Risk assessment in the KYC procedure

Automated risk assessment for AML-compliant and scalable KYC processes.

Why the risk assessment is crucial in the KYC process

The risk assessment is at the heart of every know-your-customer (KYC) process. It determines the depth of a customer check and which due diligence obligations apply.

The german Money Laundering Act (GwG) explicity prescribes a risk-based approach; companies must assess how high the risk is that a business relationship will be misused for money laundering or terrorist financing.

Only those who recognise risks can act effectively: A precise assessment protects against financial and legal consequences and enables efficient, targeted audits.

What influences the KYC risk?

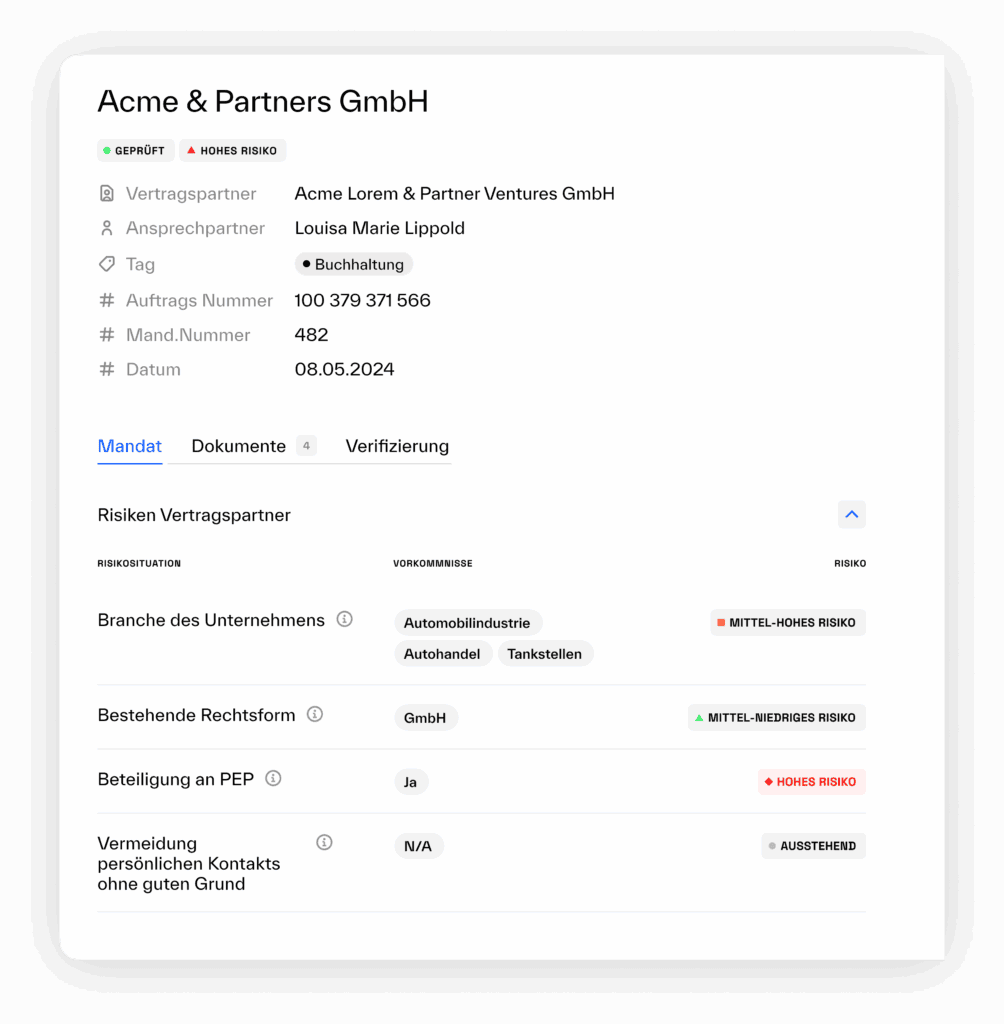

The risk assessment takes into account various factors that individually and in combination determine the overall risk.

