Our workshop on EU AML Regulation

Strategies, obligations, need for action: Jointly analyzed and efficiently implemented.

The EU AML Regulation reshapes the legal framework and creates new requirements for action. In the Regpit workshop, we analyse the impact and define clear next steps.

A selection of our clients

How it works: The EU-AMLR Workshop

In a practical, hands-on format, companies gain a quick and well-founded overview of the new EU Anti-Money Laundering Regulation (EU AMLR). Instead of abstract theory, the focus is on translating the regulation’s impact into clear, actionable steps for your organization.

Why it matters:

The EU AMLR introduces far-reaching changes, along with new obligations for companies.

This means: Act early to adapt processes in time and ensure continued compliance.

The goal of the workshop

Orientation, clarity and a concrete action plan

The Regpit workshop offers:

- A clear, compact update on the EU AML Regulation (EU AMLR) requirements

- A hands-on evaluation of your organization’s AML readiness

- Actionable guidance and next-step recommendations

The focus will be on current regulatory developments and their operational relevance with a clear view to concrete implementation.

The core contents of our workshop

Our experts cover all key aspects of the EU Anti-Money Laundering Regulation (EU AMLR): With a strong focus on the intersection between regulation and practical implementation.

- Regulations on outsourcing and reliance on other obliged entities

- Current status of relevant Regulatory Technical Standards (RTS) and guidelines

- Additional individual topics as needed

- KYC/KYB processes and update obligations

- Risk assessment and customer due diligence requirements

- Identification of beneficial owners

- Central registers and reporting of discrepancies

- Responsibilities of compliance managers and MLROs (Money Laundering Reporting Officers)

For whom is the workshop intended?

The workshop is designed for key professionals responsible for anti-money laundering (AML) and compliance within their organizations:

- MLROs (Money Laundering Reporting Officers)

- Compliance officers

- Members of senior management

- Employees in compliance, legal, or risk teams

Structure & format

Format: Two compact sessions of 3 hours each, allowing plenty of time for input, discussion, and your individual questions.

Location: Flexible — either virtual or on-site in Berlin or Frankfurt upon request.

For in-person workshops outside Berlin or Frankfurt, travel can be arranged for an additional fee.

From legislation to practice: Regpit shows you where you stand and how to successfully implement the EU AML Regulation (EU AMLR).

Your Regpit experts

More than 20 compliance specialists are there to support you personally: with in-depth expertise, practical experience and personalized advice on all aspects of your compliance solutions.

Dr. Jacob Wende

Managing Director / AML - Expert

Jan-Wolfgang Kröger

Head of Experts

Ludovica Bölting

Senior Associate - AML / AFC

Alexander Ebel

Manager - AML / AFC

Abbas Hussain

KYC Specialist

Louisa Lippold

Chief Product Officer / AML - Expert

Talk to our experts

Make an appointment directly in our calendar and secure your place in the EU AML-VO workshop.

Selected references

With our efficient approach, we have already supported obliged entities from various industries on their path to fully compliant AML practices.

Financial Sector:

International financial institutions and asset managers with offices in the USA, the UK, Asia, and Europe.

FinTechs and payment institutions

Internationally active financial institutions and asset managers with offices in the USA, the UK, Asia, and Europe.

Law firms

International law firms with lawyers, tax advisors, auditors, and notaries.

Property sector

Europe’s leading real estate agents and internationally operating property platforms.

Talk to our compliance experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

