KYC/KYB Software für

AML Compliance

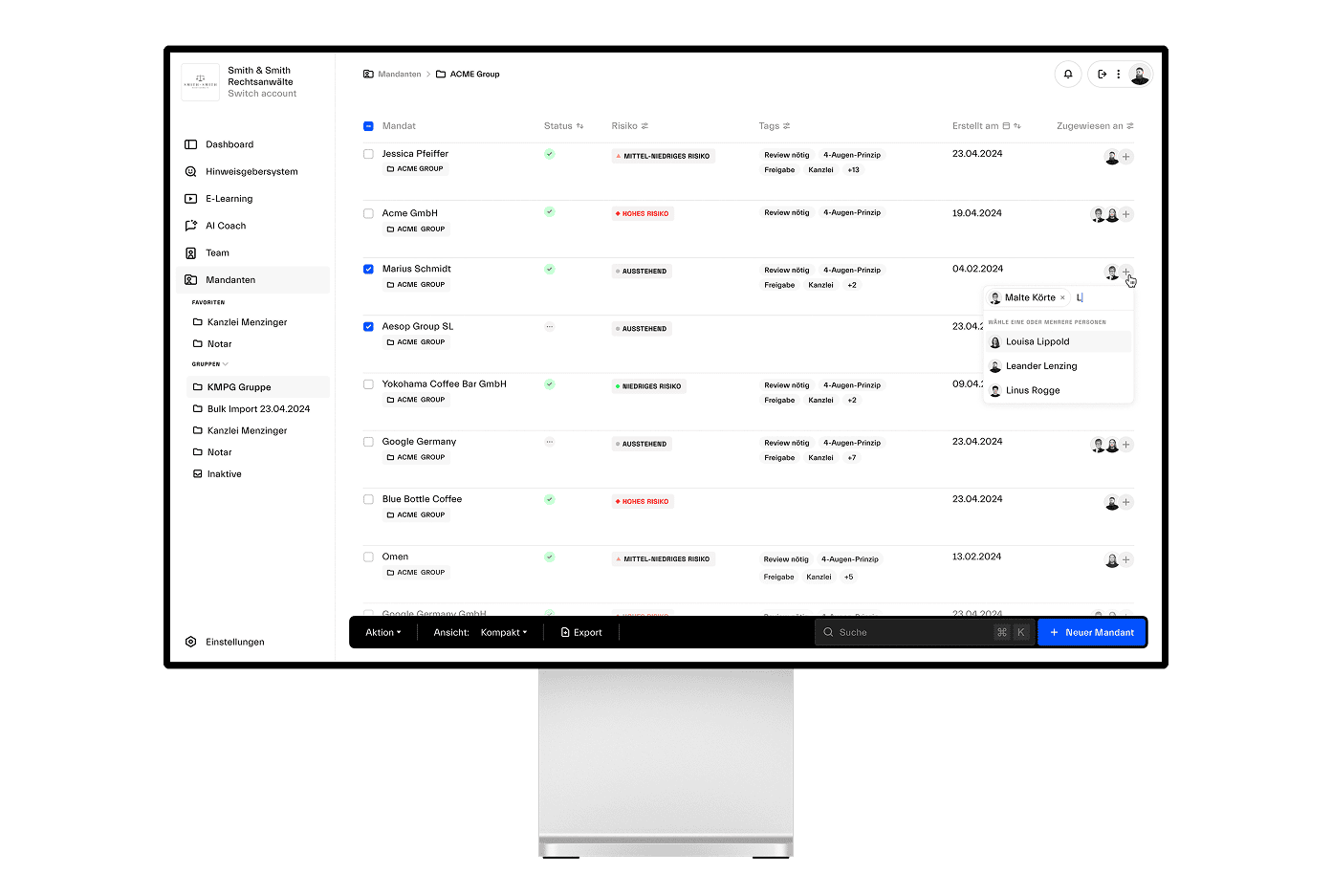

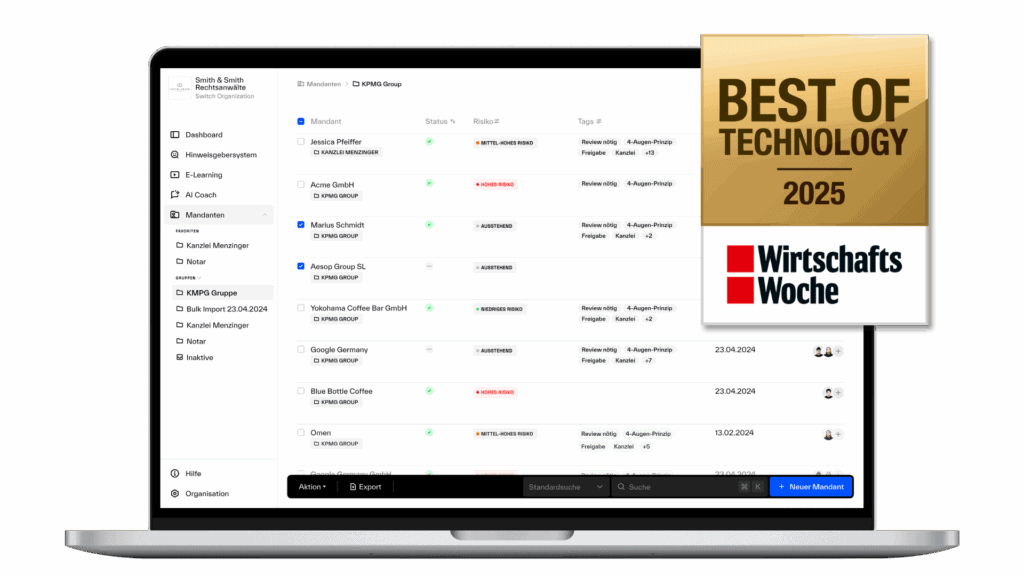

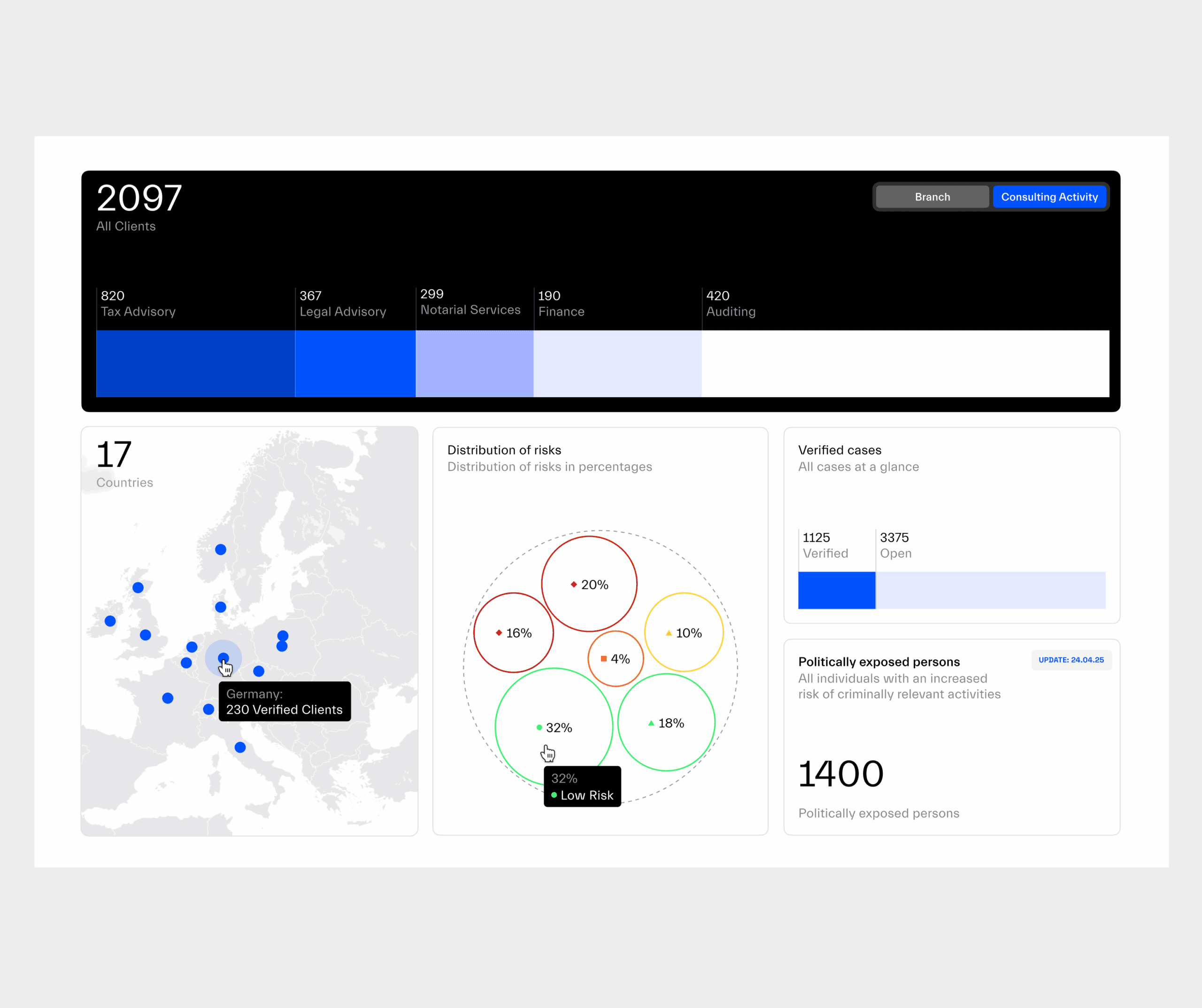

Regpit digitalisiert KYC- und KYB-Prozesse für Finanzunternehmen, Kanzleien und andere Verpflichtete nach GwG: Identifizierung, Registerprüfungen in 100+ Ländern, tägliche PEP- und Sanktionschecks sowie Risikobewertung in einem zentralen Dashboard.

A selection of our clients

This is how a KYC/KYB Software works

The KYC/KYB Solution from Regpit digitalizes the entire Know Your Customer/Business process: Identities are collected automatically, relevant documentation is verified, and screening is conducted against PEP and sanctions lists. An integrated risk assessment enables the legally compliant categorization of all business partners and is fully AML-compliant.

Your KYC/KYB Solution from a single source

Our digital KYC/KYB Solution automates your audit processes, reduces manual effort and ensures full AML compliance.

Automated verification processes, seamless onboarding, full compliance - all in one smart KYC Solution.