These include, among others:

Customer type: Private individual, company or trust

Industry: E.g. finance, real estate, art trade, gambling

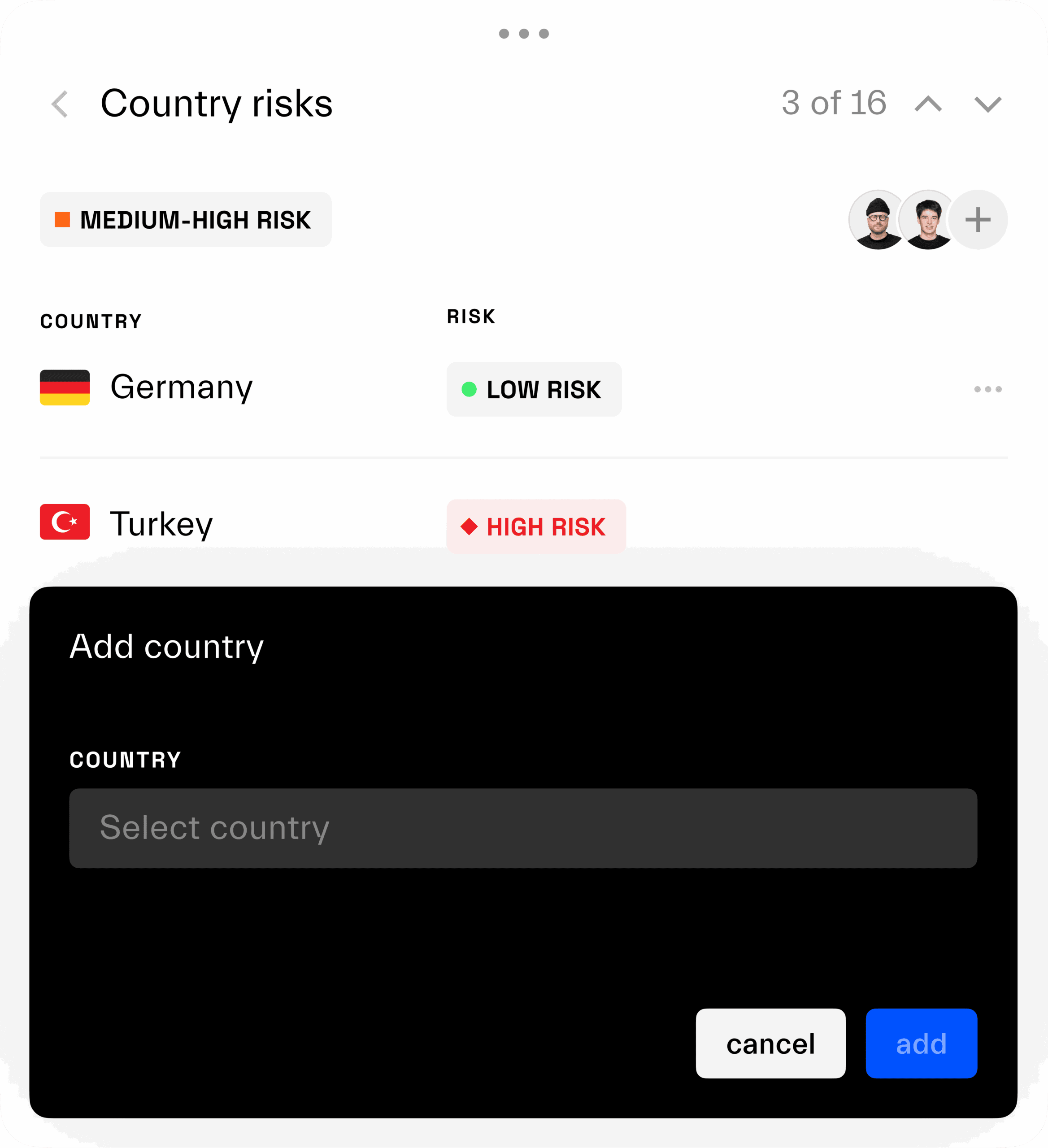

Region: Countries with an increased risk of money laundering

Transaction: Complex or cross-border payments

Distribution channel: In person, digitally or via third parties

Screening: PEP, sanction or adverse media matches

These factors are weighted to create an individual risk profile per customer, the basis of any effective AML strategy.