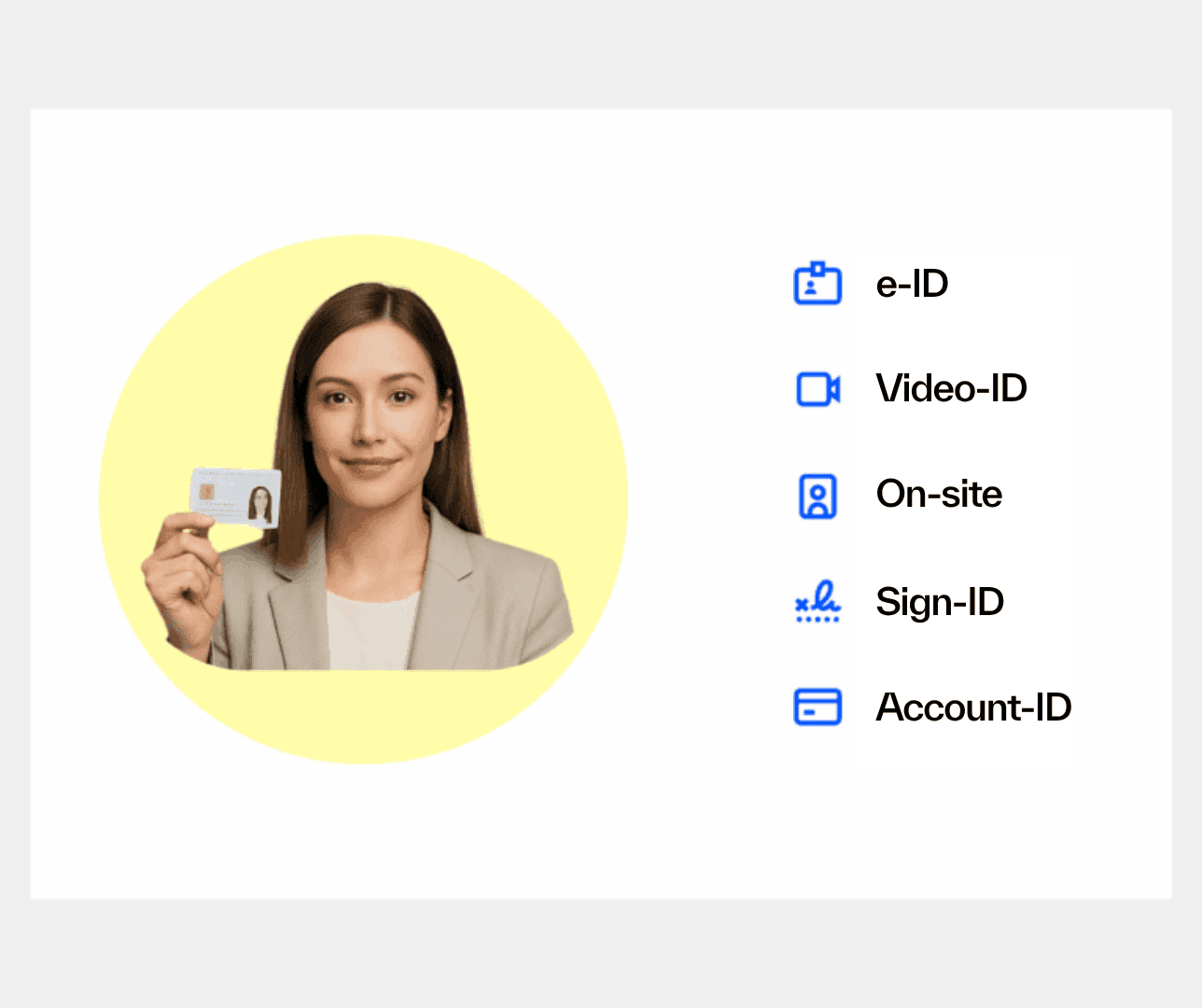

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