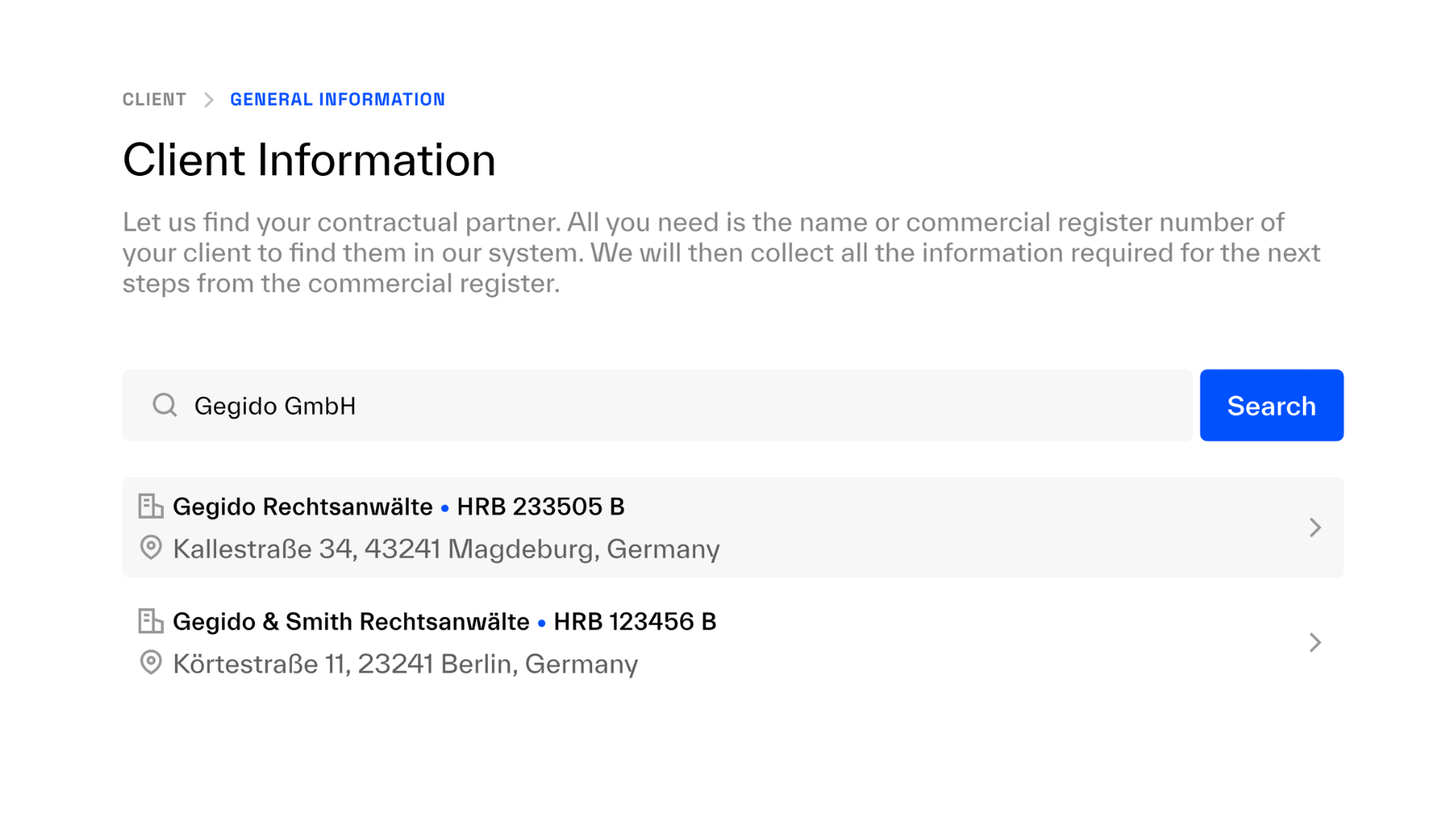

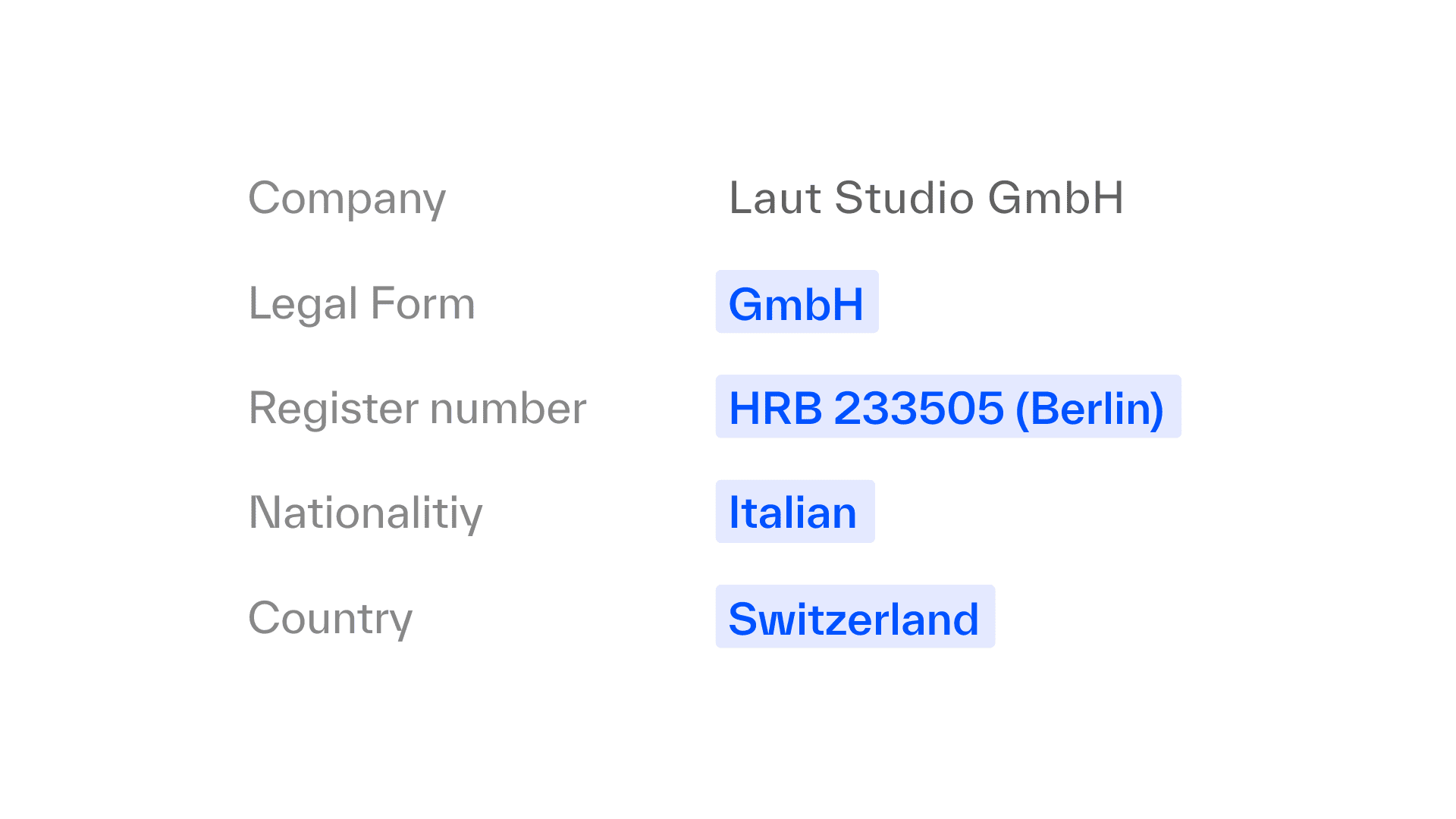

Digital onboarding and automatic data prefilling

- Optimized user experience for you and your contractual partners

- Significant time savings in the onboarding process

- Real-time access to data from registers

Create onboarding questionnaires

- Optimized user experience for end users

- Significant time savings in the onboarding process

- Always access the latest and correct data

Maximum flexibility

- Create landing pages in your design

- Organize workflows according to your requirements

