2024 was a year of progress for the Financial Intelligence Unit (FIU), marked by clear momentum in innovation, digitalisation, and international cooperation.

Fewer reports, better quality

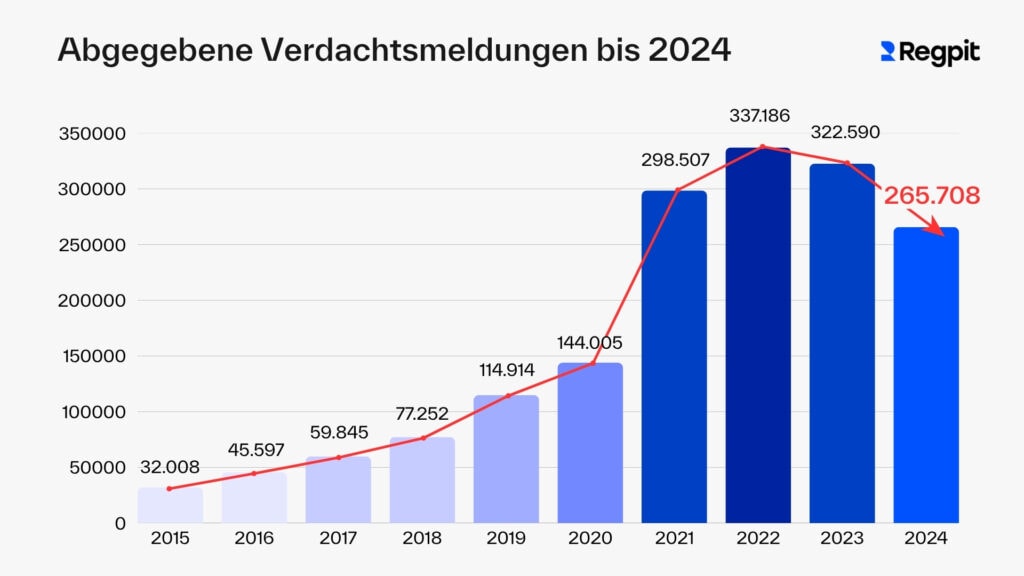

The total number of suspicious activity reports (SARs) fell to 265,708 in 2024 — a significant decrease compared to the previous year (2023: 322,590 reports) and a development that can be viewed positively. This decline does not indicate reduced diligence on the part of obliged entities. Instead, the FIU, together with BaFin and the Anti Financial Crime Alliance (AFCA), developed so-called negative typologies – specific case scenarios that do not require reporting. These practical guidelines provide greater clarity for obliged entities and help reduce unnecessary reports, allowing the FIU to focus more effectively on truly relevant cases.

Crypto in focus

Around 8,700 of the suspicious activity reports submitted in 2024 related to crypto assets. Bitcoin was by far the most frequently mentioned, followed by Ethereum, Ripple (XRP), Tether, and Litecoin. Notably, an increasing number of these reports are being submitted directly by CASPs (Crypto Asset Service Providers) — companies operating trading platforms, managing wallets, or processing crypto transactions.

This trend underlines that crypto assets are now at the heart of modern money laundering methods, and that CASPs are increasingly embracing their responsibilities as obliged entities. At the same time, the demand is growing for specialised screening, monitoring, and analytics tools to detect suspicious activity at an early stage.

“Sharks” in action

The newly established “Sharks” special unit addresses key concerns raised by the FATF in its most recent evaluation of Germany. Their mission: to investigate complex, cross-border money laundering cases and uncover emerging network structures, transaction paths, and laundering techniques. The “Sharks” work closely with national and international authorities, using anomaly detection and data-driven network analysis to identify suspicious patterns early on.

Strengthening international cooperation

Whether it’s terrorist financing, sanctions, or environmental crime, the FIU plays an active role in numerous working groups and collaborates closely with FIUs from the EU, G7, and other international partners.

AMLA operational by 2028

The new European Anti-Money Laundering Authority (AMLA) is gaining traction in Frankfurt and will significantly strengthen the coordination of EU FIUs from 2025 onwards. The AMLA is expected to become fully operational by 2028.

New obliged entities registered

In 2024, 98,810 new obliged entities registered with the FIU — a sharp increase compared to previous years. The main reason: a new legal obligation introduced on 1 January 2024 requiring entities under Section 2 GwG to register with the FIU. The increase is particularly evident in the non-financial sector, including real estate agents, art intermediaries, and legal professionals.

You can access the full FIU Annual Report on the FIU website: View the report here.