Our prices and packages

Whether you need a single module or a complete package, Regpit offers you the flexibility to choose exactly what you need. All prices are subject to the applicable statutory value added tax.

Getting started with Regpit is this simple:

1. Choose your package

2. Define your process

3. Get started

Our packages: As flexible as your requirements

Our products and services are modular and freely combinable.

To help you get started quickly, we’ve bundled the most common combinations of platform modules and services into smart packages. With annual payment, you benefit from an attractive price advantage compared to monthly billing.

Starter

Free of charge

- Access to the Regpit Academy

- Test access to the entire Regpit platform

Basic

- Basic Regpit KYC-Solution

- Ident Solution

- Access to the Regpit Academy

Add on:

- E-Learning Solution

- Whistleblower System

- Individual AML expert support

Our bestseller!

Advanced

- Advanced Regpit KYC Solution

- Ident Solution

- Monitoring Solution

- API integration & interfaces

- Access to the Regpit Academy

Add on:

- E-Learning Solution

- Whistleblower System

- Individual AML expert support

Professional

- Advanced Regpit KYC Solution

- Ident Solution

- Risk Management

- Whistleblower System

- E-Learning Solution

- Access to the Regpit Academy

Add on:

- Individual AML expert support

Talk to our compliance experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

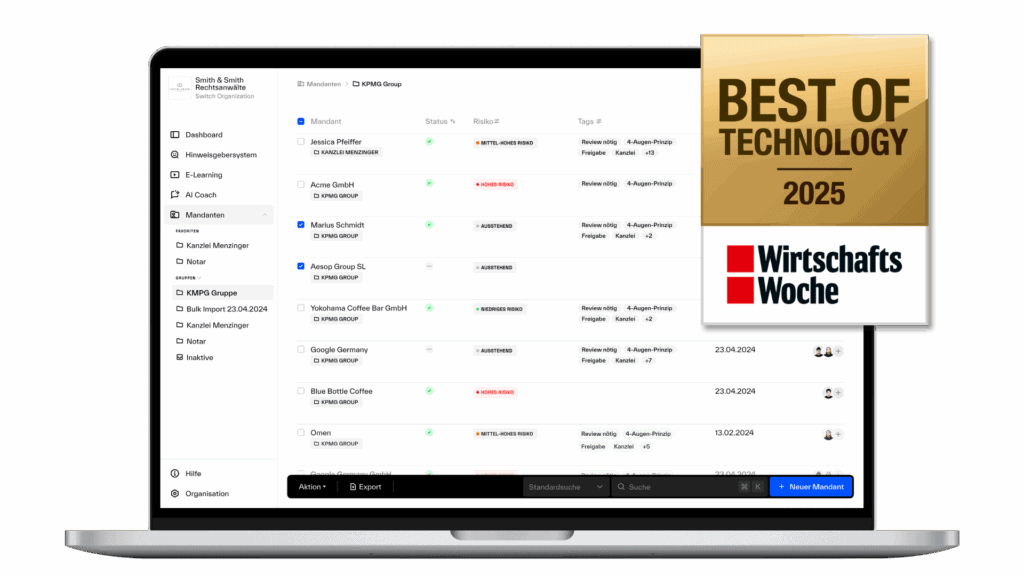

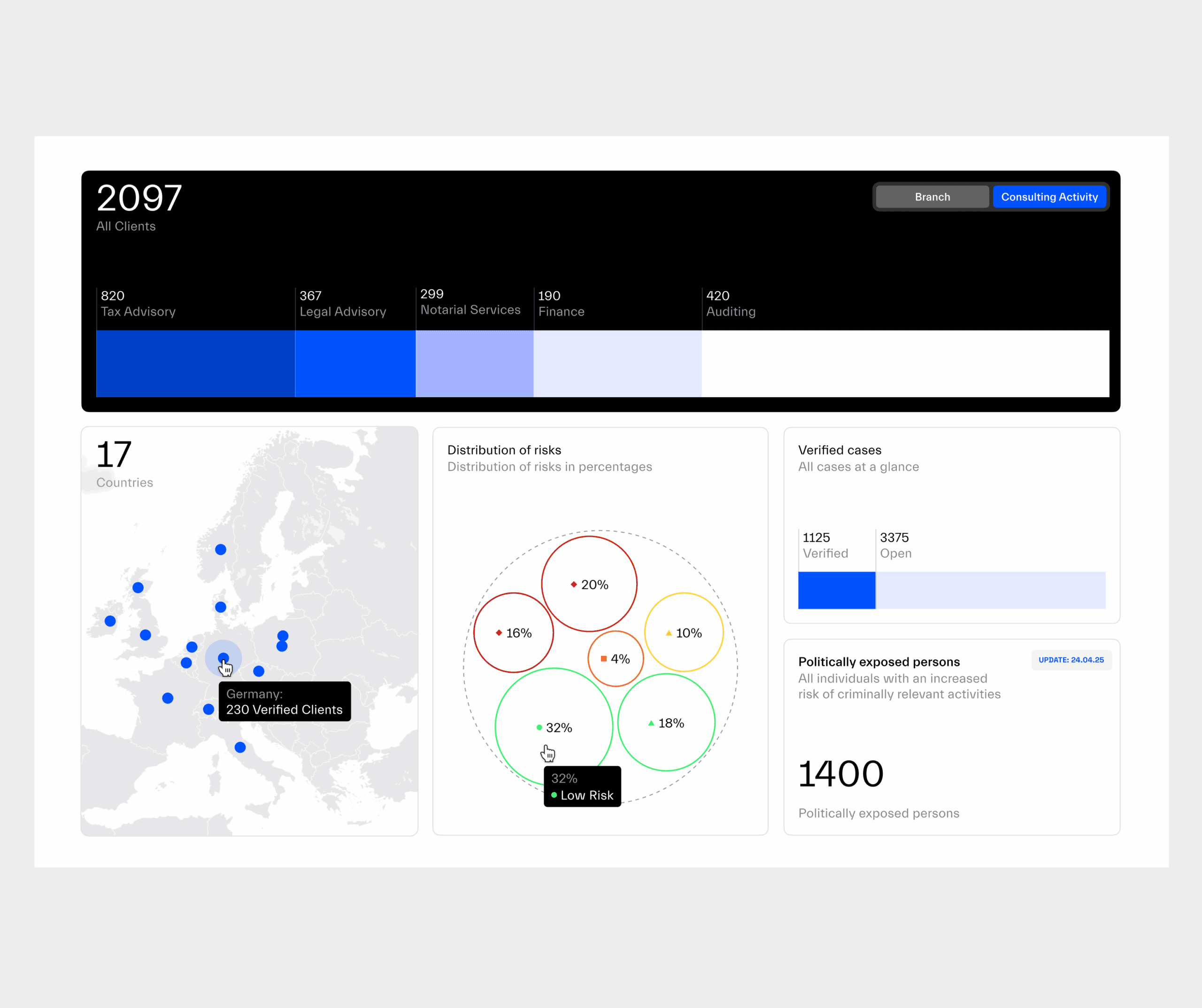

Our Products

Starter

Basic

Advanced

Professional

Dashboard

All processes converge automatically in the dashboard.