- Customize questionnaires and workflows to suit your needs

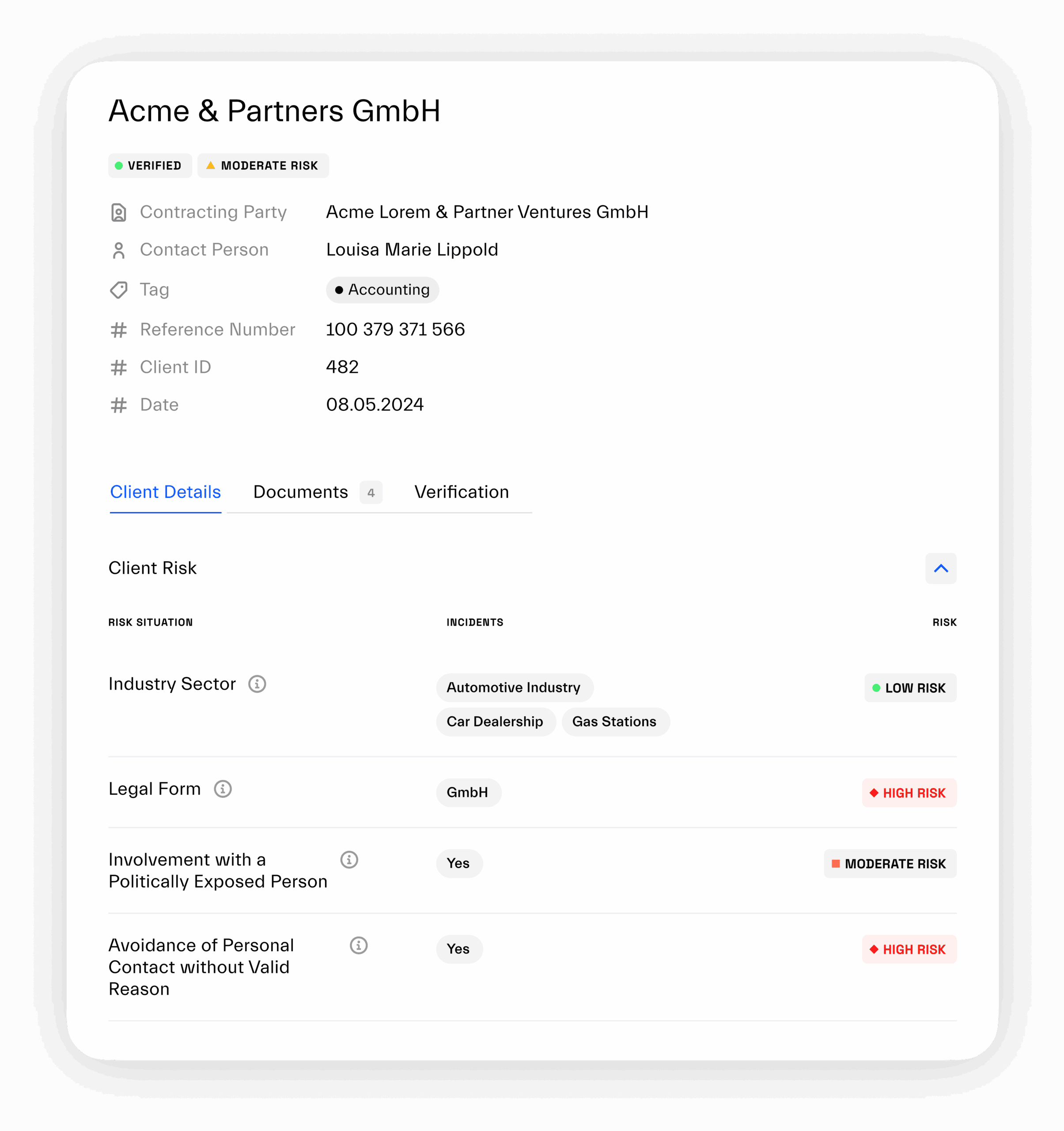

KYC report and risk assessment

The Regpit KYC Solution is used to create automated KYC reports. Perfect for supervisory documentation.

- Overall risk of the business relationship

- Specific customer risks, country risks, transaction risks, product and service risks

- All relevant documents in the appendix (e.g. ID card, register data)

- Audit-proof documentation and exportable

All functions in a KYC Software

AML audit of companies

- Automated query of commercial register and transparency register

-

