Digital money laundering prevention for tax advisors

Smart GwG software for tax advisors: KYC, training & expert support from a single source

A selection of our clients

Everything tax advisors need for GwG compliance

As a tax advisors you must recognise, assess and document money laundering risks when accepting mandates and ongoing mandates.

Regpit supports you with a digital all-in-one platform, especially for the requirements of your practice:

KYC/KYB verification, digital identification, PEP & sanctions screening, monitoring, GwG training, and a legally compliant whistleblower system.

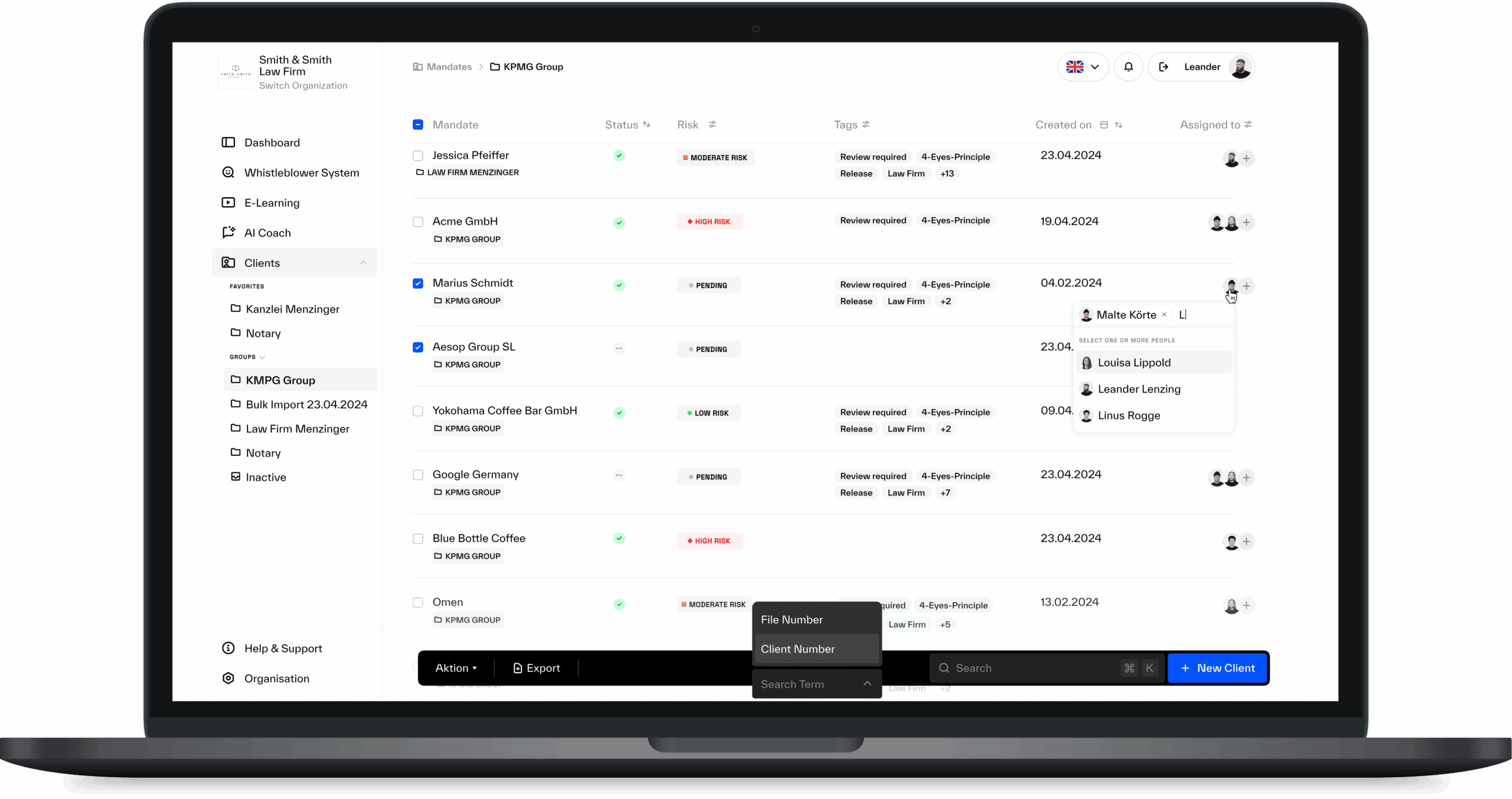

How Regpit works

Discover our platform in an interactive demo:

The real cost of non-compliance

The solution?

