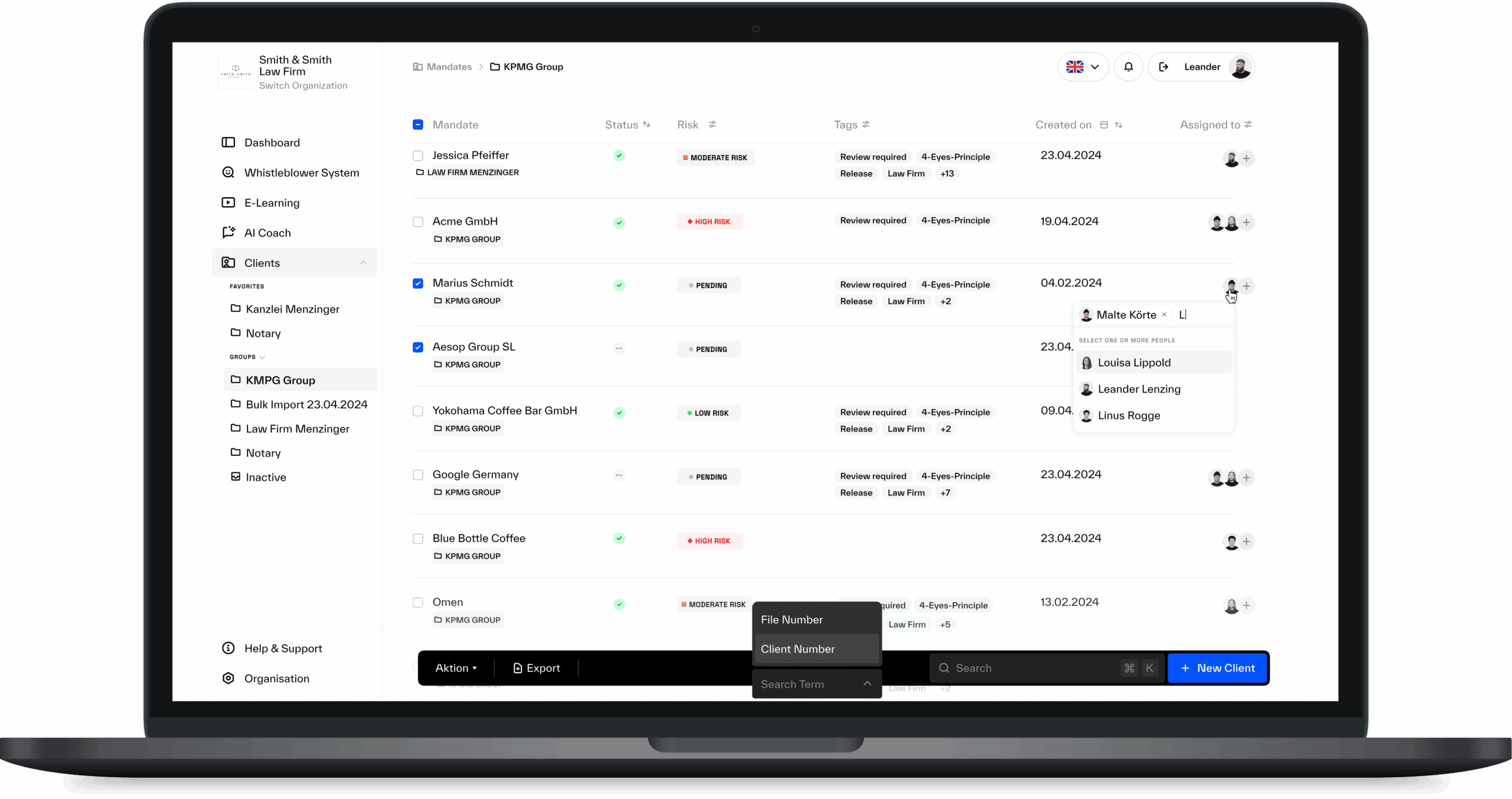

Maintain an overview: The Regpit platform automatically documents which training has been completed and when: With certificates for verification obligations and professional examinations.