The challenges for companies in risk assessment

Manual risk assessment is time-consuming, subjective and prone to errors.

Without structured evaluation systems, a lack of transparency quickly arises - and it becomes difficult to provide evidence to supervisory authorities.

Typical challenges:

Inconsistent assessment: Different assessments between departments

Lack of traceability: Lack of documentation makes auditing difficult

Time required: Manual risk analyses tie up valuable resources

Lack of topicality: Risks change, developments go unnoticed without monitoring

In short: A reliable risk assessment in the KYC procedure requires structured, data-based and automated processes.

Instead of tedious list checking: Intelligent automation that doesn't overlook anything.

The solution: Intelligent risk assessment with Regpit

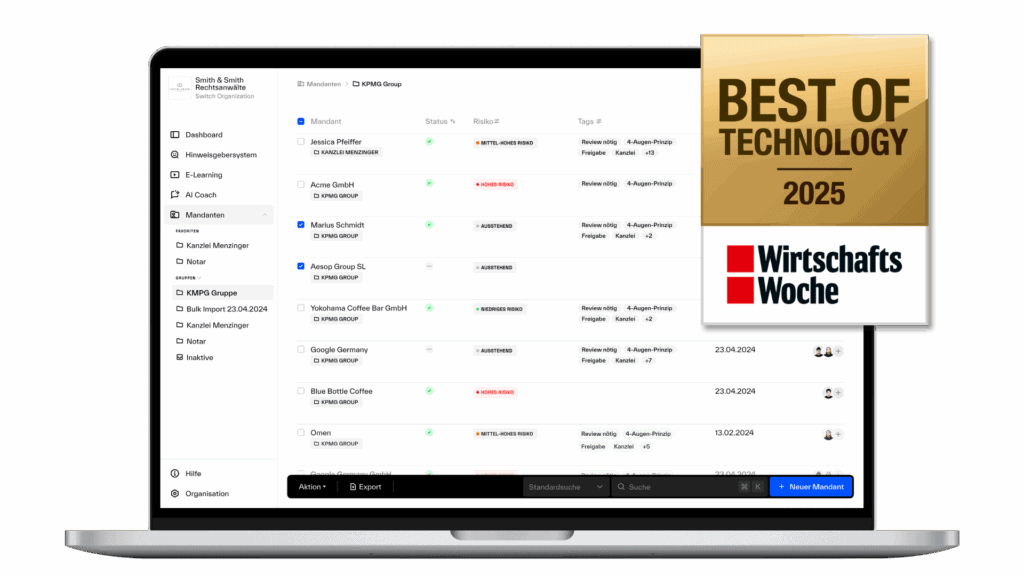

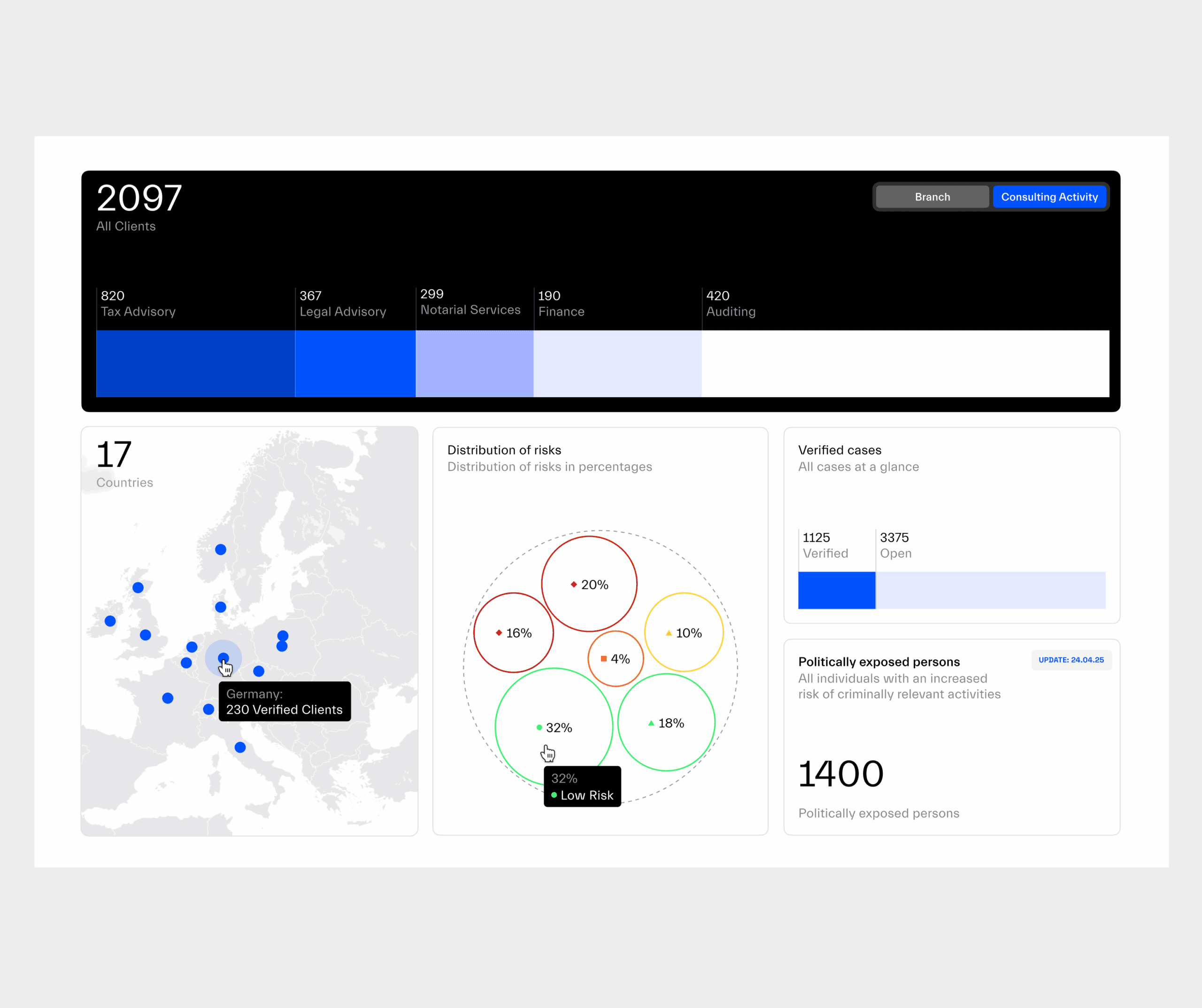

Regpit automates the entire risk assessment in the KYC and AML process: From data collection to ongoing monitoring.

- Automated risk scores: AI-supported analysis of all relevant customer and transaction data

- Rule-based assessment: Customisable risk models according to internal compliance guidelines

- Fuzzy matching technology also recognises different spellings and translations

- AI-based Risk Assessment

- Dynamic monitoring: Automatic update in the event of changes (e.g. new PEP item or sanction notification)

- Transparent documentation: Complete traceability in accordance with AMLA and supervisory authority requirements

- Risk dashboard: Clear visualisation of the individual and aggregated risk level

- Seamless integration: Directly integrated into your KYC, KYB and AML systems: Without manual intervention

Talk to our compliance experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

