Seamless integrations for end-to-end money laundering compliance processes

Regpit brings AML compliance into your processes

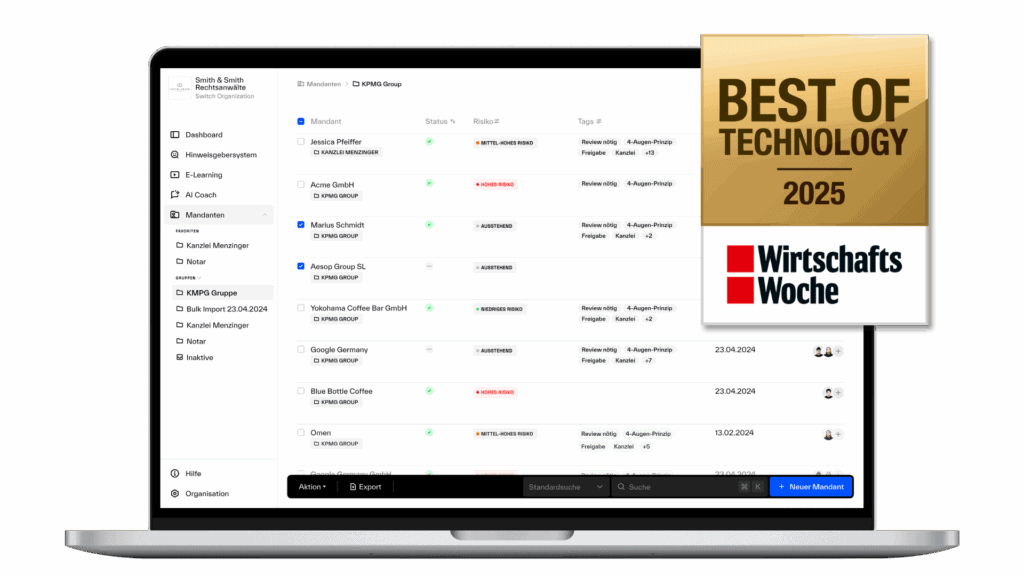

Regpit is a modular platform for money laundering prevention, KYC/KYB and sanctions monitoring, developed for regulated entities in Europe.

Regpit can be seamlessly integrated into existing systems via modern interfaces and enhances them with fully automated, legally compliant AML processes. Platforms that integrate Regpit offer their users real added value: Money laundering compliance becomes simpler and more effective, directly in the familiar workflow.