Regpit Academy

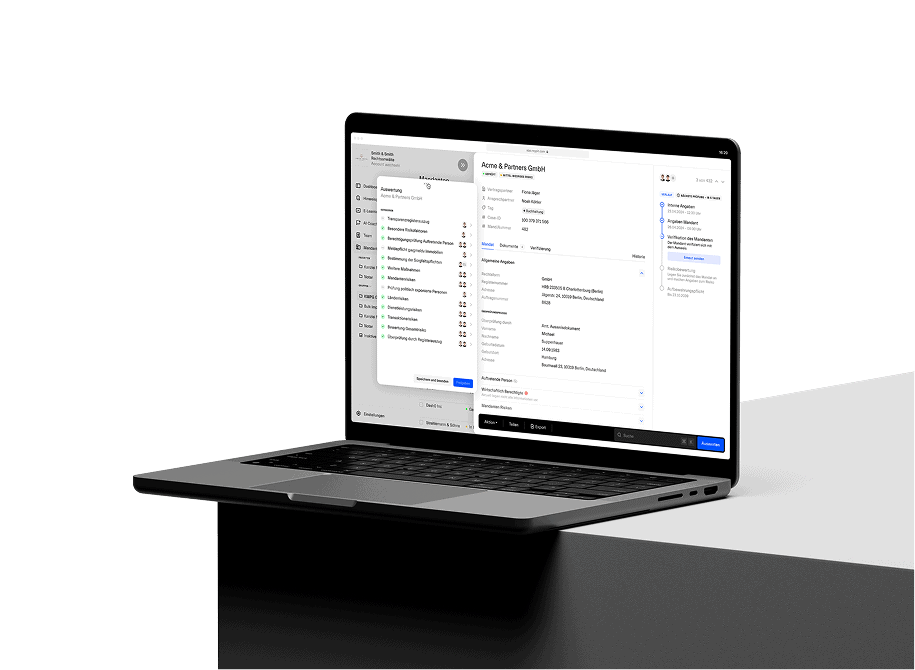

KYC/KYB Solution

Verification of natural persons

Pay per use

Verification of companies

Pay per use

Digital questionnaires

Automatic pre-filling of questionnaires

Automatic access to over 300 national and international registers

Automatic ownership and control structure chart

Beneficial owners

Sanctions list check

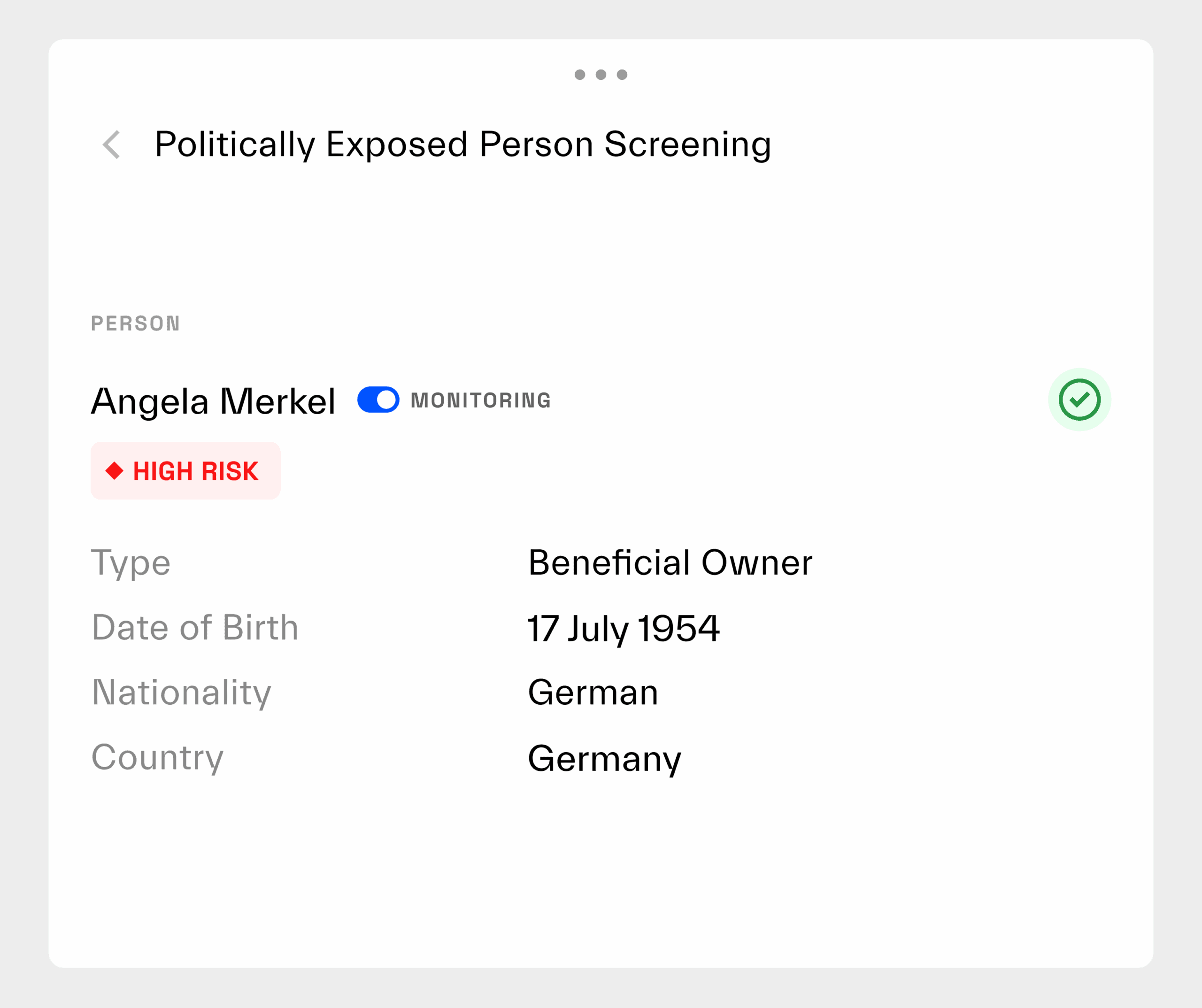

PEP screening

Adverse media screening

Transparency Register API

Credit risk/creditworthiness check

Risk report including individual risk calculation: customer risks, country risks, transaction risks, product and service risks