Our experts are here to help.

Regpit enables your organization to fulfil GwG requirements efficiently and with confidence: Through intelligent workflows, legal certainty, and personal guidance.

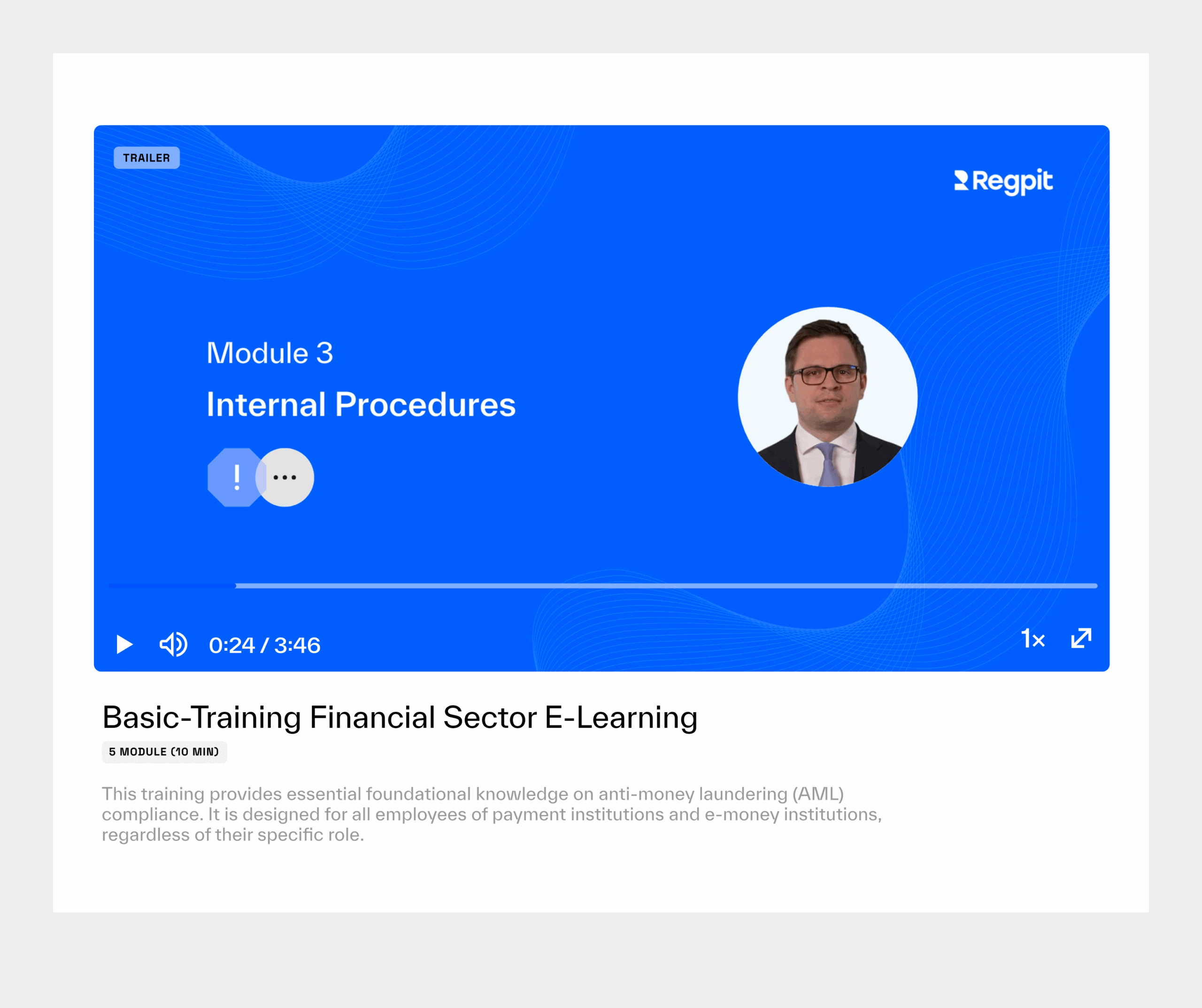

The Money Laundering Act applies to all tax advisors - We provide the right training

As a tax advisor, you are considered an obliged person according to § 2 GwG, which means that regular training is required by law. Regpit supports you with a specialised e-learning solution that is precisely tailored to your requirements.