Automated identification of economic

authorized persons - Automated risk report

- 100% Audit-proof german MLA report

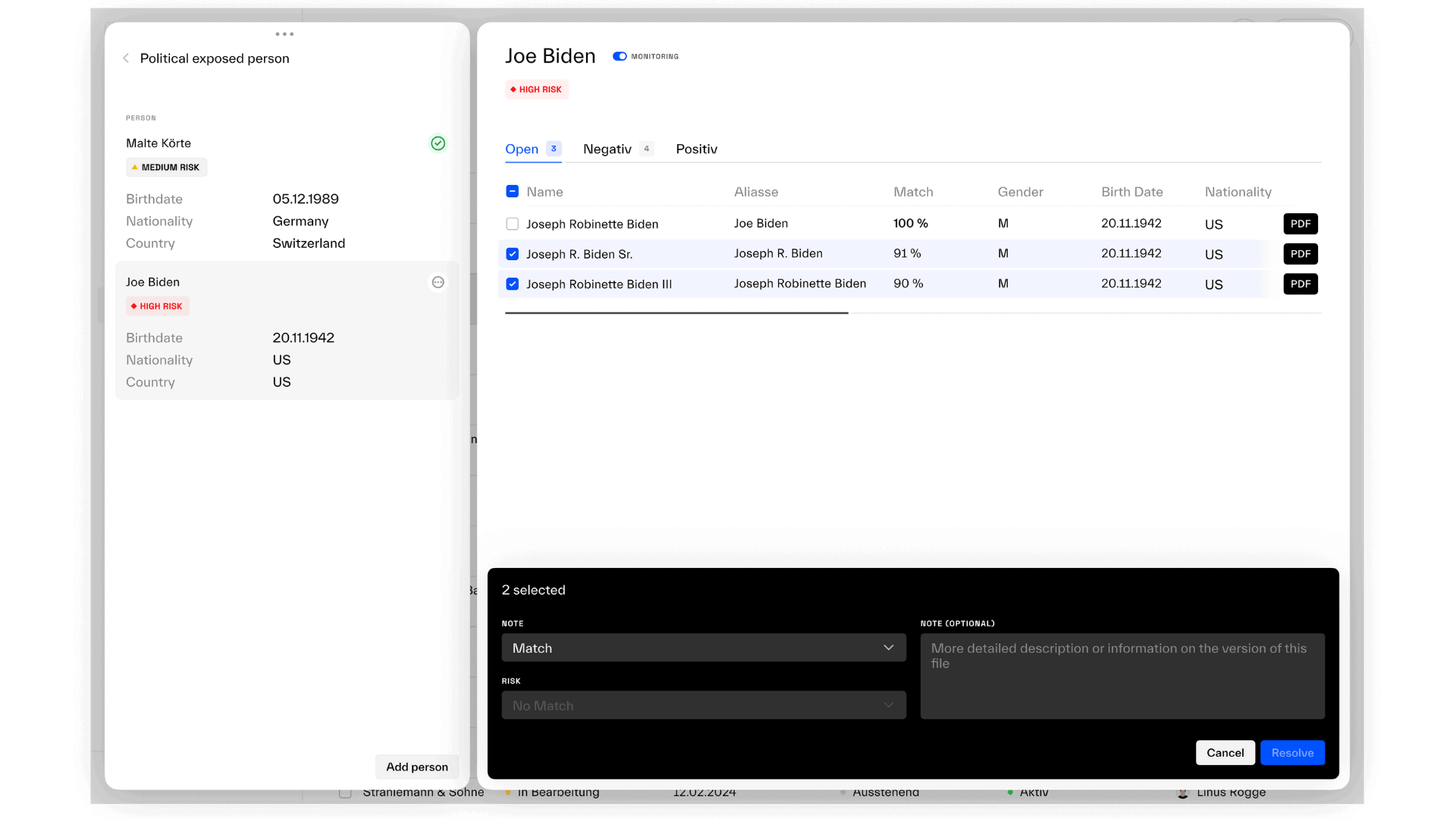

AML check of persons

- ID verification via video ID, e-ID or other AML-compliant procedures

- Check for politically exposed persons, sanctions & adverse media

- Automated risk report

- 100% Audit-proof german MLA report

KYC processes from the very first case

All KYC procedures verify the respective person, generate a KYC report with risk classification, and document every step in a legally compliant manner. Use is possible from just a single case onwards.