Support for documenting enhanced due diligence obligations

KYC profile export

KYC monitoring

Access to all interface partners

Regpit REST API

Case management for update intervals

Archiving of cases in accordance with retention periods

Import of existing customers

Audit-proof case view

Ident Solution

Video ID method

e-ID method

Account ID method

Sign-ID method

Risk Management

Risk analysis

General MLA policy

KYC policy

Suspicious activity reporting policy

Employee reliability screening

Internal reporting channel

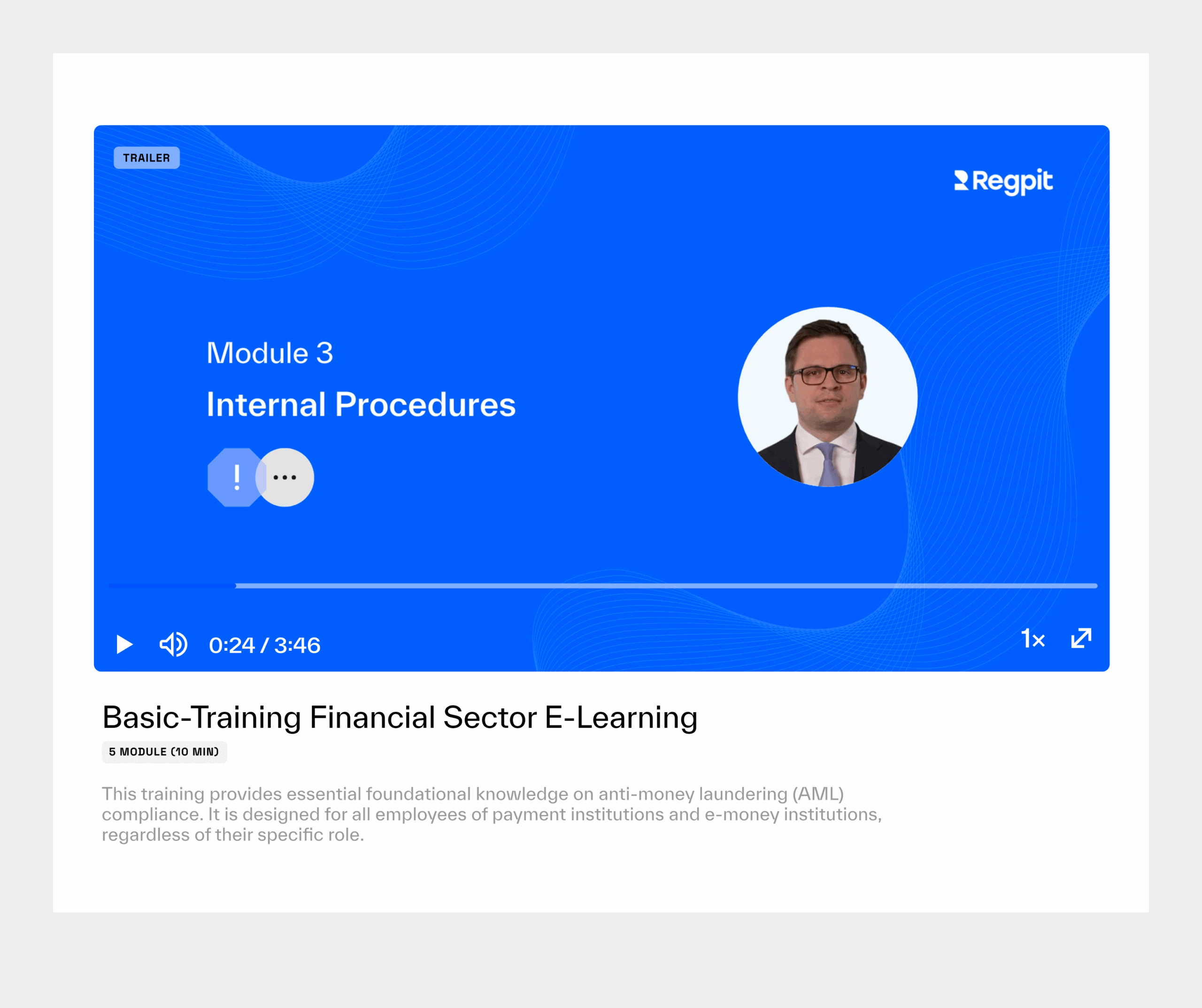

E-learning: Mandatory employee training

Basic training

Add on

Add on

Advanced training

Add on

Add on

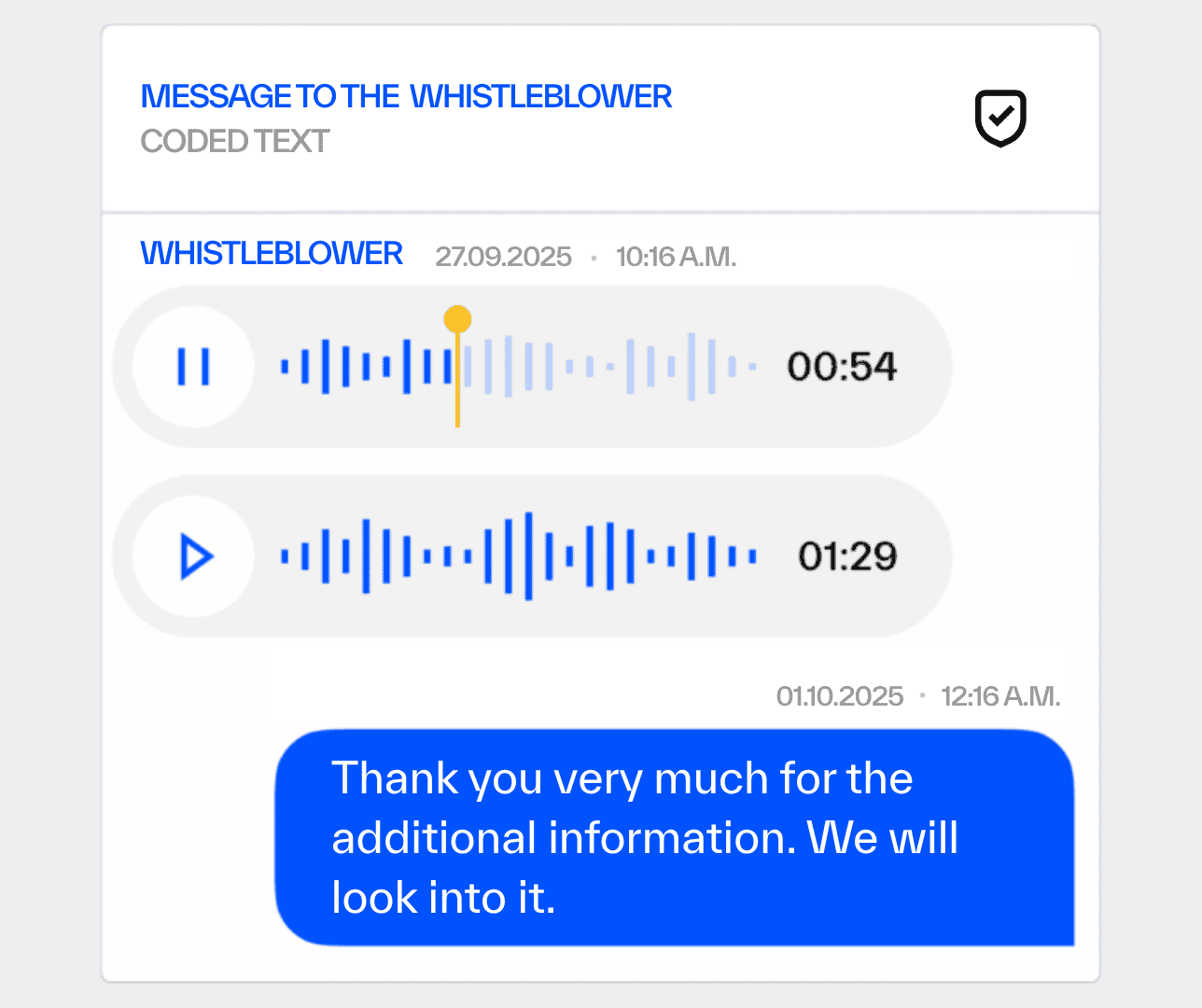

Whistleblower System

Dashboard with status overview of all cases

Add on

Add on

Fully anonymous or confidential and secure communication

Add on

Add on

Automated deadline management

Add on

Add on

Security & Support

Dedicated database for your highly sensitive data with servers located in Germany

Role and permission management system

Two-factor login

Continuous adaptation to legal developments

Helpdesk

Email support

Phone support

Personal contact person

+ Choose your individual level of expert advice

Money Laundering Reporting Officer

Add on

Add on

Add on

Managed KYC Service

Add on

Add on

Add on

Expert support

Add on

Add on

Add on

Starter

- Dashboard

- Regpit Academy

KYC/KYB Solution

- Verification of natural persons Pay per use

- Verification of companies Pay per use

- Digital questionnaires

- Automatic pre-filling of questionnaires

- Automatic access to over 300 national and international registers

- Automatic ownership and control structure chart

- Beneficial owners

- Sanctions list check

- PEP screening

- Adverse media screening

- Transparency Register API

- Credit risk/creditworthiness check