The right E-Learning for each profile

Whether basic understanding or in-depth content for tax consultants: With the e-learning programmes Basic and Professional you can train flexibly and in compliance with the law. You benefit from attractive volume discounts if you purchase several licenses.

24,90€ per licence

Basic training money laundering prevention

Licenses can be expanded based on your needs: Starting at €24.90/year per user.

- For law firm staff

- Participation certificates & tests included

- Easily manageable, ready to use immediately

49,90€ per licence

Professional training money laundering prevention

Licenses can be expanded based on your needs: Starting at €49.90/year per user.

- In-depth professional content

- Practical case studies & legal context

- Meets specific professional regulatory requirements

Clients simply from DATEV directly in Regpit import

Seamless integration

With the DATEV export, all clients can be loaded directly into the Regpit platform for the KYC check.

Automatic data prefilling in Regpit

- Optimized user experience for you and your clients

- Significant time savings in the onboarding process

- Always access the latest and correct data

The key benefits of Regpit

Ready to go immediately

Regpit is ready to use — no complex setup, no waiting times.

Legally compliant under the German AML Act

All modules meet the latest requirements of the German Anti-Money Laundering Act (GwG). You work in full compliance: Audit-proof and legally secure.

Always audit-ready

With Regpit, you are inspection-ready at any time. All processes are fully documented and can be retrieved instantly.

No IT effort

No installation or integration required. The platform runs directly in your browser: Intuitive and effortless.

Intuitive for your clients

The user interface is designed to be clear and easy to use, even for non-experts. AML compliance becomes a routine, not a hurdle.

