How FINION Capital digitizes KYC processes with Regpit

Faster. Safer. Compliant: How FINION Capital redefines onboarding with Regpit.

A selection of our clients

About FINION Capital

FINION Capital is an innovative payment service provider specializing in tailored financial solutions for the fitness industry. To make payment processing as simple and seamless as possible for fitness studios, FINION relies on fully digital processes.

Industry: Financial service provider

Location: Germany

Regulator: BaFin

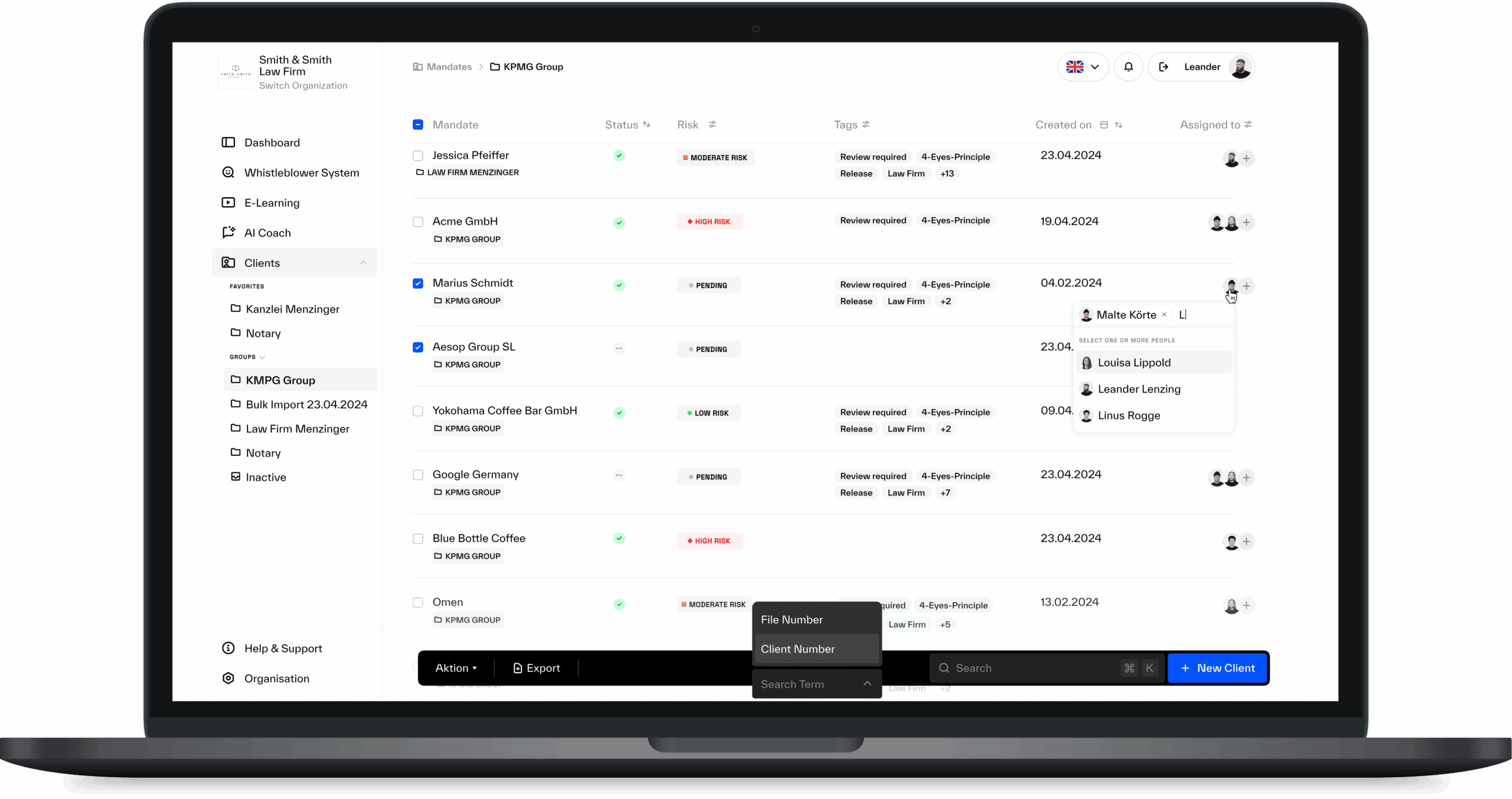

Regpit Modules: KYC Solution, E-Learning Solution, Managed KYC Solution, Ident Solution

The challenge

As a payment service provider (ZAG), FINION Capital is required to comply with the strict obligations of the German Anti-Money Laundering Act (GwG).

Problem: Many new clients are fitness studios that want to get started quickly but have little experience with complex KYC and compliance processes. The customer base is highly diverse, ranging from sole proprietors to GmbH & Co. KGs, GbRs, and GmbHs, with clients in both Germany and Austria.

Challenge 1: The wide variety of legal entity types creates complex KYC requirements during verification

Challenge 2: Fitness studios expect fast onboarding, lengthy compliance processes can undermine customer satisfaction

Challenge 3: Training and awareness for employees must be implemented efficiently and in an audit-proof manner

Risk: Long onboarding processes could lead to delays in the start of business and affect customer satisfaction

The solution with Regpit

To make this process efficient and secure, FINION Capital relies on the Regpit platform.

KYC procedure: New fitness studio clients can complete their identification fully digitally: Quickly, audit-proof, and in full compliance with legal requirements

E-learning: In addition, FINION has integrated Regpit E-Learning for its employees. This ensures that all relevant staff members are trained on their obligations under the Anti-Money Laundering Act (GwG) and receive an official certificate of completion

The results

With Regpit, FINION Capital was not only able to speed up customer onboarding, but also increase quality and security. Gym partners benefit from an easy onboarding process, while FINION Capital as a payment service provider fulfils all regulatory requirements.

- Time savings: The onboarding process has been significantly accelerated - gyms can get started faster

- Compliance security: All KYC processes are fully documented and fulfil regulatory requirements

- Employee competence: Thanks to e-learning, employees are trained, sensitised and audit-proof at all times

- Customer satisfaction: Easy handling increases the satisfaction of newly acquired studios

Digitize AML processes now - just like FINION Capital

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.