Digital money laundering prevention for FinTechs

Intelligent AML software for FinTechs: KYC, training & expert support from a single source

A selection of our clients

Regpit is your solution for secure AML compliance

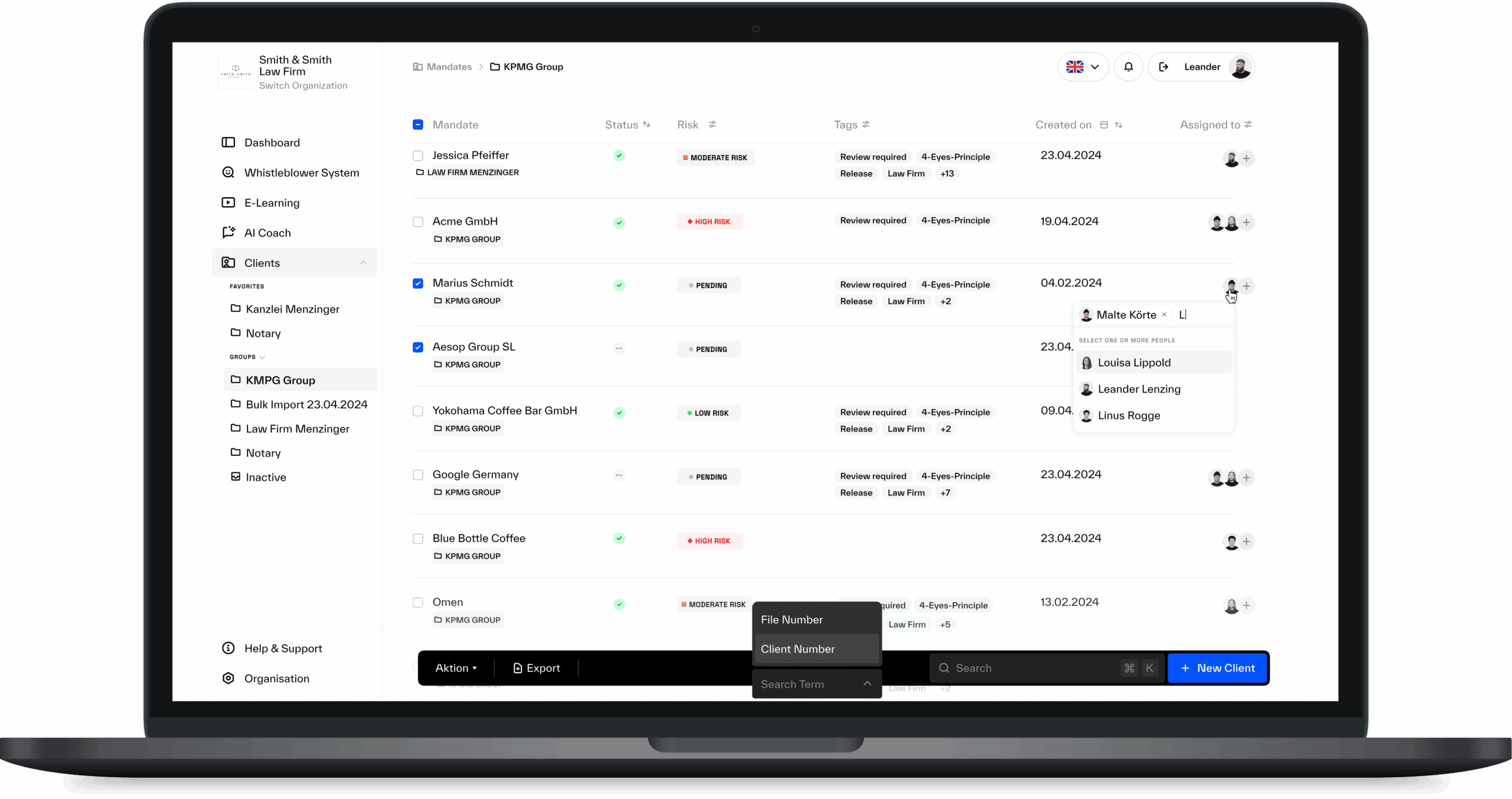

Growth and regulatory certainty don’t have to be a contradiction. Regpit is the AML platform for FinTechsthat combines speed, scalability, and compliance in one system.