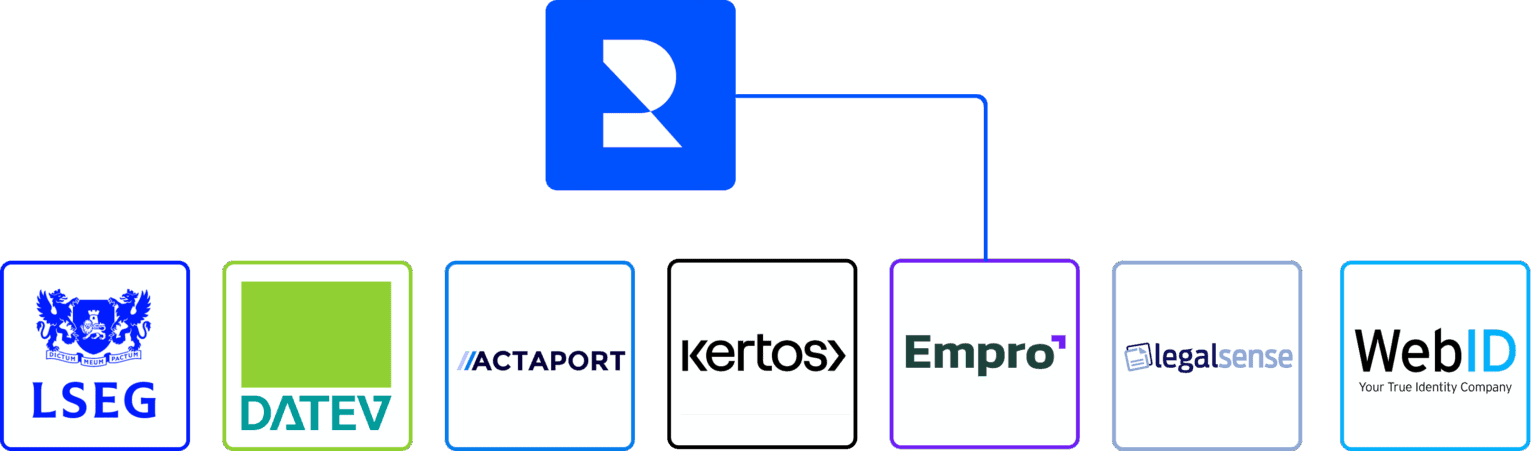

Overview of our Integrations & Partners

Regpit can be seamlessly integrated into your existing IT landscape. This means that relevant data is automatically transferred, processes are shortened and sources of error are minimized.

Datev

DATEV is the leading software platform for tax advisors, used to manage clients and financial records. With a seamless DATEV integration, client data can be transferred directly into Regpit for AML compliance checks under the german Anti-Money Laundering Act (GwG).

Legalsense

Legalsense is a law firm management software designed for time tracking, billing, and client management. The integration enables the automatic transfer of client data to Regpit for conducting KYC checks.

Actaport

Actaport is a cloud-based law firm management software offering features for case management, deadlines, and document handling. Together, a GwG (AML) module has been developed that integrates Regpit directly into the law firm’s workflow.

WebID

WebID is a provider of digital identification solutions such as Video Ident, eID, and Account Ident. All WebID procedures are fully integrated into Regpit and ready for immediate use.

Empro

Empro is a real estate management software for handling properties, client data, and brokerage processes. Through the integration interface, client data can be automatically transferred to Regpit for AML (GwG) verification.

Kertos

Kertos provides a platform for data protection, ISO certification, and IT security management. Regpit and Kertos maintain a strategic partnership, offering mutual referrals for compliance topics beyond their respective areas of expertise.