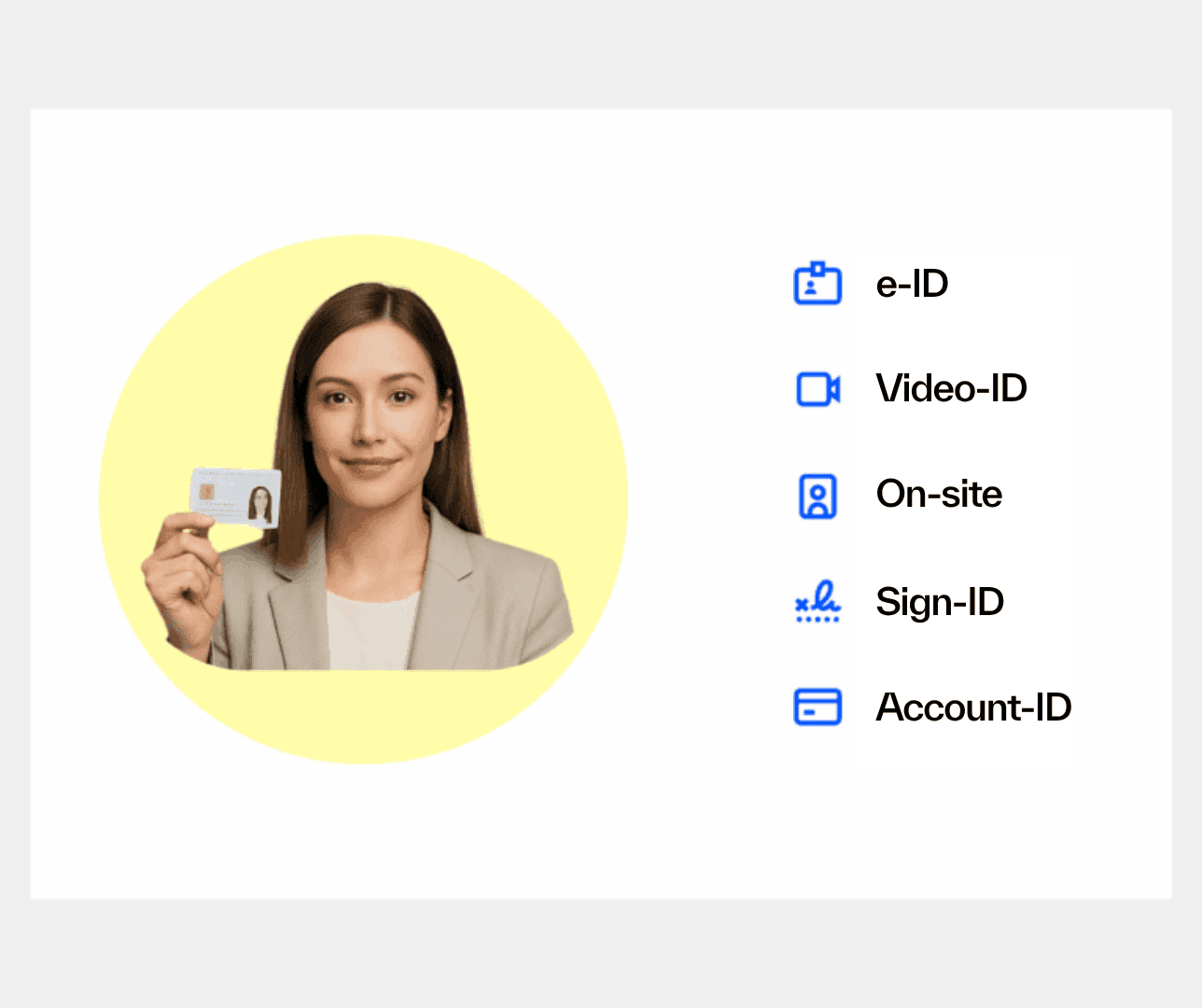

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

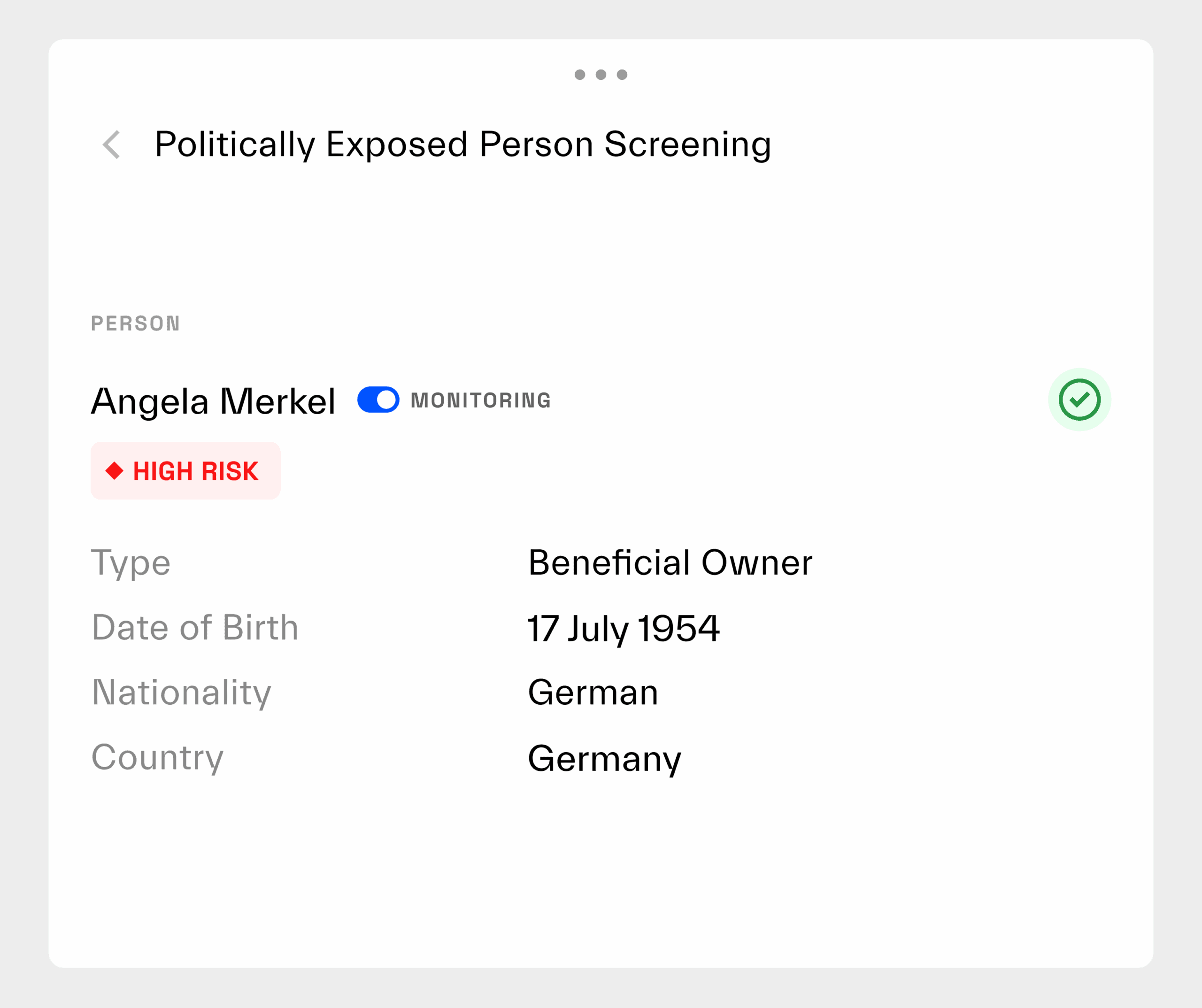

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

Whistleblowing Solution

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.