Efficiency meets service

The all-in-one solution

Book individual modules or the complete package

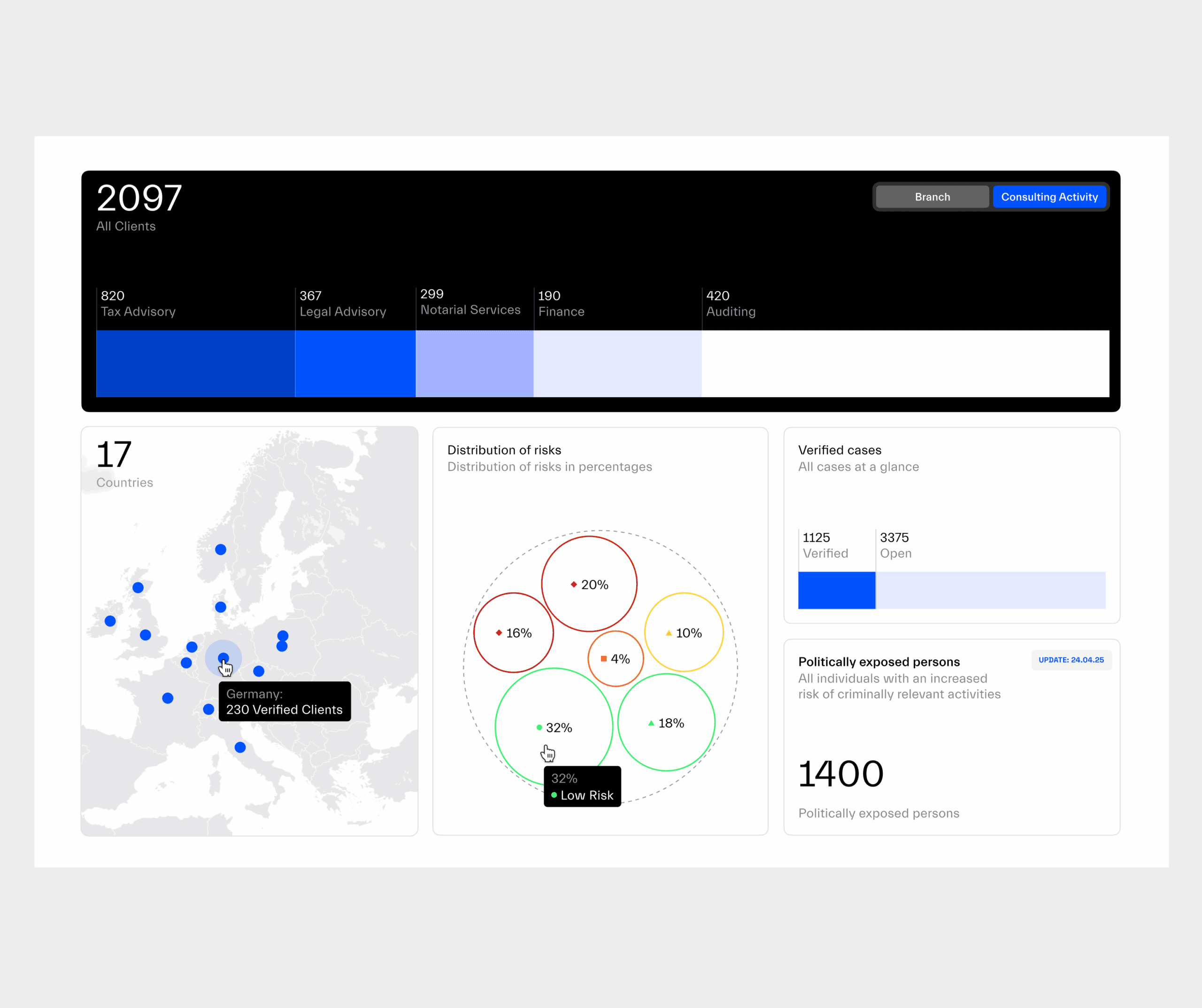

KYC/KYB Solution

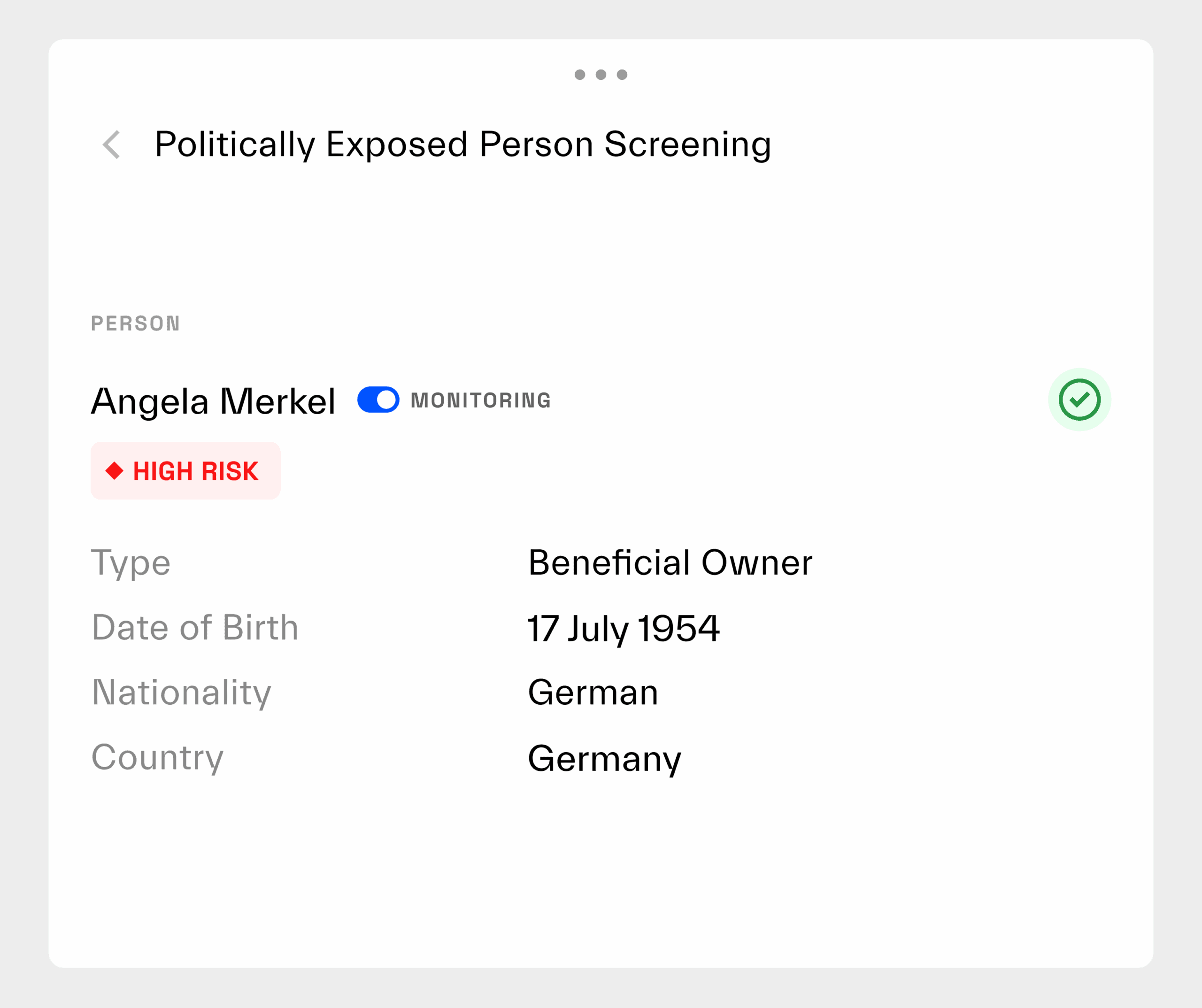

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

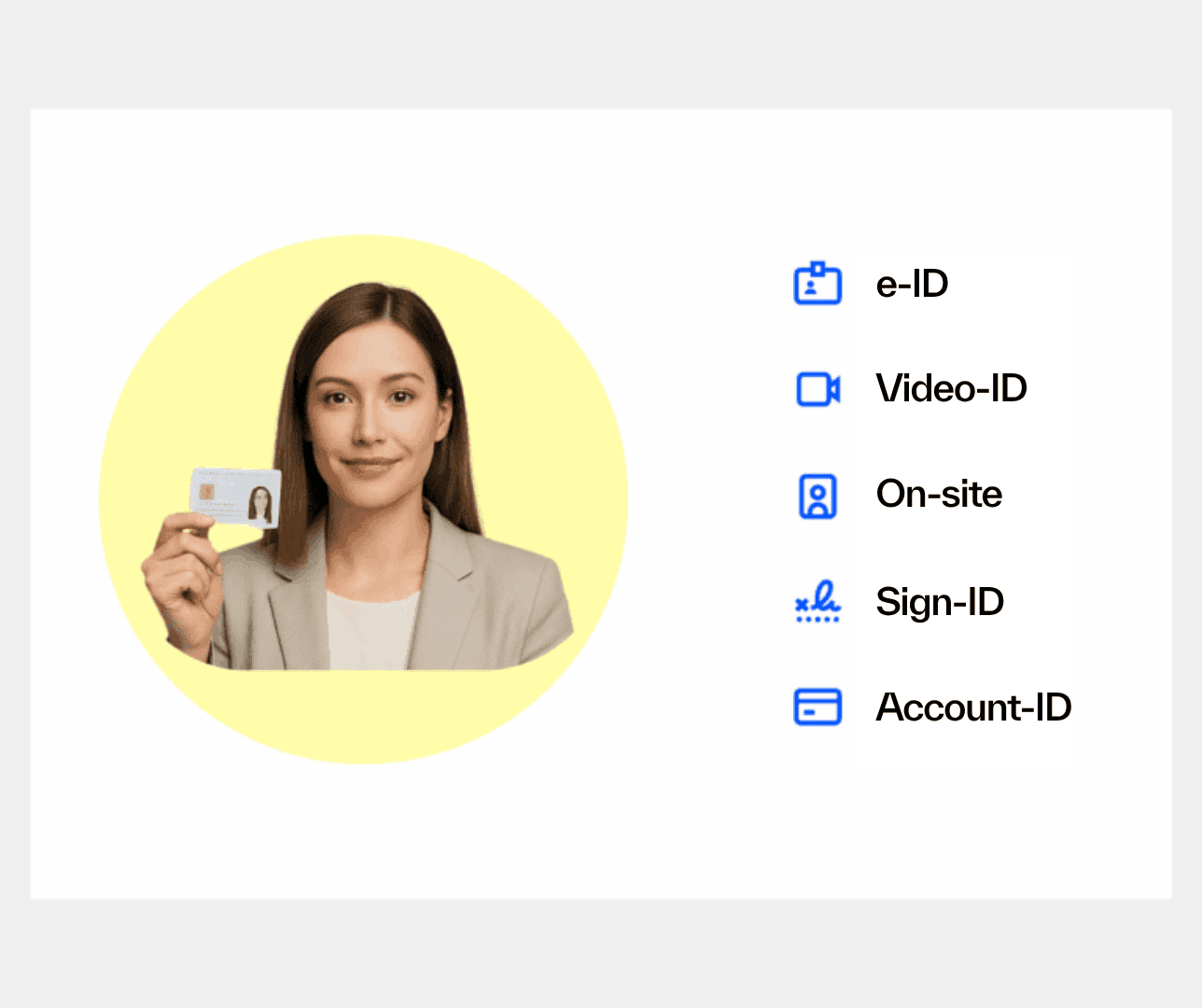

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

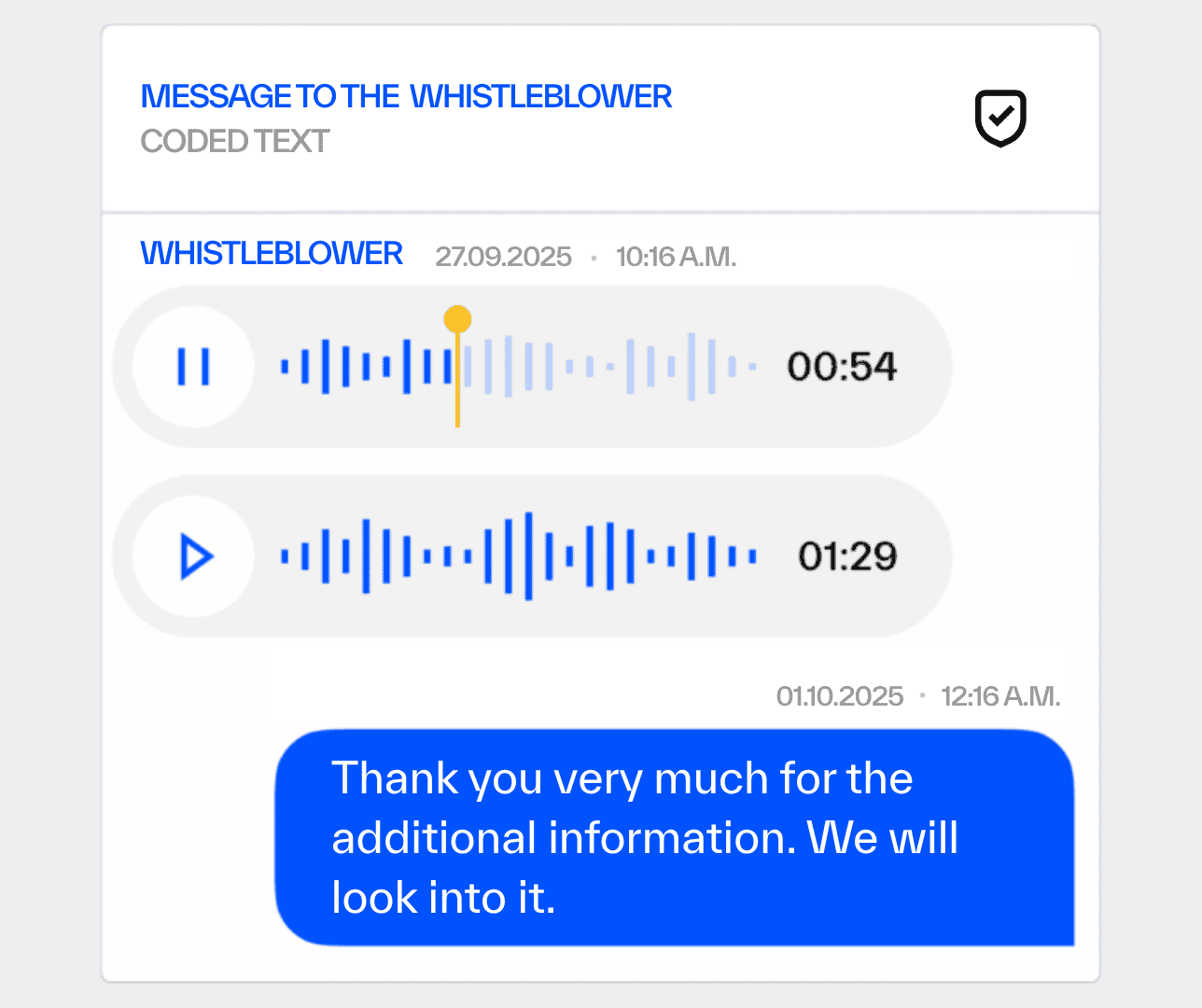

Whistleblowing Solution

Less effort. More time for your mandates.

Automated workflows, lightning-fast identification, and efficient onboarding: With Regpit, organizations save time, effort, and stress.

Known from

Your Regpit experts

Our team of over 20 experts is personally at your side – offering in-depth expertise, practical experience, and tailored guidance for your GwG compliance solutions.

Dr. Jacob Wende

Regpit expert

Louisa Lippold

Regpit expert

Ludovica Bölting

Regpit expert

Alexander Ebel

Regpit expert

Discover the Regpit platform.