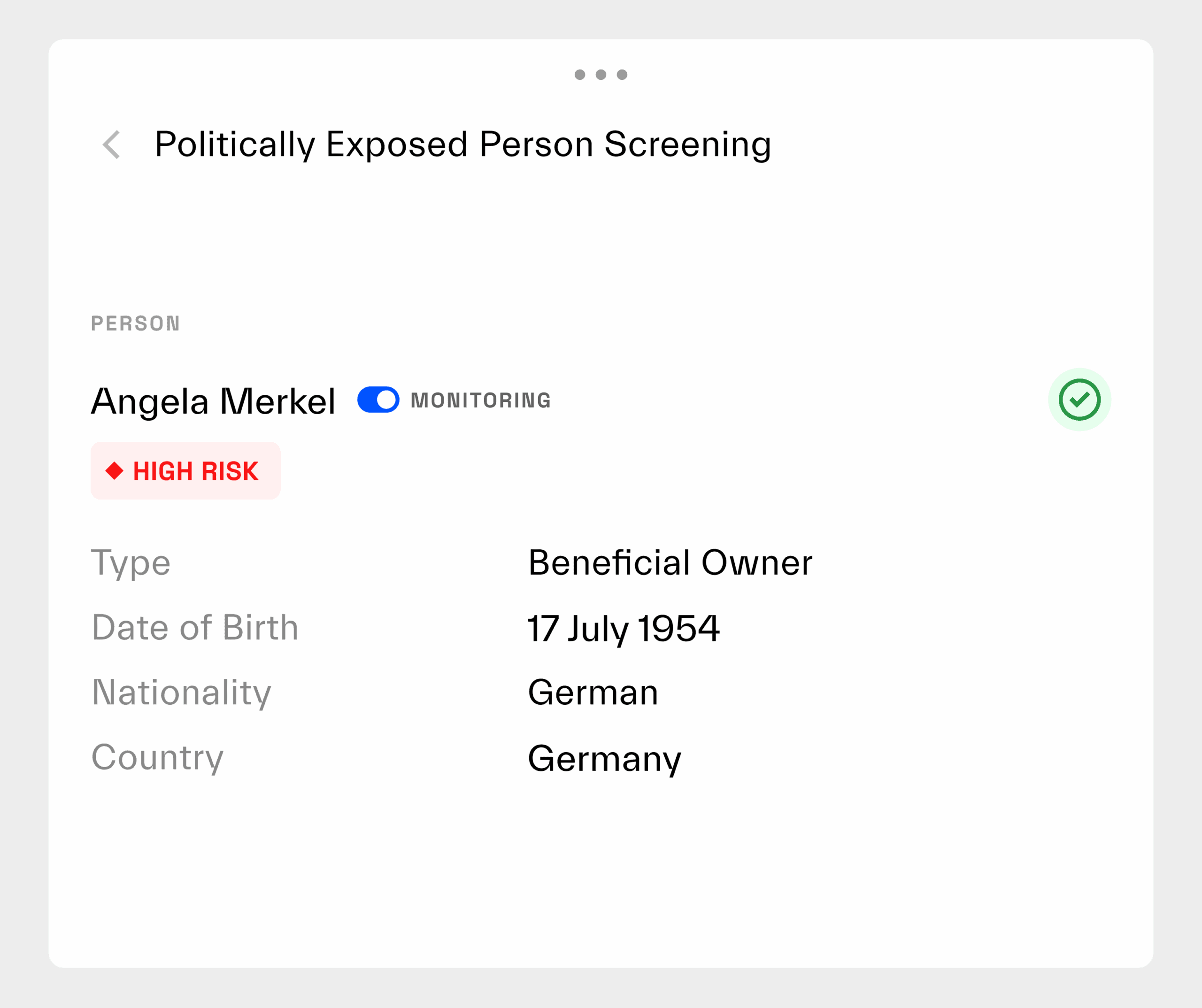

LSEG

The London Stock Exchange Group (LSEG) is a leading global source of regulatory intelligence and financial data.

Regpit integrates PEP, sanctions, and adverse media data from LSEG to power comprehensive risk assessments within its KYC module.

Why our partners integrate Regpit

Added value for your customers

Regulations can be a burden in everyday working life. Offer your users ready-to-use AML, KYC and sanctions checks.

Seamless processes instead of compliance silos

With Regpit integration, compliance processes become part of the operational workflow without additional tools or media disruptions.

Additional monetization potential

Expand your offering with legally compliant AML functionality without having to build up regulatory expertise yourself. Ideal for upsells, licence models or premium features.

Attractive for regulated target groups

With a Regpit integration, you can tap into attractive, high-growth markets: Financial service providers, law firms, PropTechs, investment platforms.

Simple, modern connection

Our API is clearly documented, secure, multi-client capable and can be integrated quickly. Support, sandbox access and flexible modules included.

RegTech directly from the field

Regpit was developed by lawyers and compliance experts. The platform is in line with BaFin regulation, GDPR-compliant and is already being used successfully by regulated entities in Europe.

Your Regpit experts

More than 20 compliance specialists are there to support you personally: with in-depth expertise, practical experience and personalized advice on all aspects of your compliance solutions.

Dr. Jacob Wende

Managing Director / AML - Expert

Jan-Wolfgang Kröger

Head of Experts

Ludovica Bölting

Senior Associate - AML / AFC

Alexander Ebel

Manager - AML / AFC

Abbas Hussain

KYC Specialist

Louisa Lippold

Chief Product Officer / AML - Expert

Before

Without Regpit

- Users leave the platform for KYC and AML processes

- Media disruptions make onboarding and documentation more difficult

- No centralized solution for regulatory requirements

- High risk of manual errors during mandatory audits

- Limited scalability in regulated industries

Afterwards

With Regpit

- KYC, screening & risk analysis directly in your own system

- Audit-proof AML processes without your own compliance infrastructure

- Automated processes for an efficient user experience

- Added value for customers with regulatory obligations

- Competitive advantage through embedded compliance functionality

The comparison: Integration that makes the difference

Less effort for your users. More value for your platform.