- Risk report including individual risk calculation: customer risks, country risks, transaction risks, product and service risks

- Support for documenting enhanced due diligence obligations

- KYC profile export

- KYC monitoring

- Access to all integratoin partners

- Regpit REST API

- Case management for update intervals

- Archiving cases for the retention period

- Import of existing customers

- Audit-proof case view

Ident Solution

- Video ID method

- e-ID method

- Account ID method

- Sign-ID method

Risk Management

- Risk analysis

- General MLA policy

- KYC policy

- Suspicious activity reporting policy

- Employee reliability screening

- Internal reporting channel

E-learning: Mandatory employee training

- Basic training

- Advanced training

Whistleblower System

- Dashboard with status overview of all cases

- Fully anonymous or confidential and secure communication

- Automated deadline management

Security & Support

- Dedicated database for your highly sensitive data with servers located in Germany

- Role and permission management system

- 2-factor login

- Continuous updates in line with legal changes

- Helpdesk

- Email support

- Phone support

- Personal contact person

+ Choose your individual level of expert advice

- Money Laundering Reporting Officer

- Managed KYC Service

- Expert support

Basic

- Dashboard

- Regpit Academy

KYC/KYB Solution

- Verification of natural persons Pay per use

- Verification of companies Pay per use

- Digital questionnaires

- Automatic pre-filling of questionnaires

- Automatic access to over 300 national and international registers

- Automatic ownership and control structure chart

- Beneficial owners

- Sanctions list check

- PEP screening

- Adverse media screening

- Transparency Register API

- Credit risk/creditworthiness check

- Risk report including individual risk calculation: customer risks, country risks, transaction risks, product and service risks