From 4,50€

Natural person

(National/International)

- Quick creation of a structured profile

- Digital onboarding process

- PEP and sanctions screening

- Adverse media

- Automated risk report (PDF)

- Audit-proof documentation

Add on:

- ID verification via Video ID, eID and more

From 11,50€

Legal person

(National)

- Quick creation of a structured profile

- Digital onboarding process

- Automatic prefill of questionnaires

- Automated queries of commercial and transparency registers

- Automatic ownership and control structure chart / beneficial ownership identification

- PEP and sanctions screening

- Adverse media

- Automated risk report (PDF)

- Audit-proof documentation

Add on:

- ID verification via Video ID, eID and more

From 7,50€

Legal person

(International)

- Quick creation of a structured profile

- Digital onboarding process

- Automated queries of 300+ registers worldwide

- Access to 120 million company records

- PEP and sanctions screening

- Adverse media

- Automated risk report (PDF)

- Audit-proof documentation

Add on:

- ID verification via Video ID, eID and more

Real success stories

Our Solutions are used by law firms, financial service providers and compliance teams across Europe. Read how our customers benefit from them.

“Thanks to Regpit, we’re able to carry out a customer-friendly onboarding process at the highest level — even in the area of money laundering prevention — simply, securely, and efficiently. That’s extremely important to us as a FinTech!”

"The requirements for law firms in the area of money laundering prevention and sanctions are becoming ever more extensive. We are delighted to have a specialised partner at our side with Regpit!"

Talk to our compliance experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