- Centralized training management

- Audit-proof evidence available at any time

- Automatic certificate issuance

Current legislative developments

Our training content is continuously updated on the basis of legal changes, professional regulations and relevant market standards.

- Always regulatory up-to-date and practical

- No manual updating of content necessary

- Direct implementation of new requirements

Developed by professionals for real-world use

Our training courses have been developed by experienced lawyers and compliance experts: With a clear focus on AMLA obligations and typical advisory situations. This results in e-learning that not only informs, but also really helps in practice.

The right E-Learning for each profile

Whether basic understanding or in-depth content for tax consultants: With the e-learning programmes Basic and Professional you can train flexibly and in compliance with the law. You benefit from attractive volume discounts if you purchase several licenses.

24,90€ per licence

Basic training money laundering prevention

Licenses can be expanded based on your needs: Starting at €24.90/year per user.

- For law firm staff

- Participation certificates & tests included

- Easily manageable, ready to use immediately

49,90€ per licence

Professional training money laundering prevention

Licenses can be expanded based on your needs: Starting at €49.90/year per user.

- In-depth professional content

- Practical case studies & legal context

- Meets specific professional regulatory requirements

Talk to our experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

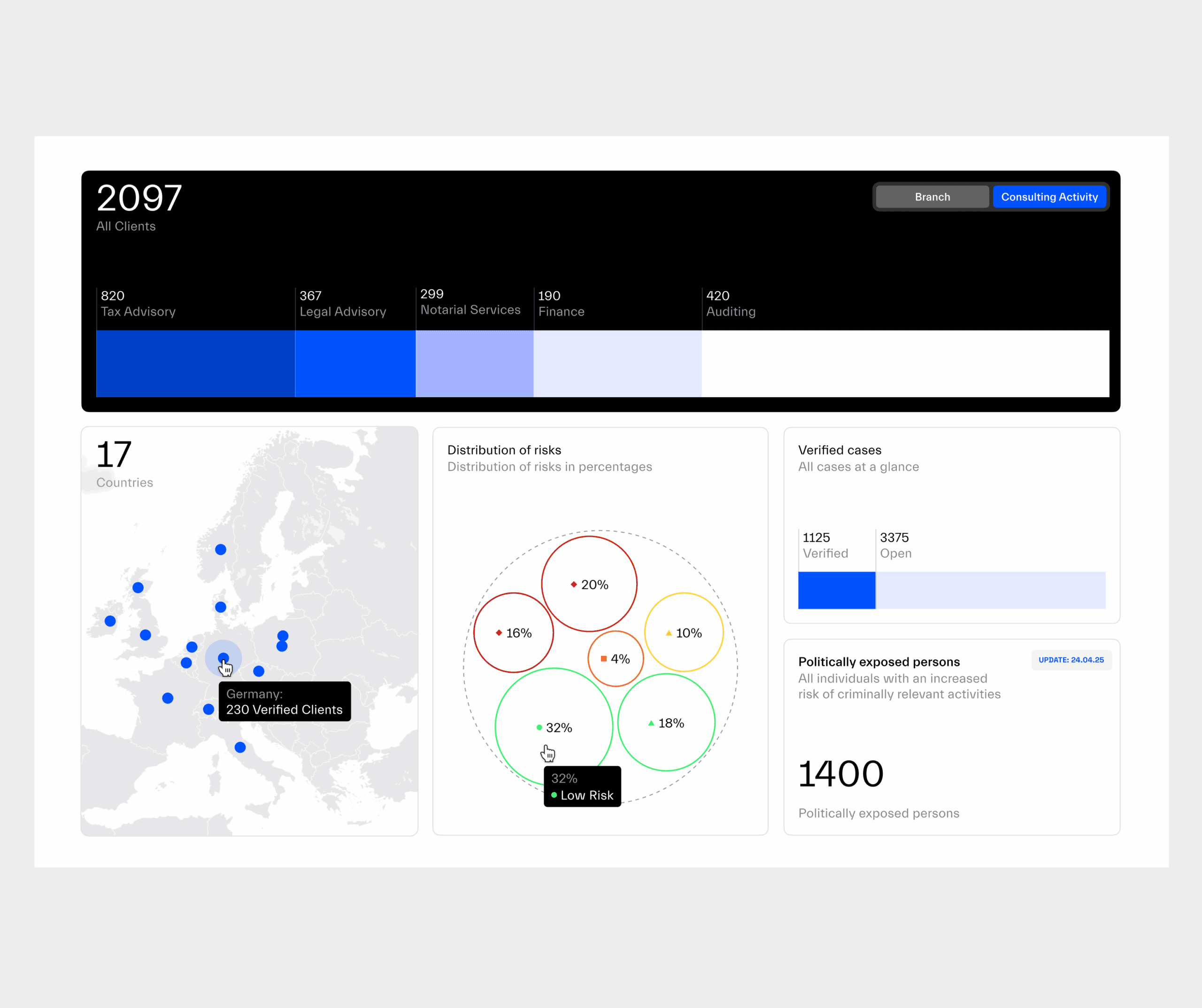

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

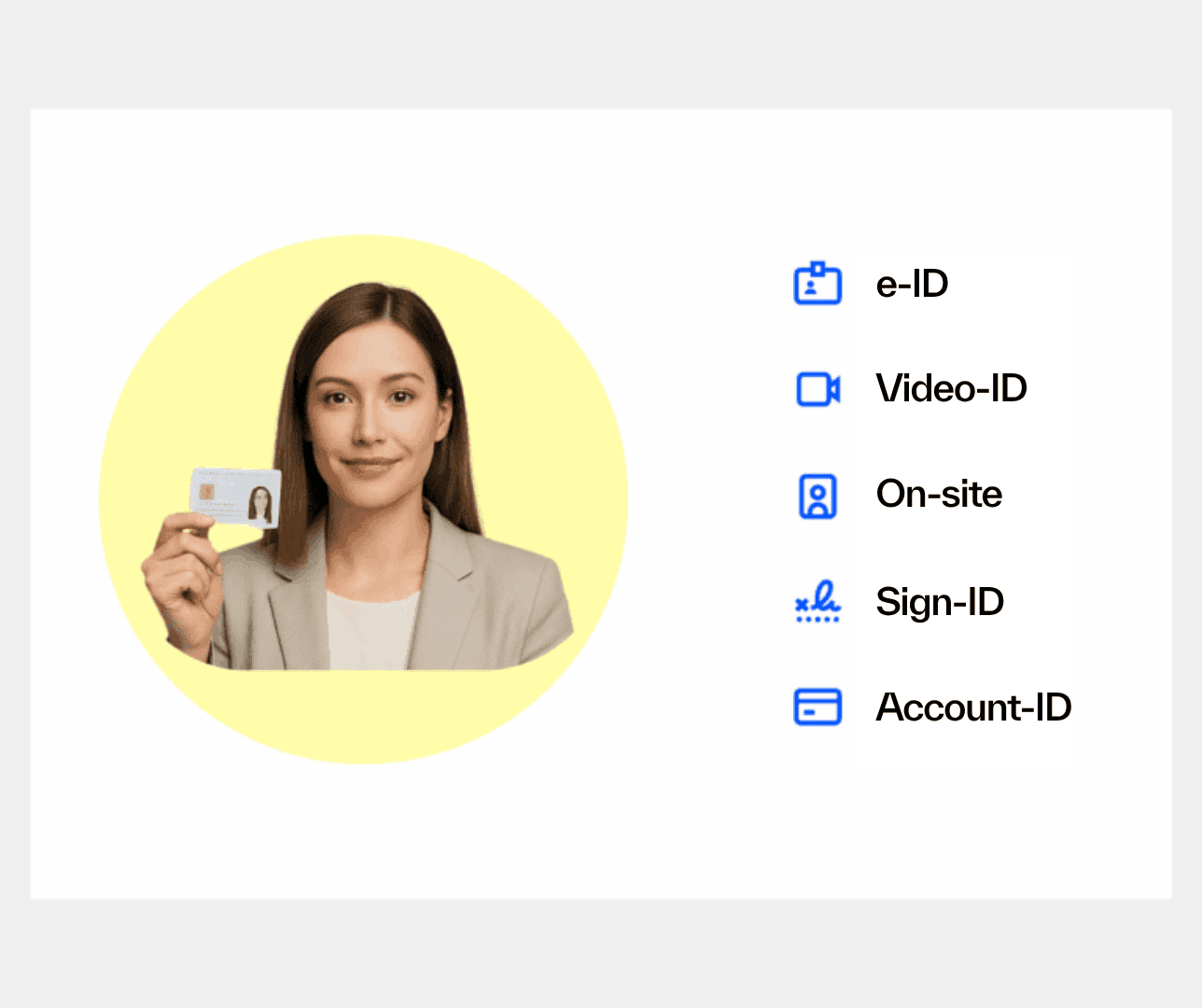

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

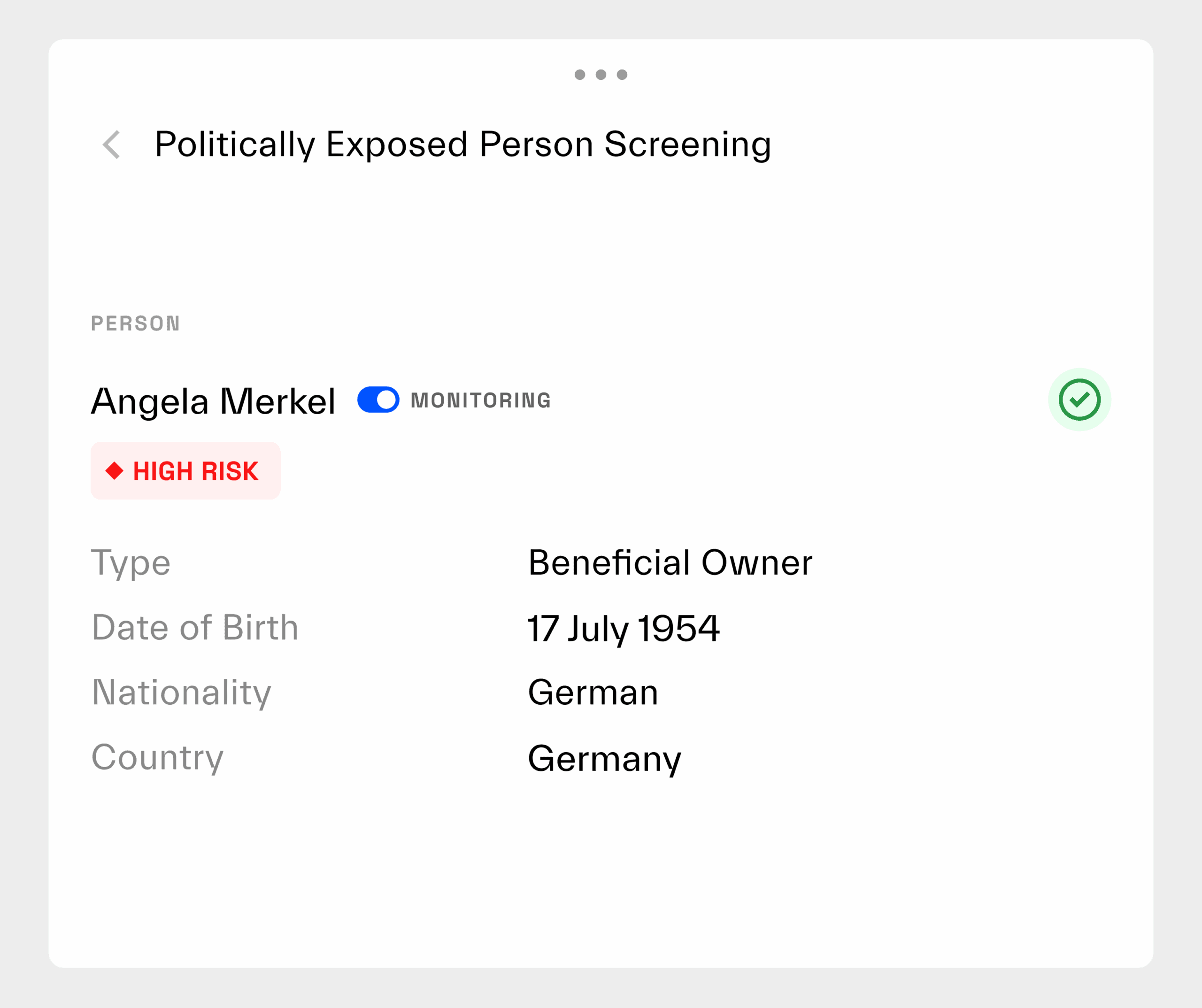

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

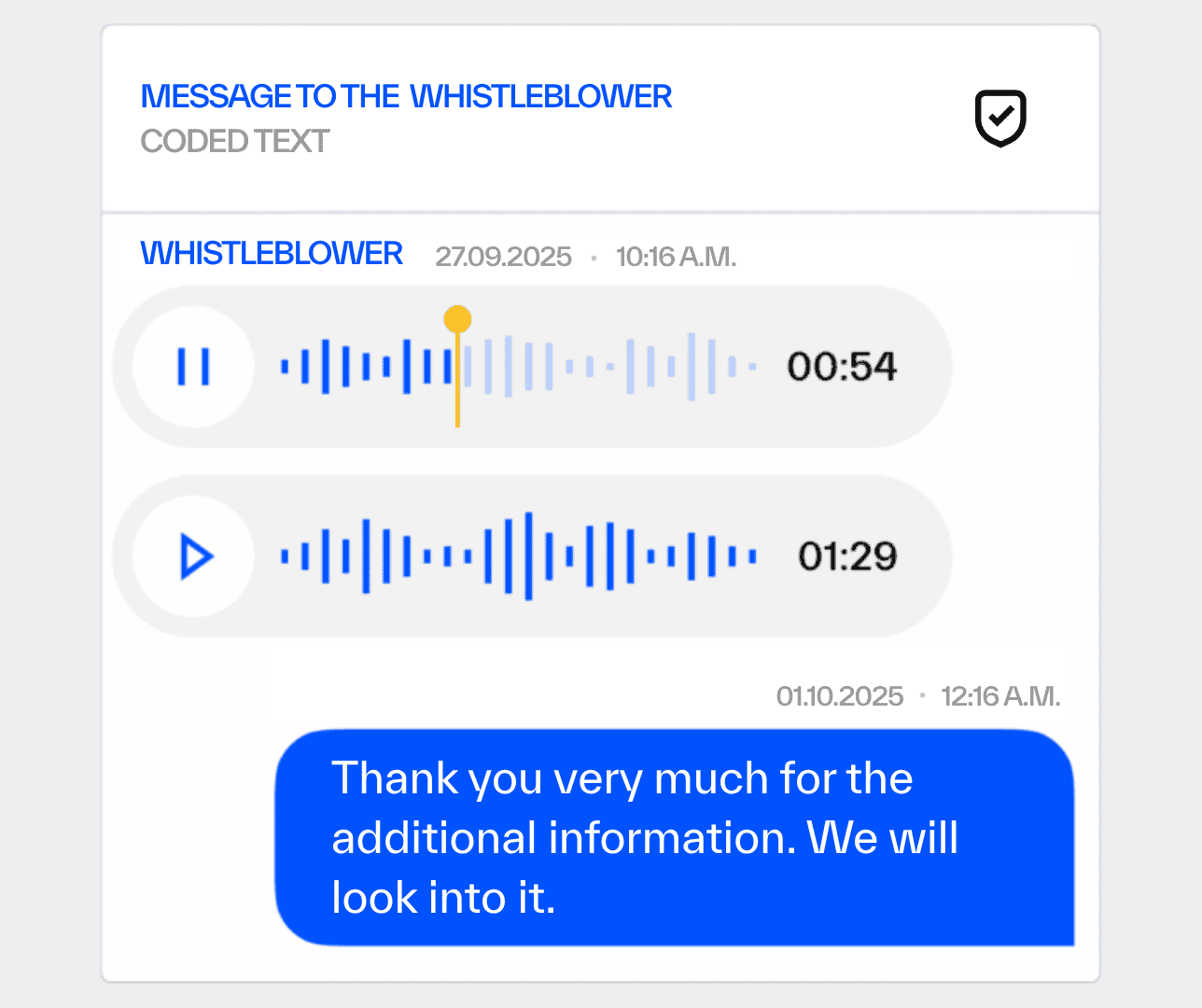

Whistleblowing Solution

Frequently asked questions (FAQ)

Who must take part in money laundering prevention training?