- Support for documenting enhanced due diligence obligations

- KYC profile export

- KYC monitoring

- Access to all integratoin partners

- Regpit REST API

- Case management for update intervals

- Archiving cases for the retention period

- Import of existing customers

- Audit-proof case view

Ident Solution

- Video ID method

- e-ID method

- Account ID method

- Sign-ID method

Risk Management

- Risk analysis

- General MLA policy

- KYC policy

- Suspicious activity reporting policy

- Employee reliability screening

- Internal reporting channel

E-learning: Mandatory employee training

- (Add on) Basic training

- (Add on) Advanced training

Whistleblower System

- (Add on) Dashboard with status overview of all cases

- (Add on) Fully anonymous or confidential and secure communication

- (Add on) Automated deadline management

Security & Support

- Dedicated database for your highly sensitive data with servers located in Germany

- Role and permission management system

- Two-factor login

- Continuous updates in line with legal changes

- Helpdesk

- Email support

- Phone support

- Personal contact person

+ Choose your individual level of expert advice

- (Add on) Money Laundering Officer

- (Add on) Managed KYC Service

- (Add on) Expert support

Advanced

- Dashboard

- Regpit Academy

KYC/KYB Solution

- Verification of natural persons Pay per use

- Verification of companies Pay per use

- Digital questionnaires

- Automatic pre-filling of questionnaires

- Automatic access to over 300 national and international registers

- Automatic access to over 300 national and international registers

- Automatic ownership and control structure chart

- Beneficial owners

- Sanctions list check

- PEP screening

- Adverse media screening

- Transparency Register API

- Credit risk/creditworthiness check

- Risk report including individual risk calculation: customer risks, country risks, transaction risks, product and service risks

- Support for documenting enhanced due diligence obligations

- KYC profile export

- KYC monitoring

- Access to all integratoin partners

- Regpit REST API

- Case management for update intervals

- Archiving cases for the retention period

- Import of existing customers

- Audit-proof case view

Ident Solution

- Video ID method

- e-ID method

- Account ID method

- Sign-ID method

Risk Management

- Risk analysis

- General MLA policy

- KYC policy

- Suspicious activity reporting policy

- Employee reliability screening

- Internal reporting channel

E-learning: Mandatory employee training

- (Add on) Basic training

- (Add on) Advanced training

Whistleblower System

- (Add on) Dashboard with status overview of all cases

- (Add on) Fully anonymous or confidential and secure communication

- (Add on) Automated deadline management

Security & Support

- Dedicated database for your highly sensitive data with servers located in Germany

- Role and permission management system

- Two-factor login

- Continuous updates in line with legal changes

- Helpdesk

- Email support

- Phone support

- Personal contact person

+ Choose your individual level of expert advice

- (Add on) Money Laundering Officer

- (Add on) Managed KYC Service

- (Add on) Expert support

Professional

- Dashboard

- Regpit Academy

KYC/KYB Solution

- Verification of natural persons Pay per use

- Verification of companies Pay per use

- Digital questionnaires

- Automatic pre-filling of questionnaires

- Automatic access to over 300 national and international registers

- Automatic ownership and control structure chart

- Beneficial owners

- Sanctions list check

- PEP screening

- Adverse media screening

- Transparency Register API

- Credit risk/creditworthiness check

- Risk report including individual risk calculation: customer risks, country risks, transaction risks, product and service risks

- Support for documenting enhanced due diligence obligations

- KYC profile export

- KYC monitoring

- Access to all integratoin partners

- Regpit REST API

- Case management for update intervals

- Archiving cases for the retention period

- Import of existing customers

- Audit-proof case view

Ident Solution

- Video ID method

- e-ID method

- Account ID method

- Sign-ID method

Risk Management

- Risk analysis

- General MLA policy

- KYC policy

- Suspicious activity reporting policy

- Employee reliability screening

- Internal reporting channel

E-learning: Mandatory employee training

- Basic training

- Advanced training

Whistleblower System

- Dashboard with status overview of all cases

- Fully anonymous or confidential and secure communication

- Automated deadline management

Security & Support

- Dedicated database for your highly sensitive data with servers located in Germany

- Role and permission management system

- Two-factor login

- Continuous updates in line with legal changes

- Helpdesk

- Email support

- Phone support

- Personal contact person

+ Choose your individual level of expert advice

- (Add on) Money Laundering Officer

- (Add on) Managed KYC Service

- (Add on) Expert support

Note:

All Regpit modules, whether products or services, can be flexibly combined. This allows you to put together exactly the solution that fits your needs.