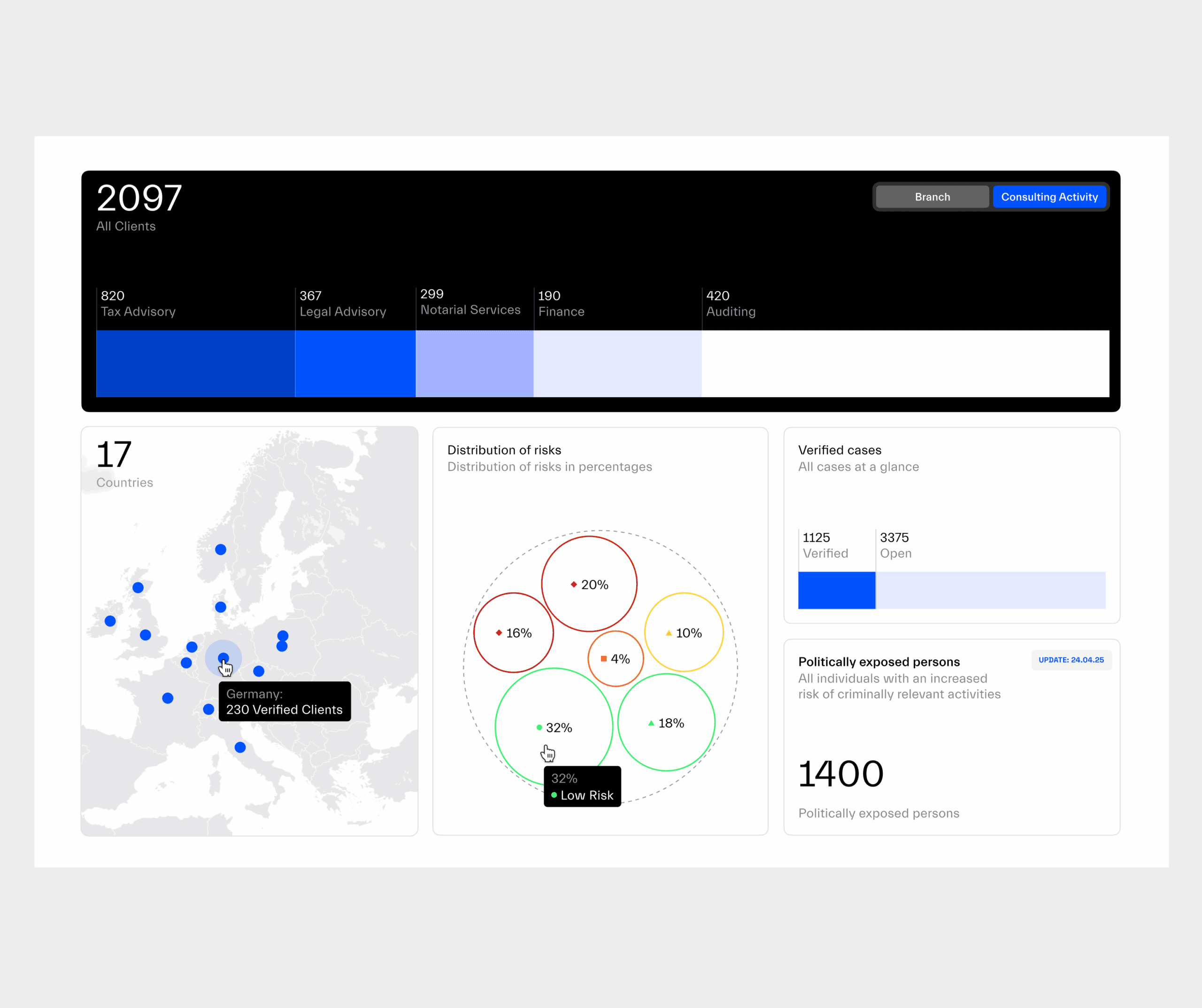

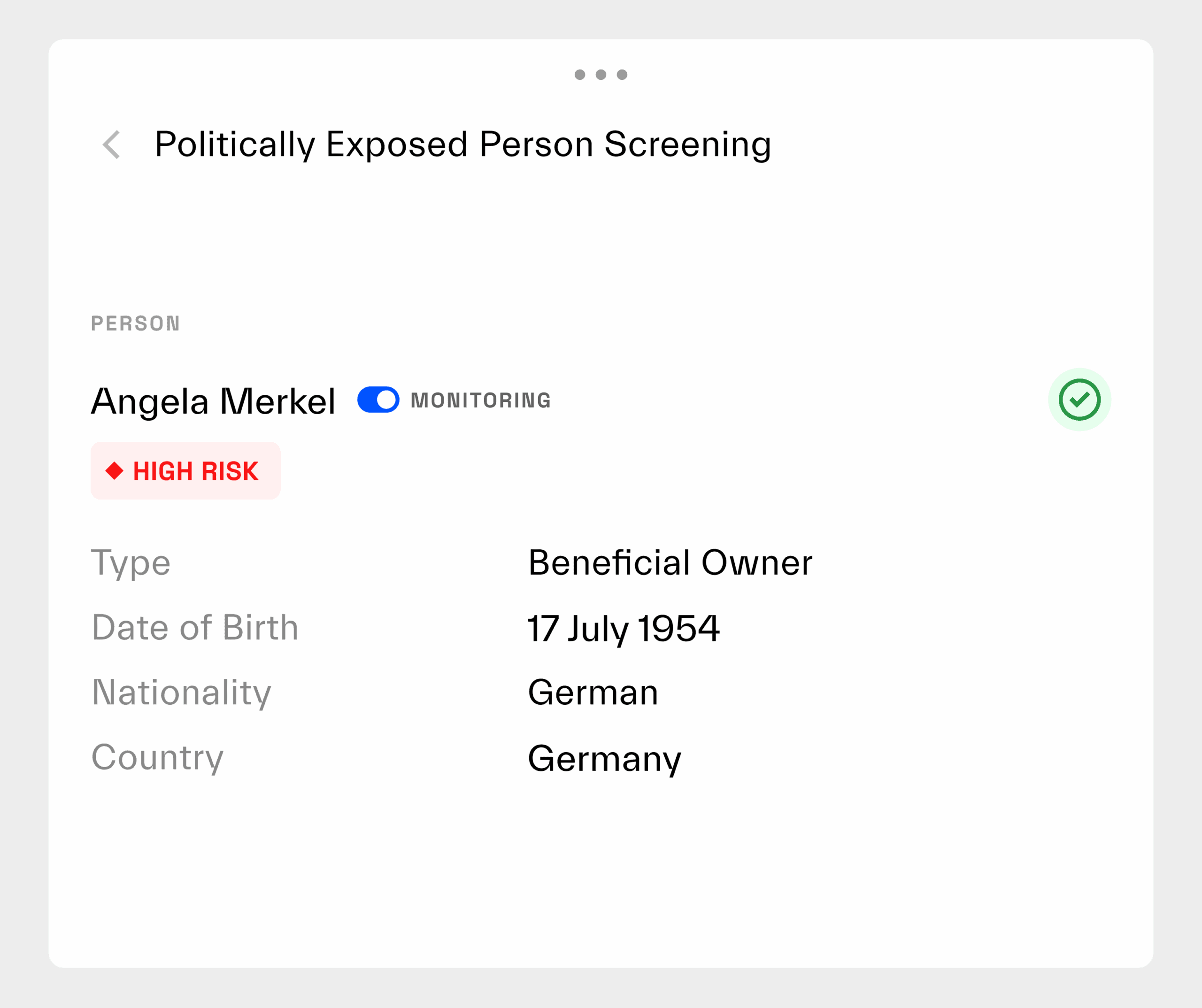

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