In principle, all employees in tax consultancy must receive regular training. This obligation applies to all professionals subject to the AMLA, regardless of the size of the firm or the field of activity.

Why is money laundering prevention training required by law?

According to Section 6 (2) No. 5 GwG, tax advisors are also obliged to regularly instruct their employees. The aim is to recognise risks at an early stage, understand obligations and handle suspected cases correctly.

What are the contents of a MLA training course?

Typical practical content: Fundamentals of the GwG, obligations for tax advisors and employees, KYC/monitoring, typical money laundering signals, reporting obligations (Section 43 GwG), dealing with suspected cases, sanctions for violations and data protection.

How often does MLA training have to be carried out?

At least once a year, additionally in the event of new hires or relevant changes to the law. Depending on the law firm's risk profile, more frequent training may be required. Regpit automatically reminds you when training is due.

How does the online training on money laundering prevention work at Regpit?

Tax advisors and employees complete the training online via the Regpit eLearning module. The content is interactive, test-based and can be accessed at any time. After successful participation, a certificate is automatically created and documented in the system.

Is an online training course MLA-compliant?

Yes, online training courses are also permitted for tax advisors, provided that the content is up-to-date, complete and comprehensible. Regpit ensures that all content is legally checked and always up to date with the latest version of the Money Laundering Act.

What happens if tax advisors do not train their employees?

Tax advisors who do not fulfil their training obligations risk fines, professional consequences and reputational damage. Proof of training is mandatory for audits by chambers and supervisory authorities.

What are the advantages of digital AMLA training?

Online training courses save time and resources, enable location-independent learning and automatically document all progress. Regpit ensures simple tracking and audit security.

How is participation in MLA training courses documented?

Regpit automatically saves all training data in the compliance dashboard. You can see which employees have been trained, who is still missing and when a repetition is due, fully exportable for internal documentation or external audits.

Does Regpit provide certificates of participation?

Yes, all participants receive a digital certificate after passing the final exam, individually issued, legally compliant and available at any time.

Can training be tailored to individual roles?

Yes, Regpit offers modular content depending on function or AMLA responsibility: e.g. for tax advisors, specialised staff, reception or money laundering officers. This means that everyone receives targeted training without unnecessary additional effort.

How up-to-date is the content of the Regpit training courses?

All content is continuously updated by legal experts, and the training is updated in the event of changes to the law or new information from the supervisory authorities.

What does the MLA training at Regpit cost?

The training can be flexibly booked as a module in the Regpit system, on a user basis or as a flat rate for teams.

The entry-level price is 24,90 EUR per licence. With higher user numbers, the price decreases automatically depending on the volume. No additional tools or licences are required, everything runs centrally via the Regpit platform.

Can external partners or clients also be trained?

Yes, Regpit can also be used to securely train external persons, e.g. clients, freelancers or co-operation partners. All evidence remains centrally documented and can be viewed at any time.

How quickly can I start the training?

Once the module has been activated, your employees can get started straight away. No setup, no IT adjustments, simply invite, send the link and get started.

Does Regpit also offer face-to-face training by MLA experts?

Yes, Regpit also offers individual training on site or via live webinar.

In addition to the digital e-learning module, training courses can also be conducted in person by our experienced money laundering experts, as in-house training, interactive live sessions or customised workshops. Ideal for tax advisors with an increased risk profile or specific training needs in the team.

Can I be certified as an anti-money laundering officer at Regpit?

Yes, Regpit offers in-depth training with a certificate of attendance to prepare you for the role of money laundering officer.

Our in-depth training courses provide the specialist knowledge required to take on the role of money laundering officer in accordance with Section 7 GwG. Upon successful completion, participants receive a meaningful certificate as proof for the supervisory authority, with a practical module and individual counselling on request.

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.