KYC processes from the very first case

All KYC procedures verify the respective person, generate a KYC report with risk classification, and document every step in a legally compliant manner. Use is possible from just a single case onwards.

From 4,50€

Natural person

(National/International)

- Quick creation of a structured profile

- Digital onboarding process

- PEP and sanctions screening

- Adverse media

- Automated risk report (PDF)

- Audit-proof documentation

Add on:

- ID verification via Video ID, eID and more

From 11,50€

Legal person

(National)

- Quick creation of a structured profile

- Digital onboarding process

- Automatic prefill of questionnaires

- Automated queries of commercial and transparency registers

- Automatic ownership and control structure chart / beneficial ownership identification

- PEP and sanctions screening

- Adverse media

- Automated risk report (PDF)

- Audit-proof documentation

Add on:

- ID verification via Video ID, eID and more

From 7,50€

Legal person

(International)

- Quick creation of a structured profile

- Digital onboarding process

- Automated queries of 300+ registers worldwide

- Access to 120 million company records

- PEP and sanctions screening

- Adverse media

- Automated risk report (PDF)

- Audit-proof documentation

Add on:

- ID verification via Video ID, eID and more

E-Learning on anti-money laundering

Whether you need a basic understanding or in-depth content for professionals: with the Basic and Professional e-learning courses, you can provide legally compliant, flexible, and efficient training. Attractive volume discounts are available for multiple licences.

24,90€ per licence

Basic training money laundering prevention

Licenses can be expanded based on your needs: Starting at €24.90/year per user.

- For law firm staff

- Participation certificates & tests included

- Easily manageable, ready to use immediately

49,90€ per licence

Professional training money laundering prevention

Licenses can be expanded based on your needs: Starting at €49.90/year per user.

- In-depth professional content

- Practical case studies & legal context

- Meets specific professional regulatory requirements

Additional features

In addition to our core modules, Regpit offers a wide range of additional features to make your compliance even more efficient. Discover how Regpit supports your requirements with precision.

Schedule a personal consultation today.

Expert Support

Regpit’s expert support offers professional assistance with AML matters and complex review cases, directly from experienced legal and compliance professionals.