With automated KYC workflows, integrated identification procedures and efficient onboarding, Regpit adds ready-to-use AML functionality to your solution without additional development effort.

Interested in an integration with Regpit?

Simply leave your email address — no commitment required. We’ll get in touch with more information and discuss the next steps together. Let’s make AML compliance simpler and more connected.

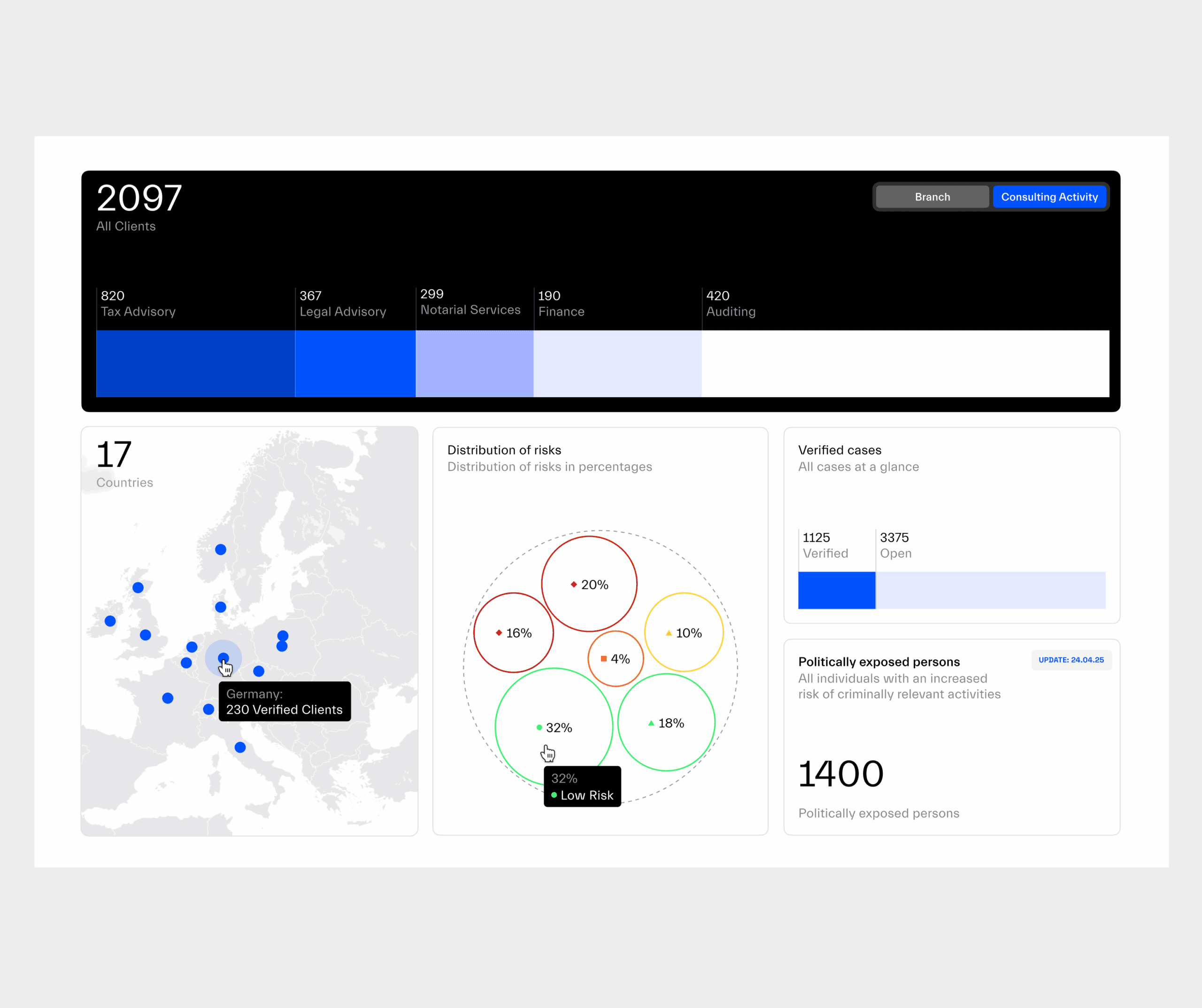