We look forward to your inquiry and will be happy to show you how Regpit can make your GwG compliance processes more efficient.

free of charge & non-binding

Frequently asked questions (FAQ)

What is money laundering prevention and why does it also affect tax advisors?

Money laundering prevention includes measures to prevent illegal funds from being channelled into the legal economic cycle. According to the German Money Laundering Act (GwG), tax advisors are "obliged entities" and are therefore subject to specific due diligence obligations, particularly when accepting mandates.

Do all tax advisors really have to deal with money laundering prevention?

Yes. The Money Laundering Act applies to tax consultants in every client relationship. Anyone who does not document or check this carefully risks sanctions from the supervisory authority.

What exactly do I have to document and check as a tax advisor in accordance with the GwG?

Typical duties include:

Identification of clients (KYC/KYB)

Verification of the beneficial owner

Comparison with sanctions and PEP lists

Risk assessment of the client

Documentation and, if necessary, suspicious activity report

These tasks are not optional, but are required by law and are increasingly being monitored.

Is Regpit also suitable for small law firms or individual consultants?

Absolutely. Regpit is ready for immediate use, without IT implementation, without lengthy training. Even small law firms benefit from digitalised processes, automated checks and legally compliant documentation. This noticeably reduces the workload.

What are the specific benefits of Regpit compared to manual testing?

Time saving: identification, risk analysis, PEP/sanction checks are automated.

Error minimisation: Regpit checks completely and in a structured manner, no detail is lost.

Documentation at the touch of a button: all steps are stored in an audit-proof manner.

Up-to-date: Changes to the law (e.g. due to new EU regulations or the money laundering package) are automatically taken into account.

Do I need to have previous legal knowledge to be able to work with Regpit?

No. The platform is intuitive and guides you through the process step by step. A compliance support team is available if required. Complex topics such as "beneficial owner of foundations & co." are presented in an understandable way.

What happens in the event of abnormalities, does Regpit help even then?

Yes, if there are indications of risk or a potential suspicion, Regpit delivers:

Concrete recommendations for action

A standardised suspicious activity report template

Optional: Support from Regpit compliance experts

What if I already have my own solution?

Regpit is modular. It can be specifically integrated into existing processes, e.g. only for PEP/sanction checks or risk management. Thanks to API interfaces, Regpit can also work with existing law firm software systems.

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.