- Flexibly bookable depending on needs and case specifics

- Support with suspicious activity reports

- Personal advice on anti-money laundering and sanctions law

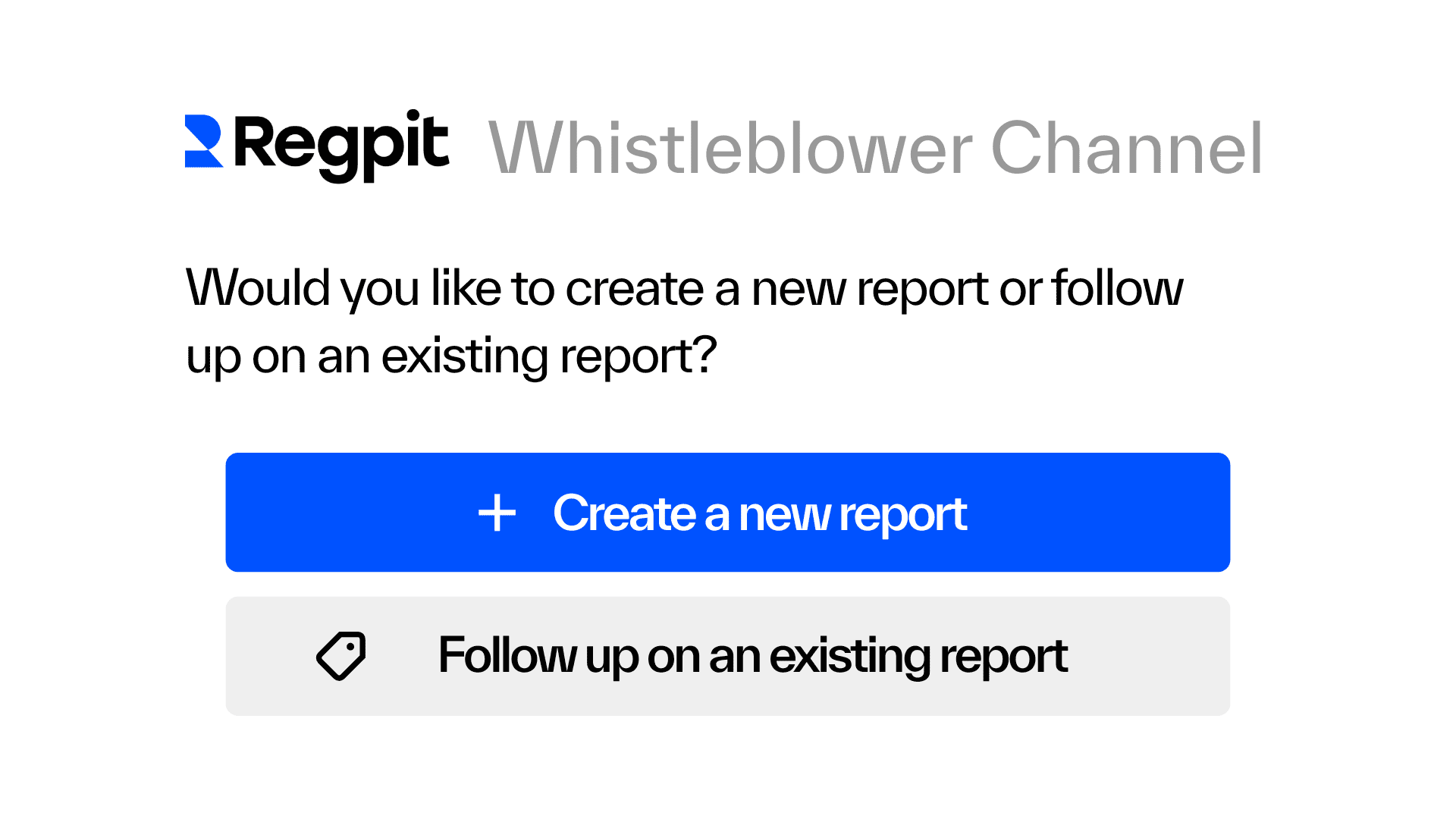

Whistleblowing Solution

Regpit’s whistleblower system is ready to use immediately, intuitive to operate, and fully compliant with the latest legal standards.

- Audit-proof & GDPR-compliant

- Anonymous reporting

- Ready to use immediately, made in Germany

The simple solution for strong compliance

- All-in-one AML solution

- Compliance without the headache

- Reduce KYC & onboarding costs

- Audit-proof processes & documentation

Frequently asked questions (FAQ)

What are the benefits of Regpit?

Regpit simplifies anti-money laundering compliance through an intuitive, digital platform that efficiently maps all AML processes — from KYC and monitoring to training and whistleblowing systems. Companies and law firms benefit from automated workflows, legally compliant documentation, and ready-to-use modules without unnecessary IT complexity. Thanks to the optional REST API, Regpit is flexibly integrable and scalable.

If needed, it can be combined with tailored advice from experienced AML experts — for maximum security with minimal effort.

How long does it take to start onboarding?

Onboarding with Regpit is quick and straightforward. As soon as you choose our solution, you can get started right away. You’ll receive immediate access to all features and can map your compliance and AML processes efficiently from day one. No lengthy setup, no technical barriers — just register, log in, and go.

Tip: If you need assistance, our personal contacts and hands-on support will guide you — so you’re ready to go in just a few minutes.

Do I have to book a package or can I choose individual modules?

With Regpit, the choice is yours:

You can book one of our packages, which combine all essential features and services for legally compliant anti-money laundering.

Or you can choose individual modules tailored to your needs — for example, our e-learning or the whistleblowing system.

We offer maximum flexibility: start as small or as comprehensive as suits your business, and expand your solution at any time as needed.

What are the contract details?

You can upgrade to a higher package at any time.

Are there any additional costs?