The all-in-one solution

Book individual modules or the complete package

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

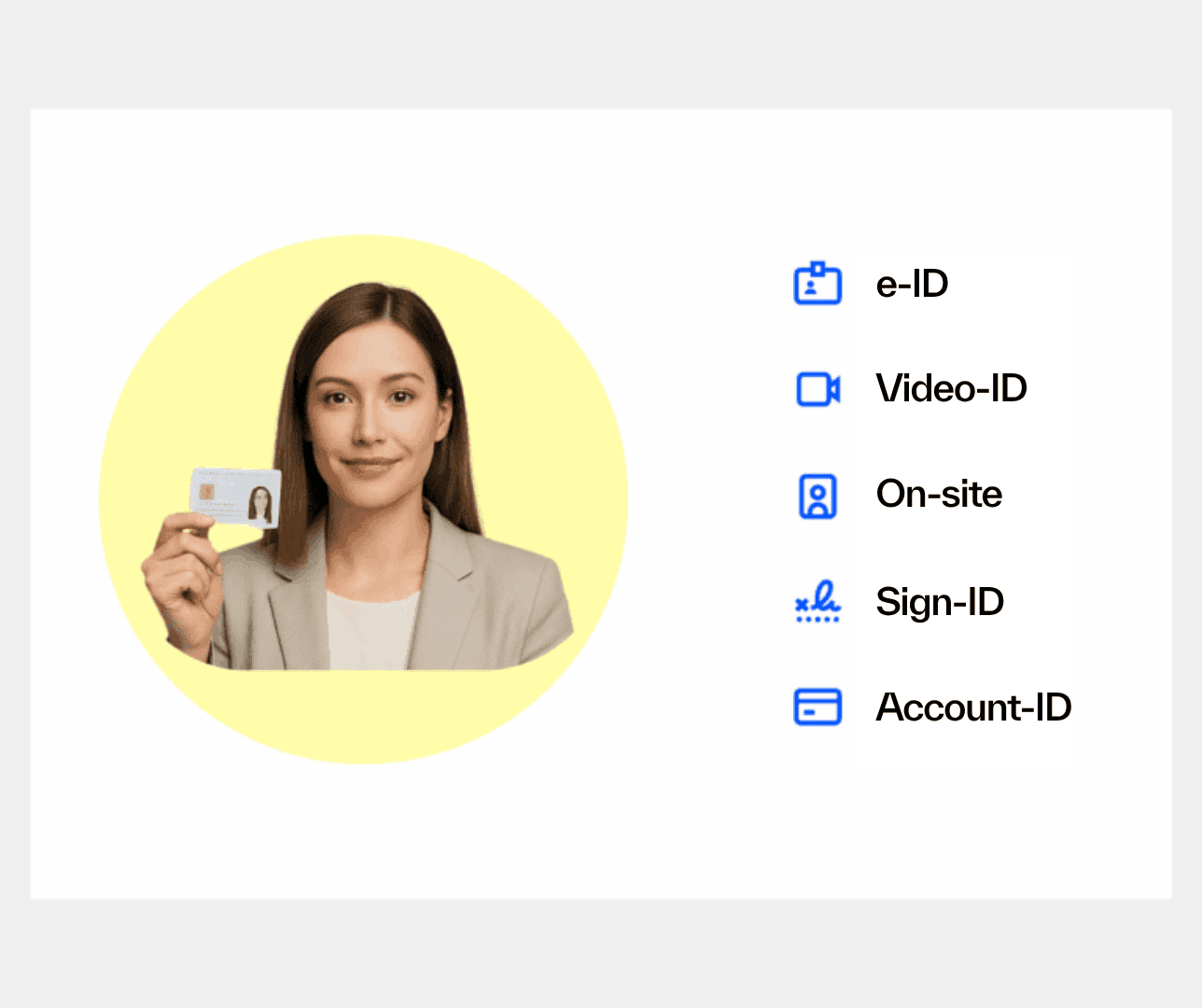

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

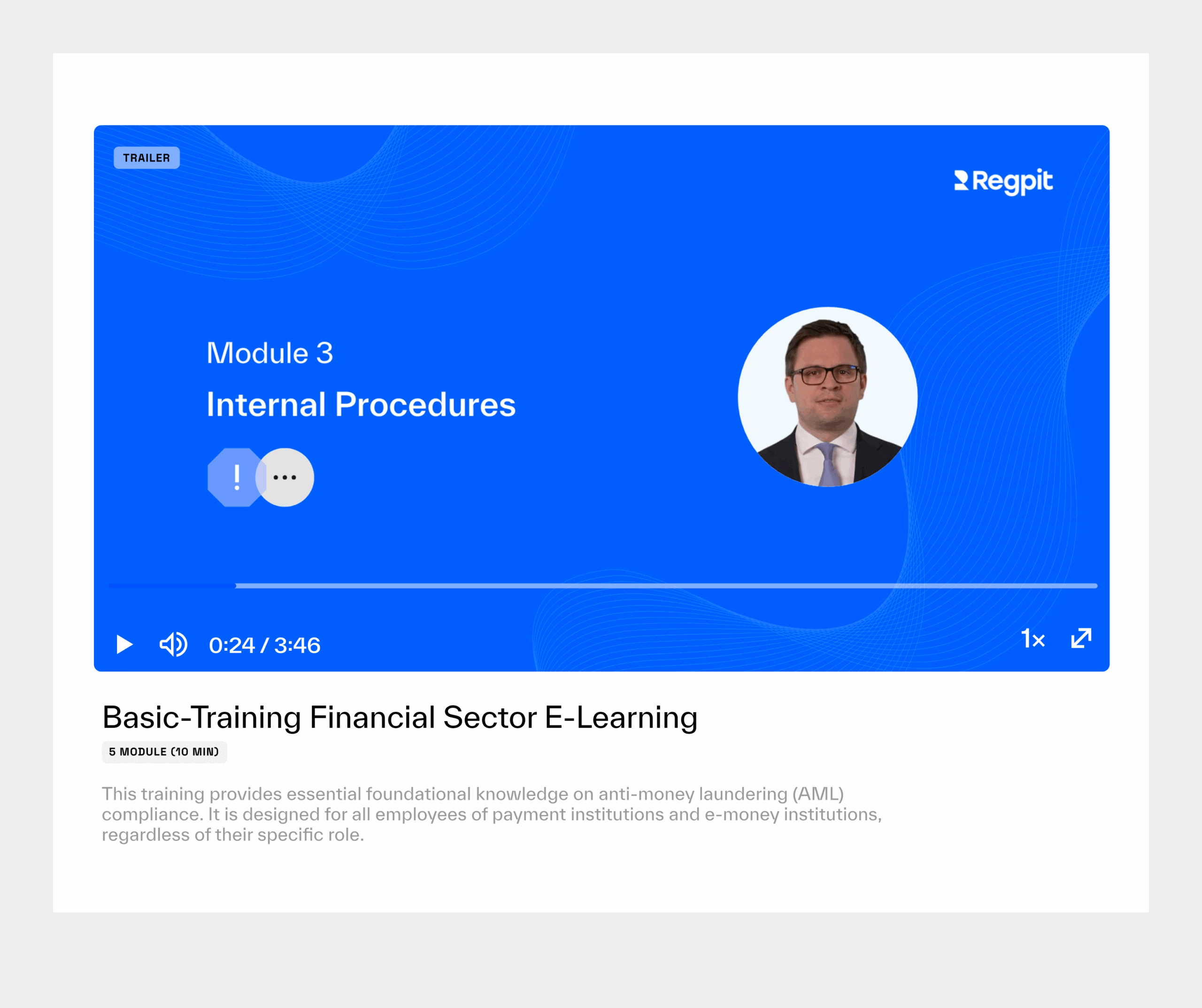