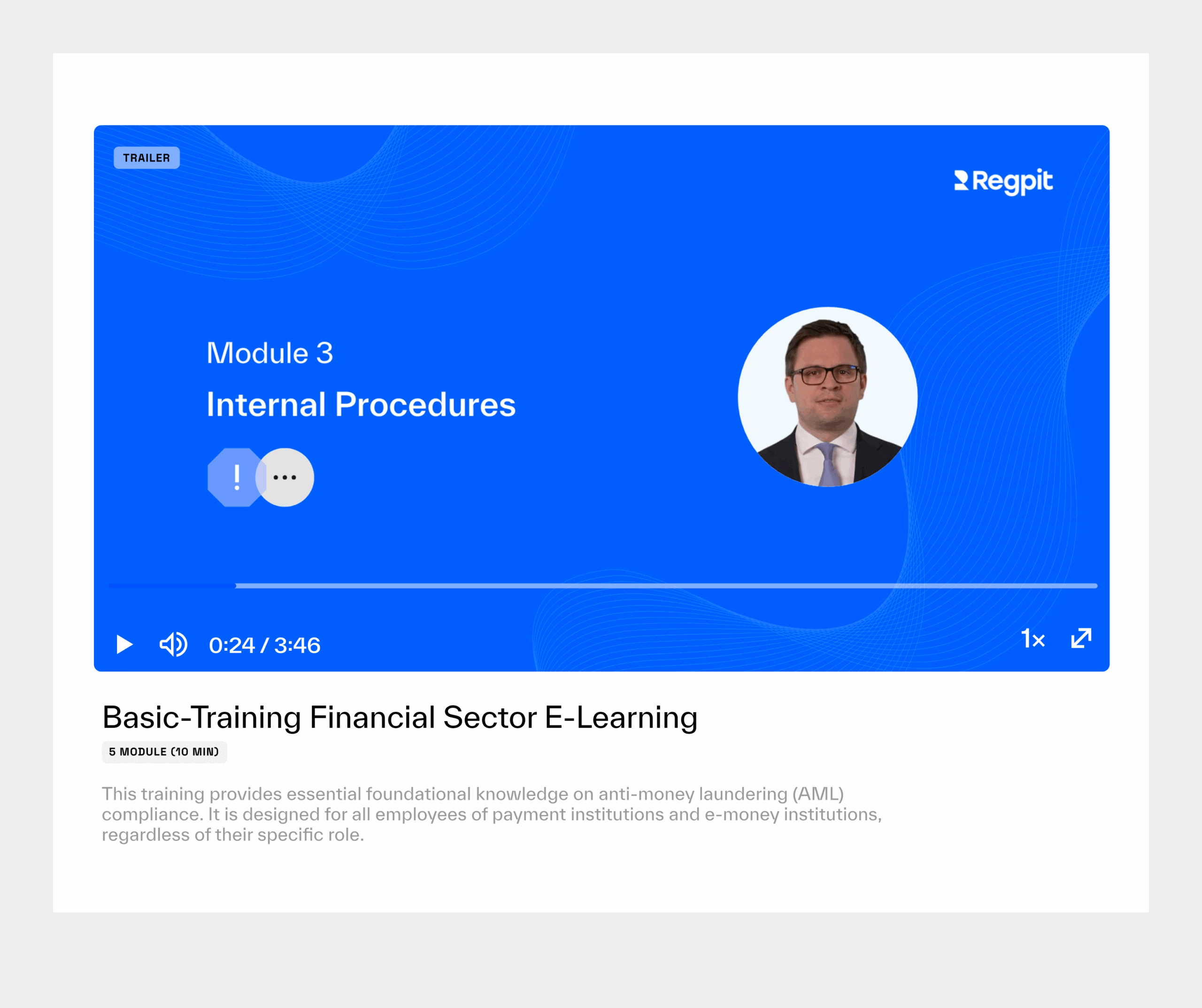

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