No, there are no hidden extra costs with Regpit. All features and services included in your selected package are transparently displayed on the platform.

What support does Regpit offer?

Regpit provides the right level of support tailored to your package:

Basic Package: Access to our Help Center with practical guides and email support from our expert team.

Advanced Package: Everything from the Basic Package plus phone support — get fast, personal assistance by phone.

Professional Package: Comprehensive premium support including Help Center, email and phone support, plus a dedicated contact person who knows your business and offers tailored assistance.

This ensures you always receive the support you need — whether independently via our knowledge base or directly in exchange with our experts.

Which pricing model is right for my company?

The right pricing model depends primarily on the size of your company and the services you need. You can find more details about our packages on our pricing page: HERE.

Managed KYC

Fulfil your KYC obligations without tying up internal resources, while minimizing risks with the experts from Regpit.

- Outsourced KYC audit by experts

- Relief of internal resources

- Fast processing & clear results

External Money Laundering Reporting Officer (MLRO)

With our service as an external AML Officer, experienced Regpit experts take on your legal obligations.

- Assumption of all duties in accordance with § 7 GwG

- No internal effort for training or communication with authorities

- Outsourcing with full responsibility and documentation

Real success stories

Our Solutions are used by law firms, financial service providers and compliance teams across Europe. Read how our customers benefit from them.

“Thanks to Regpit, we’re able to carry out a customer-friendly onboarding process at the highest level — even in the area of money laundering prevention — simply, securely, and efficiently. That’s extremely important to us as a FinTech!”

"The requirements for law firms in the area of money laundering prevention and sanctions are becoming ever more extensive. We are delighted to have a specialised partner at our side with Regpit!"

Talk to our experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

Whistleblowing Solution

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.