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

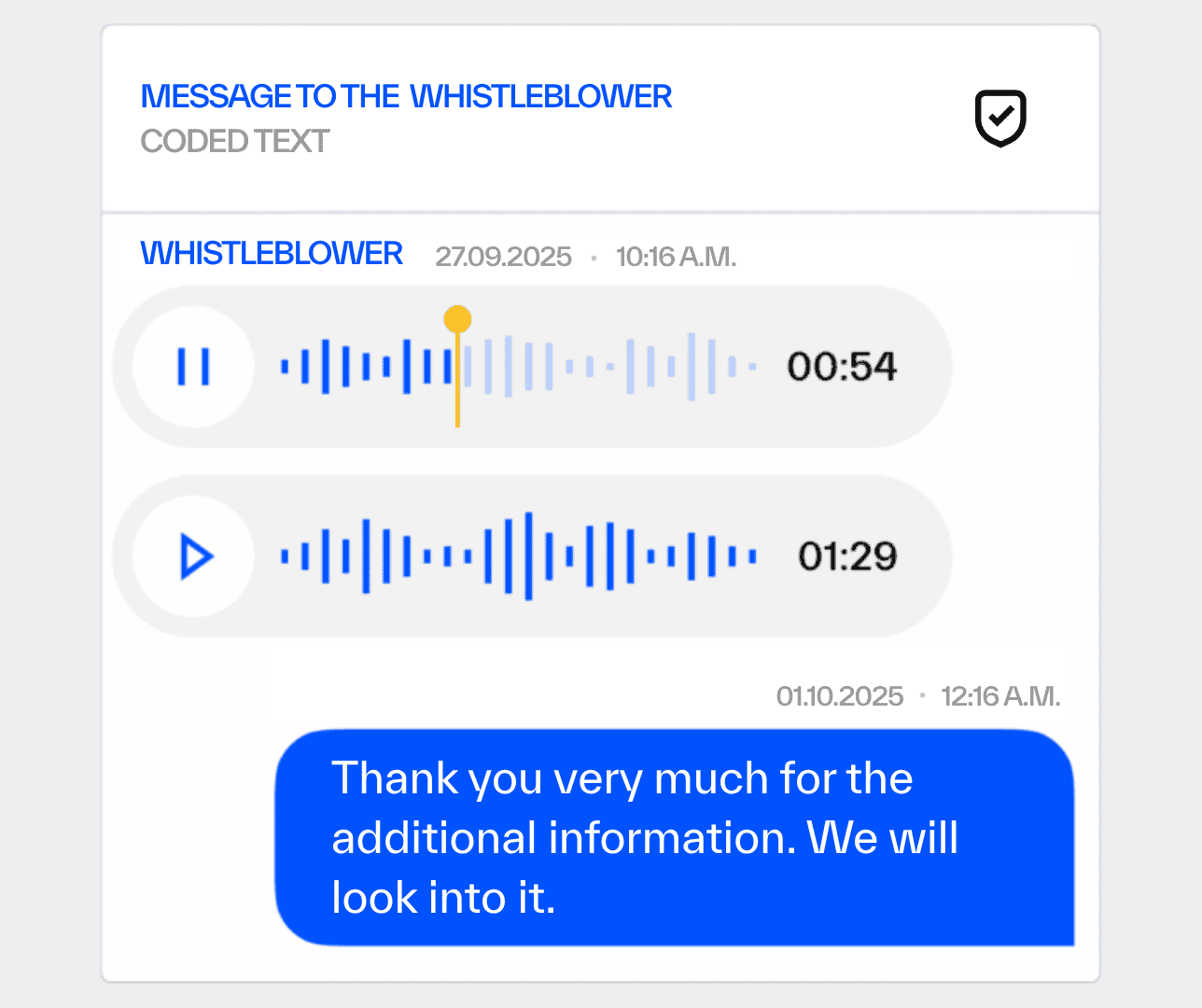

Whistleblowing Solution

Known from

Discover the Regpit platform.

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.