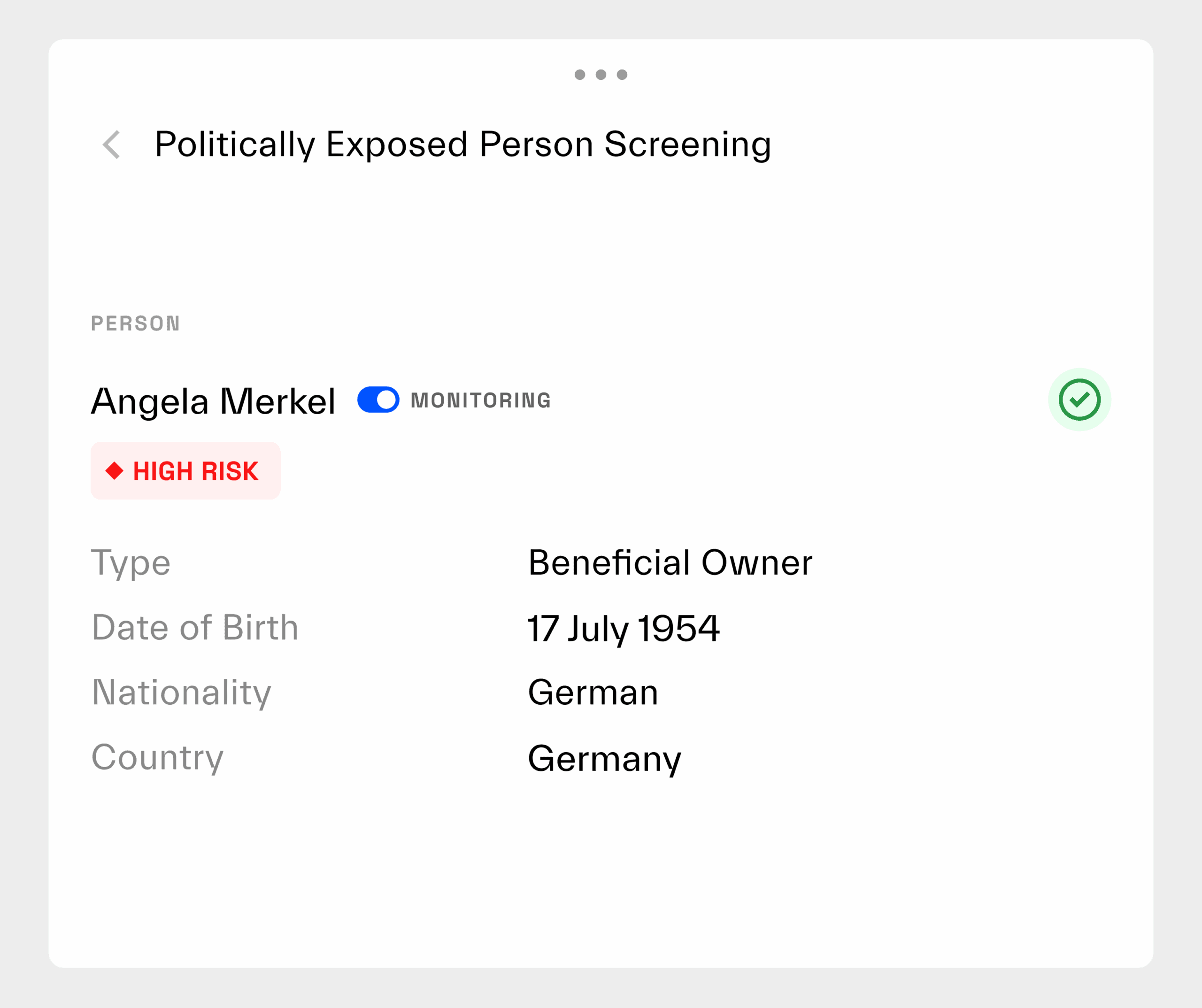

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

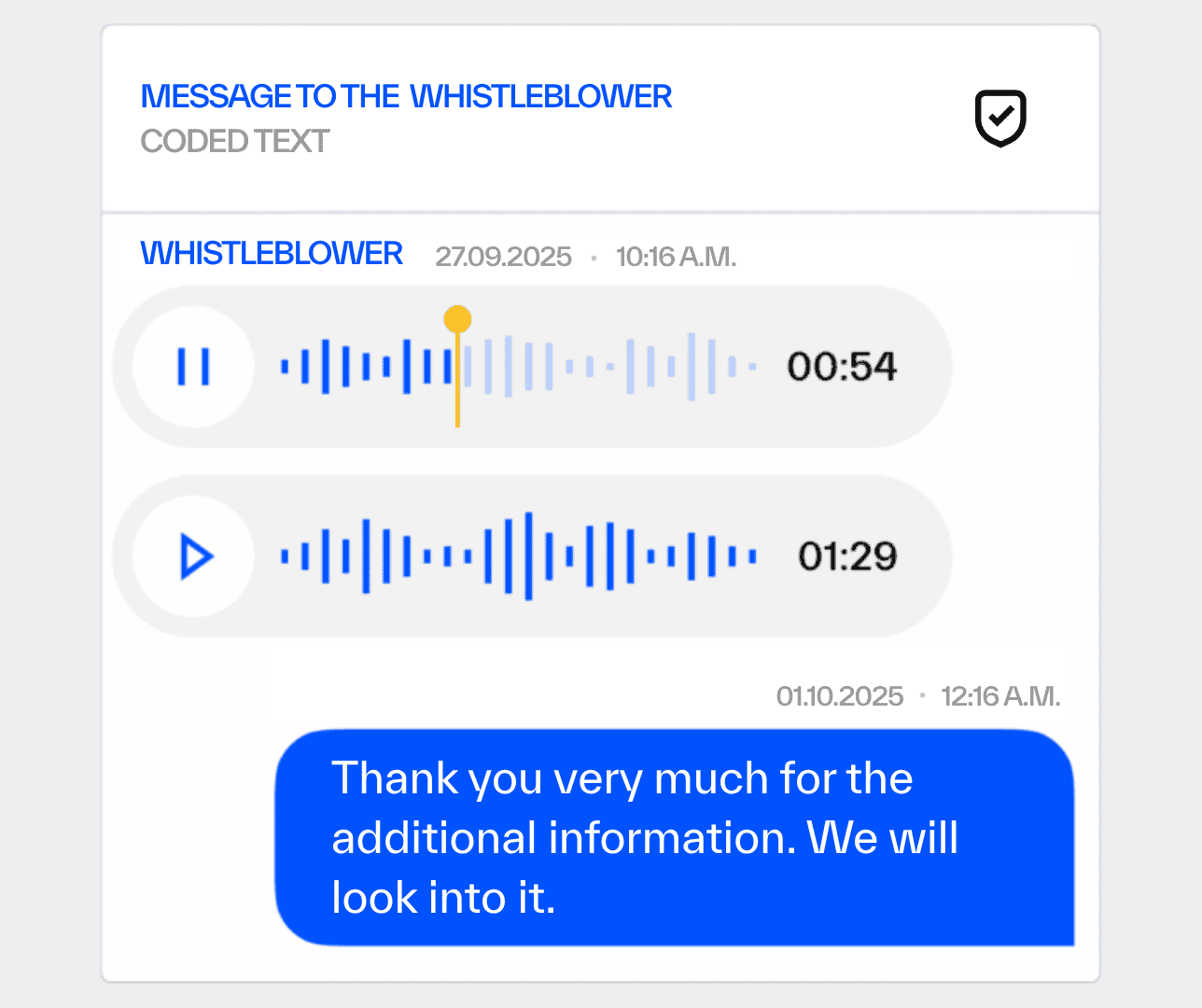

Whistleblowing Solution

Frequently asked questions (FAQ)

What does KYC mean?

"KYC" is the abbreviation for "Know Your Customer".

The term describes regulatory auditing obligations that companies must fulfil as part of money laundering prevention, including identity checks or, in the case of corporate customers, company audits and the identification of beneficial owners as well as risk assessments.

What is KYC?

KYC stands for "Know Your Customer" and refers to the legally required identification and verification of customers.

As part of KYC, companies must establish the identity of their customers in order to prevent money laundering and terrorist financing. This includes, for example, ID checks, obtaining register documents, checking for politically exposed persons and risk assessments.

What is KYC data?

KYC data is personal and business-related information that is collected as part of the identification process to prevent money laundering.

This includes, for example, name, date of birth, address, ID data, beneficial owners in the case of legal entities and information on the origin of funds or risk classification.

What is a KYC procedure?

A KYC procedure describes the entire verification process for the identification and risk assessment of customers.

It includes steps such as data collection, document verification, comparison with sanctions and PEP lists and categorisation into risk classes, all with the aim of preventing money laundering and terrorist financing.

Who is obliged to take the KYC test?

All companies and professional groups that are subject to the Money Laundering Act (GwG) are obliged to carry out KYC checks.

It includes steps such as data collection, document verification, comparison with sanctions and PEP lists and categorisation into risk classes, all with the aim of preventing money laundering and terrorist financing.

What is money laundering?