Digital identity verification, automated KYC/KYB, PEP and sanctions screening, monitoring, AML training, and a whistleblowing system: All GwG-compliant, API-ready, and instantly deployable.

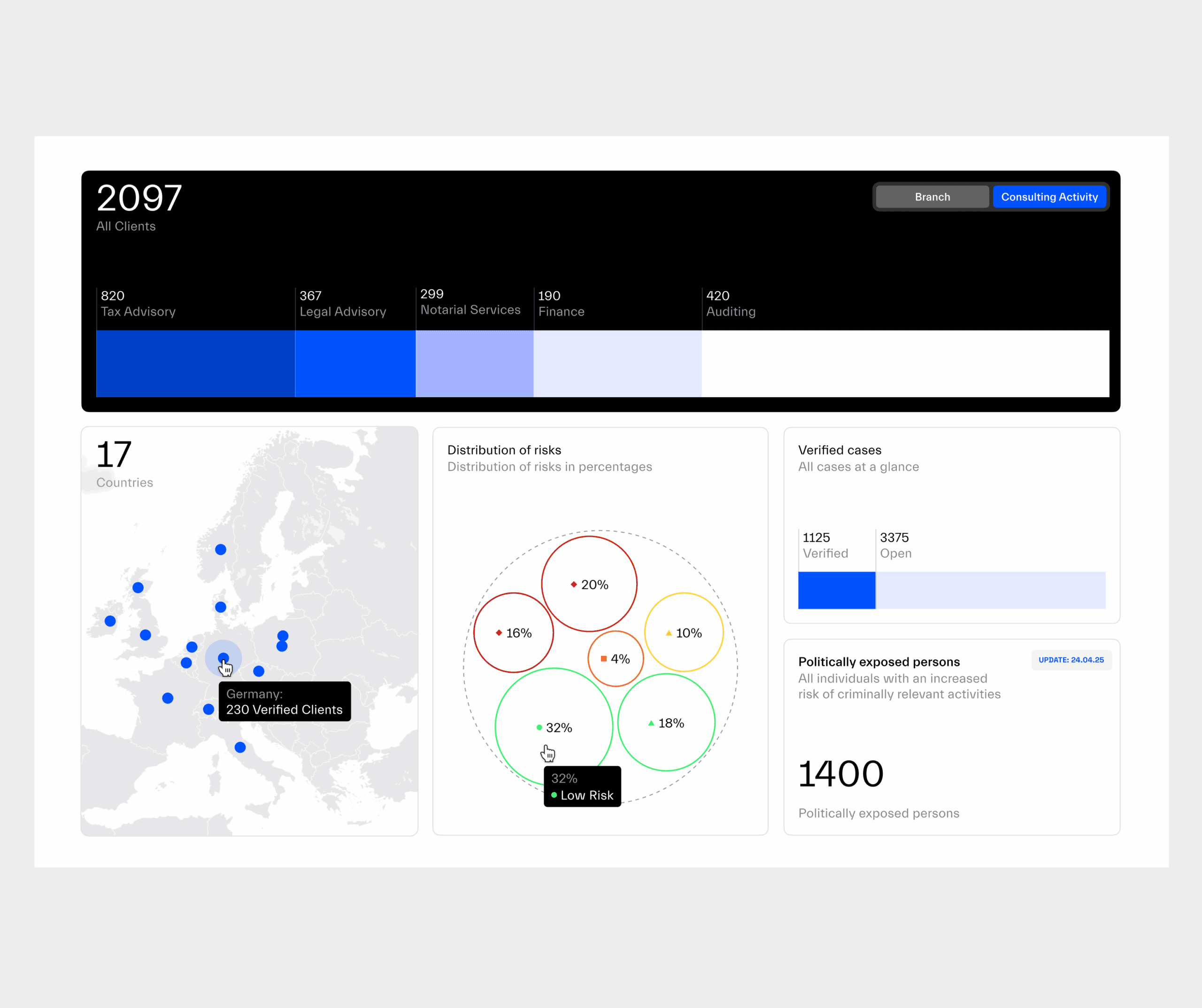

How Regpit works

Discover our platform in an interactive demo:

The real cost of non-compliance

The solution?

Our experts are here to help.