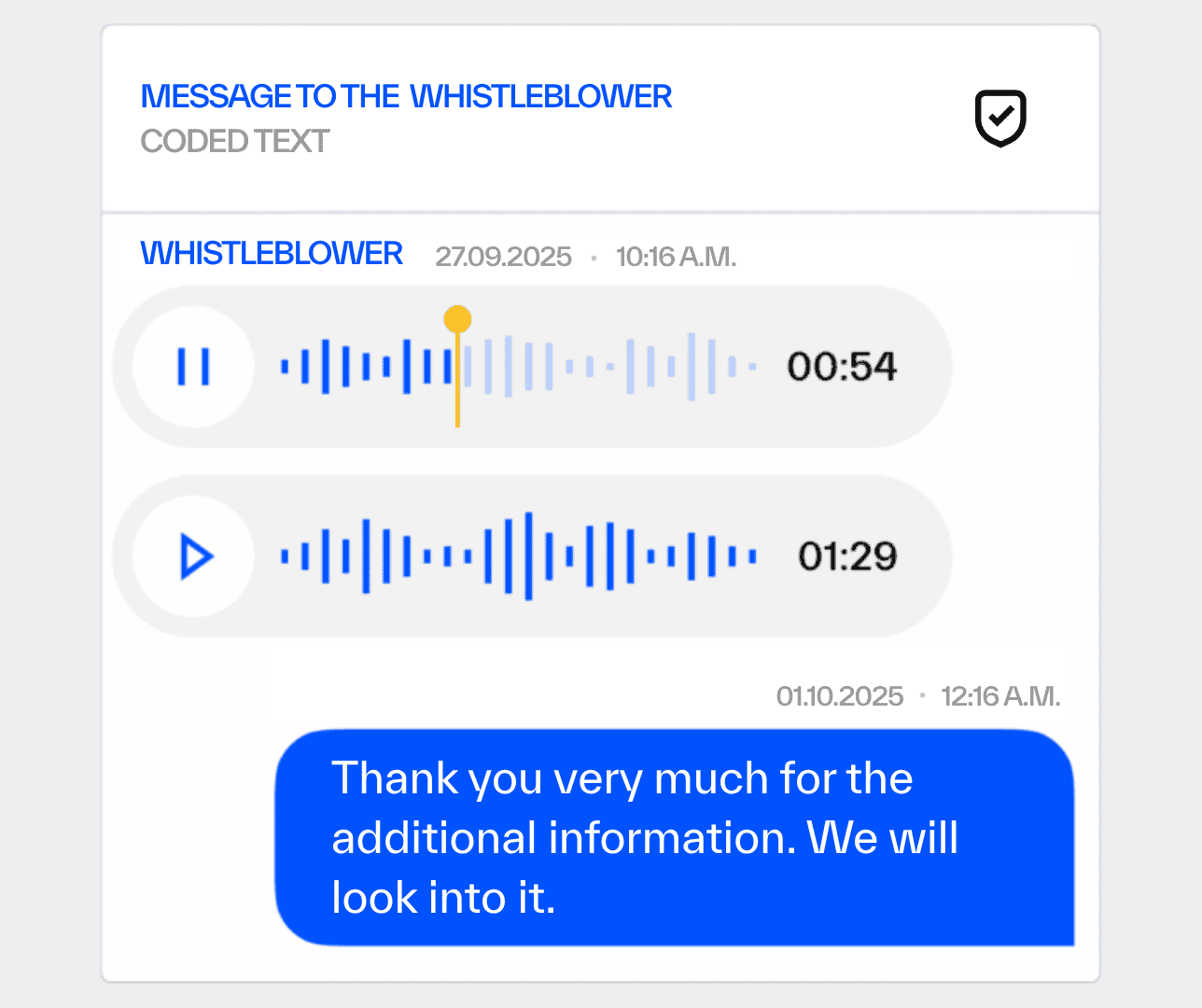

Whistleblowing Solution

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.