Money laundering refers to all activities intended to conceal the illegal origin of assets. The aim is to make criminally acquired money, for example from fraud, drug trafficking or corruption, appear "clean" through transactions or investments and to channel it into the legal economic cycle.

The process typically takes place in three phases: Injection, concealment and integration. Money laundering is a criminal offence and is combated by the Money Laundering Act (GwG) and international regulations to protect the integrity of the economy and the financial system.

What is a politically exposed person (PEP)?

A politically exposed person (PEP) is a person with important public functions who therefore carries an increased risk of corruption.

These include, for example, members of government, members of parliament, judges of high courts, ambassadors or executives of state-owned companies. Family members and close business partners are also considered PEP-affiliated persons.

What does "legal representative" mean?

A legal representative is a person who is authorised by law to make legally binding decisions on behalf of another person or a company.

In the corporate context, this is usually the management, the board of directors or another person authorised to represent the company according to the commercial register. In the case of minors or legally incapacitated persons, it is e.g. parents or court-appointed carers.

Legal representatives must be identified and verified as part of KYC or AMLA audits.

What is the MLA?

"GwG" stands for Money Laundering Act: a central law for the prevention of money laundering and terrorist financing in Germany.

The AMLA sets out obligations for so-called obliged entities, including identity checks (KYC), risk analyses, suspicious activity reports, training and internal security measures. It is based on the EU Money Laundering Directives.

What is a KYC tool and how does it work?

A KYC tool helps companies to carry out legally required identification processes efficiently. It automatically collects relevant customer data, checks ID cards, compares information with sanctions and PEP lists and documents all steps in an audit-proof manner.

How can I recognise a good KYC tool?

You should pay attention to this when choosing a KYC tool:

A good KYC tool is legally compliant, easy to use, flexible to integrate and scalable. It should cover all relevant procedures (e.g. video ID, eID), automatically check and transparently highlight risks.

How does a KYC process with Regpit work?

Regpit offers a fully digital customer journey: from identification and risk assessment to the final risk report. Users select the appropriate procedure, upload documents or verify themselves via video ID; the process is intuitive and MLA-compliant.

Why is KYC mandatory for my company?

The Money Laundering Act (GwG) obliges certain professional groups and companies to identify their customers. The aim is to recognise illegal money flows at an early stage and prevent misuse.

What data must be collected by the KYC?

Depending on the type of contracting party (natural or legal person), the name, date of birth, address, identification documents and beneficial owners must be recorded. In the case of companies, extracts from the commercial register, authorised representatives and ownership structure must also be recorded.

Can I use the Regpit KYC tool without an IT setup?

The Regpit platform is completely web-based. Companies do not need any implementation or special infrastructure; after logging in, the KYC check can be started immediately.

How does the Regpit KYC tool differ from traditional solutions?

Regpit combines regulatory expertise with modern technology. In contrast to stand-alone solutions, the platform offers a modular, legally compliant overall system with a high level of user-friendliness and optional technical support.

Which identification methods does Regpit support?

Regpit offers video ID, eID, on-site identification and account ID. All procedures are MLA-compliant and can be used flexibly.

Where is KYC data stored at Regpit?

All customer data is stored in a GDPR-compliant and audit-proof manner in German data centres. The platform fulfils the highest security standards and documents every step in a traceable manner.

What does a KYC tool like Regpit's cost?

Regpit offers a flexible SaaS model with a monthly licence and transaction-based fees. You only pay for the modules and processes you actually use, transparently, scalably and without hidden costs.

How much effort does a digital KYC tool save?

Thanks to automated data collection, processes without media discontinuity and immediate checks, Regpit reduces the workload by up to 90 % compared to manual processes and at the same time reduces the risk of errors.

Is Regpit's KYC tool GDPR-compliant?

Yes, all processes and data processing fulfil the requirements of the General Data Protection Regulation. This includes data storage, access controls and deletion concepts.

Am I obliged to identify my customers?

KYC obligation explained: When identification is necessary

In principle, obligated parties under the Money Laundering Act must identify their contractual partner before the start of each new business relationship.

Is a digital KYC process recognised?

Digital identification procedures are permitted by law, provided they meet certain technical and organisational requirements. Regpit ensures that all procedures are tested and legally compliant.

What does the KYC scope depend on?

The audit effort depends on the risk and the type of due diligence obligations. Regpit supports automated risk assessment and dynamically adjusts the intensity of the audit.

What are the legal KYC obligations?

The basis for this is the German Money Laundering Act (GwG). In addition, there is also guidance from the relevant supervisory authorities (e.g. BaFin or bar associations). Regpit is harmonised with these requirements and is updated on an ongoing basis.

Why is an automated KYC tool worthwhile?

Manual checks are error-prone, time-consuming and difficult to scale. A tool like Regpit automates all processes, reduces operational effort and increases regulatory security at the same time.

Who can use the Regpit KYC tool?

Regpit is ideal for banks, insurance companies, FinTechs, law firms, tax consultancies, property companies and all other MLA obligated parties. Thanks to its modular structure, the tool adapts to any setup, from start-ups to large companies.

Is Regpit's KYC tool GDPR-compliant?

Yes, all processes and data processing fulfil the requirements of the General Data Protection Regulation. This includes data storage, access controls and deletion concepts.

Should I replace my existing KYC system?

If your current system is inefficient, based on manual processes, not legally compliant or difficult to use, you should consider a solution like Regpit. Digital KYC tools automate time-consuming checks, reduce errors and noticeably relieve your team. The changeover is quick and the added value is immediately visible.

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.