Regpit enables your organization to fulfil GwG requirements efficiently and with confidence: Through intelligent workflows, legal certainty, and personal guidance.

The key benefits of Regpit

Ready to go immediately

Regpit is ready to use — no complex setup, no waiting times.

Legally compliant under the German AML Act

All modules meet the latest requirements of the German Anti-Money Laundering Act (GwG). You work in full compliance: Audit-proof and legally secure.

Always audit-ready

With Regpit, you are inspection-ready at any time. All processes are fully documented and can be retrieved instantly.

No IT effort

No installation or integration required. The platform runs directly in your browser: Intuitive and effortless.

Intuitive for your customers

The user interface is easy to understand, even for non-experts. This means that money laundering prevention does not become a hurdle, but a quick routine.

Efficiency meets service

The all-in-one solution

Book individual modules or the complete package

KYC/KYB Solution

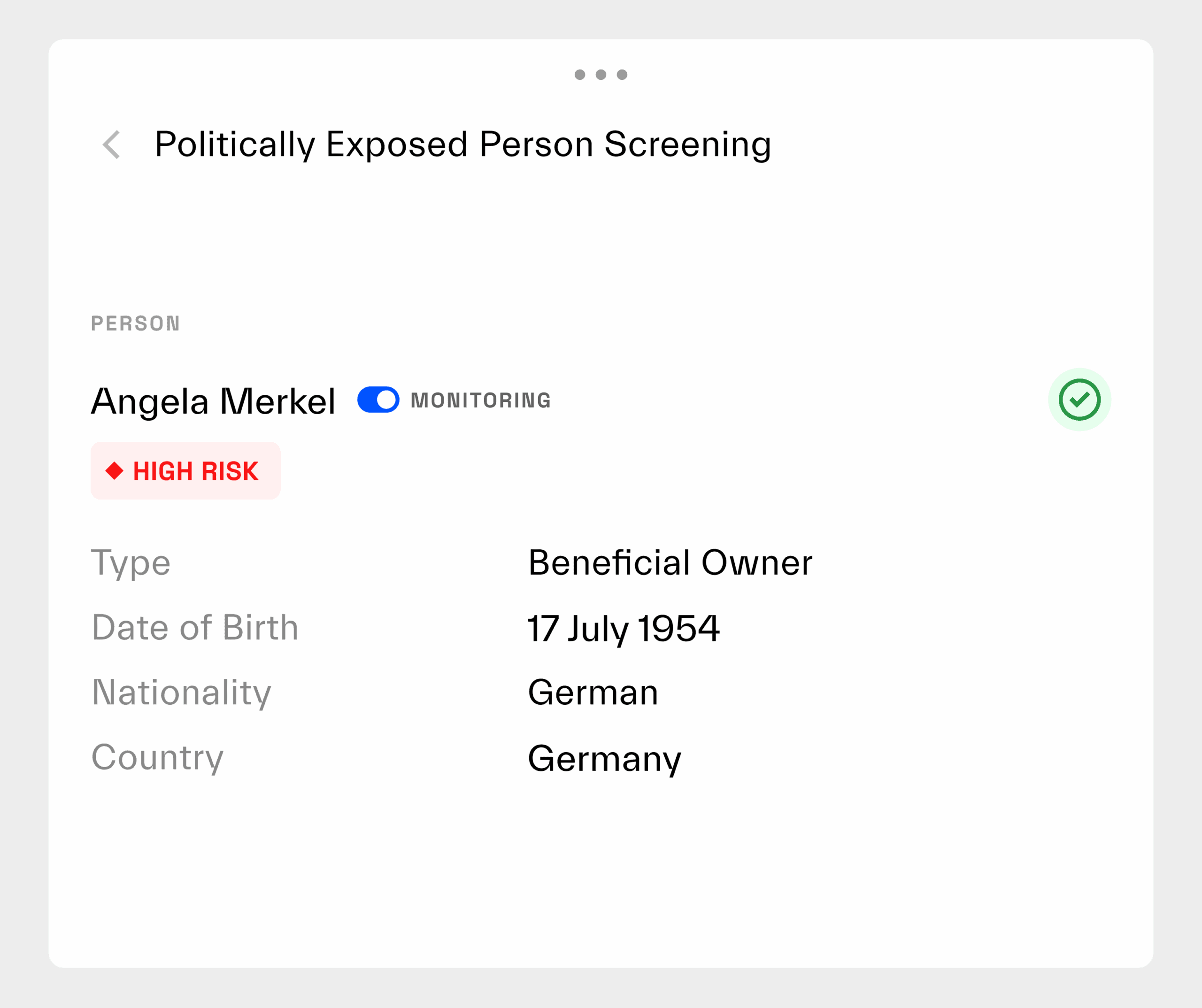

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

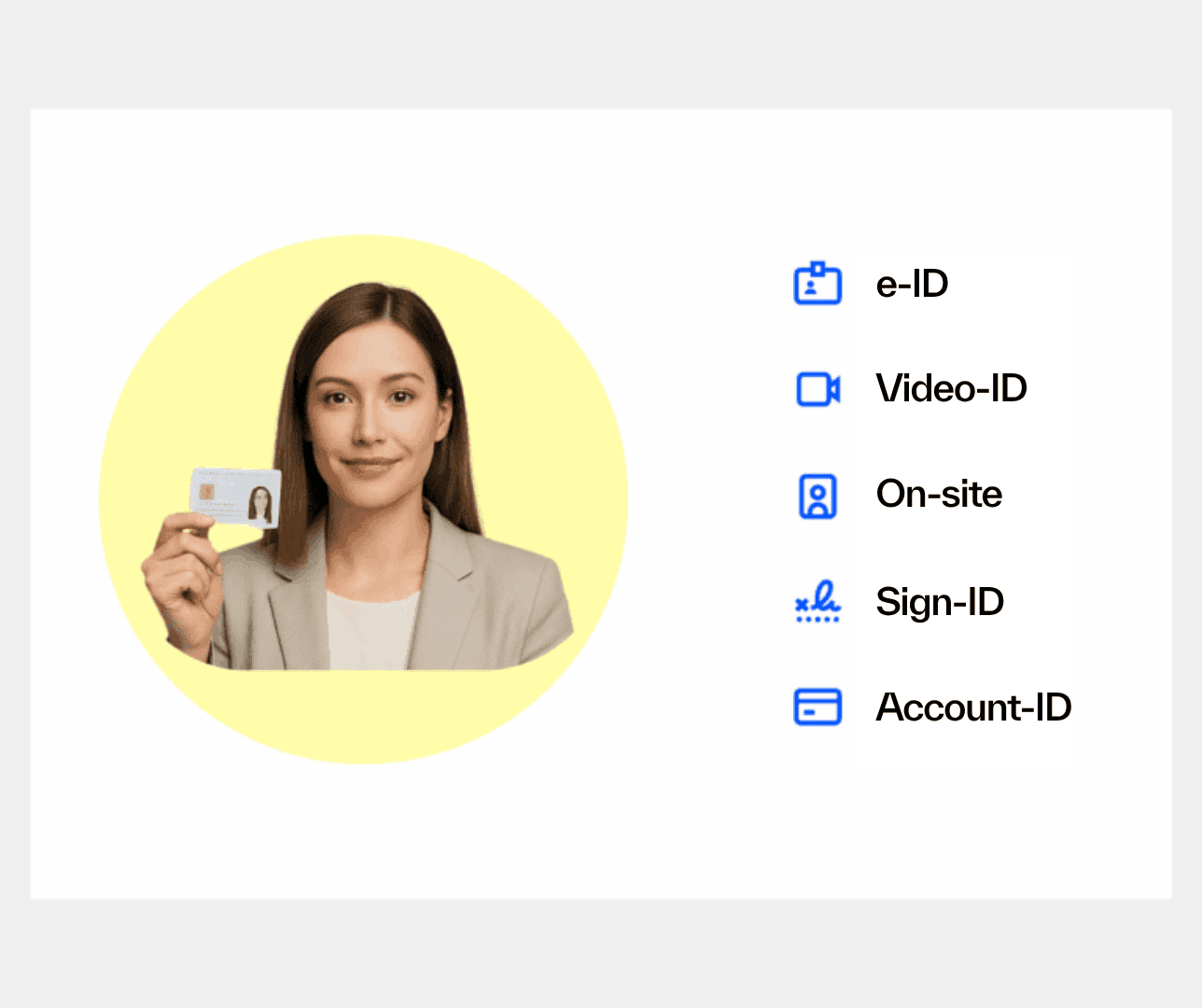

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

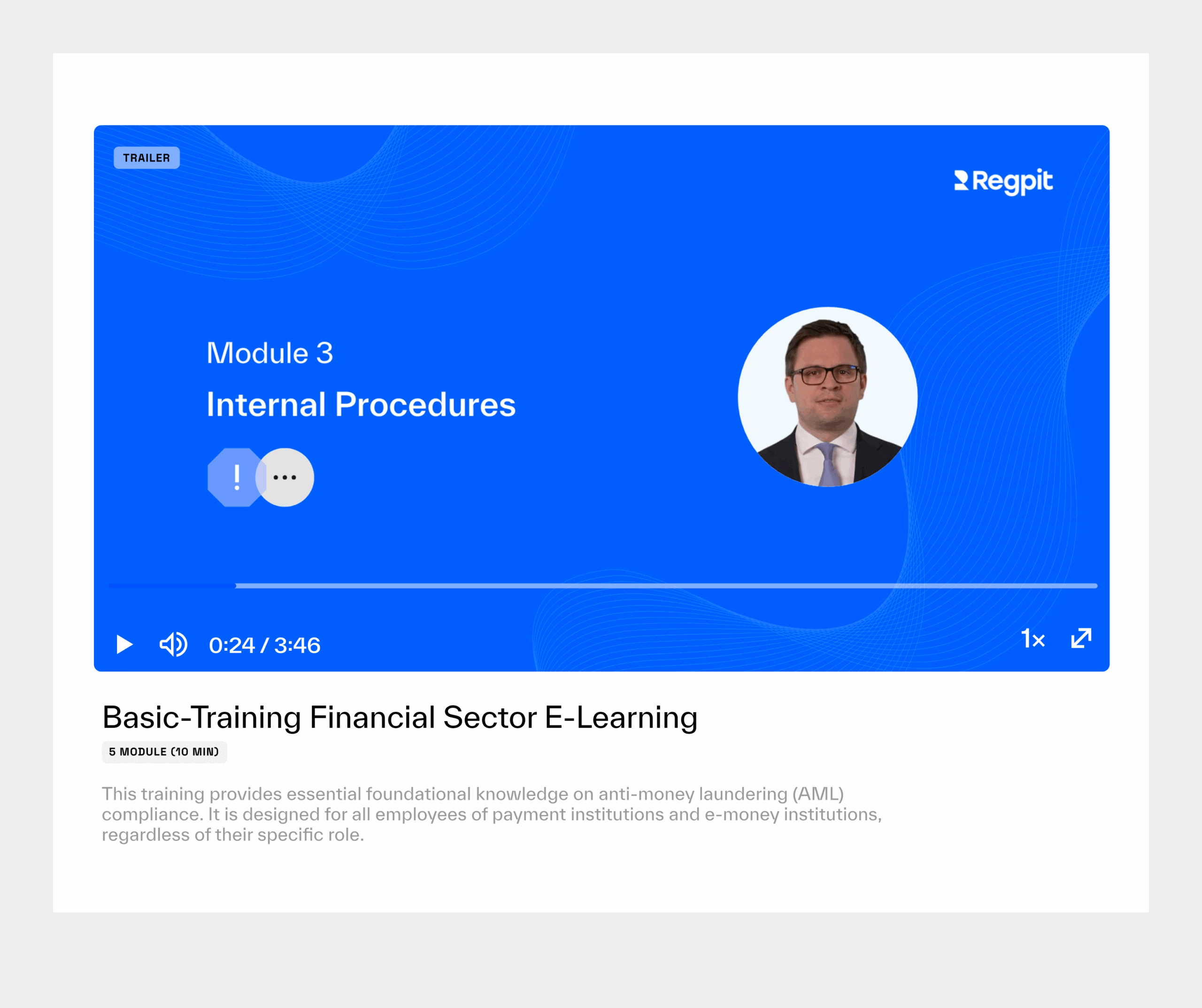

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

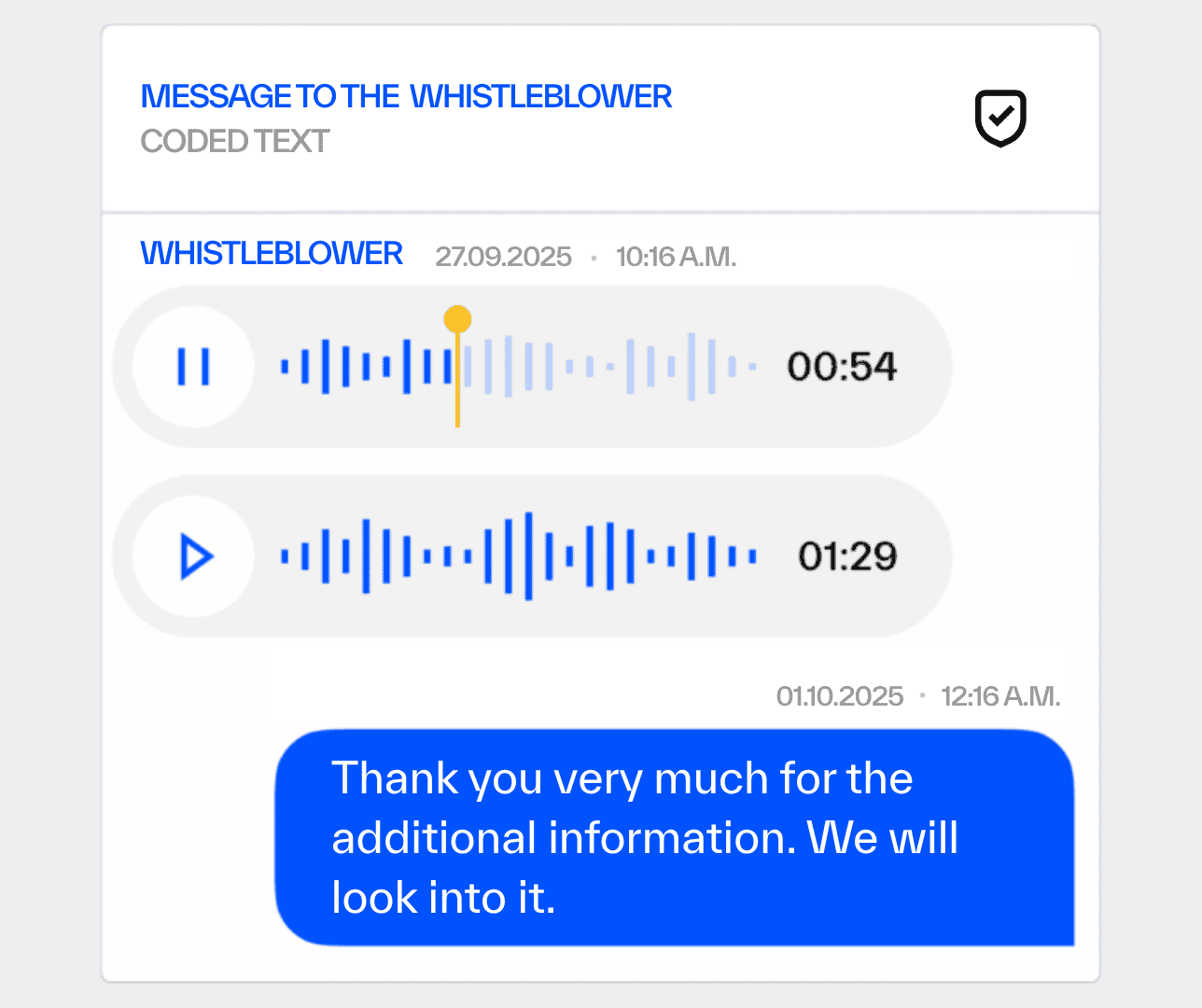

Whistleblowing Solution

Faster AML compliance. Less effort.

Automated workflows, lightning-fast identification and efficient onboarding - Regpit saves companies time, effort and stress.

Known from

Your Regpit experts

More than 20 compliance specialists ready to assist you: Combining legal expertise, practical insight, and personal guidance to strengthen your AML strategy.

Dr. Jacob Wende

Regpit expert

Louisa Lippold

Regpit expert

Ludovica Bölting

Regpit expert

Alexander Ebel

Regpit expert

Discover the Regpit platform.

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.