AML- & GwG-compliant E-Learning Solution

Digital money laundering training courses in accordance with the German Money Laundering Act

A selection of our clients

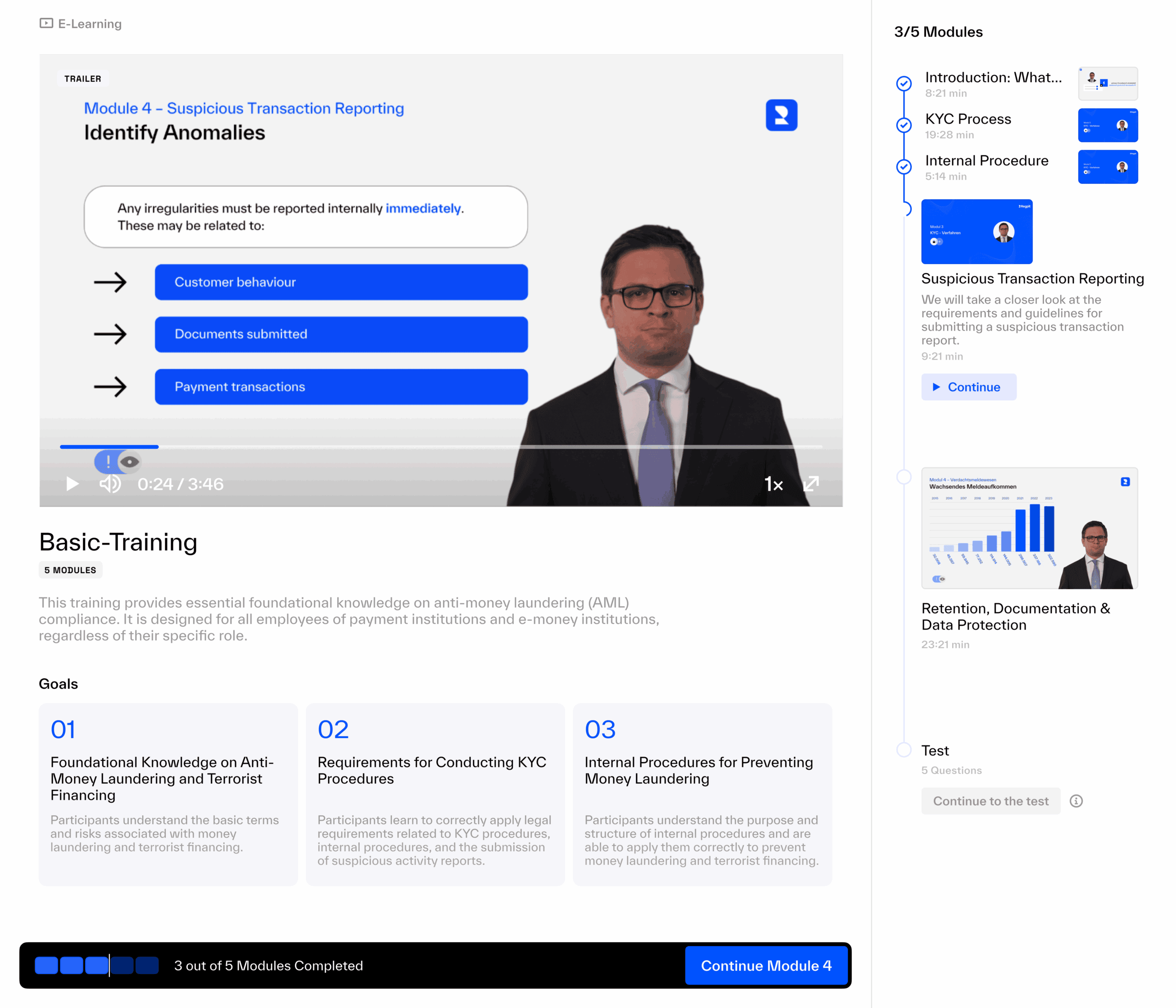

How it works: MLA e-learning

The e-learning solution offers Legally compliant online training courses with Automated tests and Certificates of participation. Progress and evidence can be easily managed, so the fulfilment of the Schulungspflicht nach dem Geldwäschegesetz not only efficient, but also verifiable.

Annual training for employees

The annual training takes place digitally in just a few clicks. The training covers all the basics: Ideal for new employees or for mandatory annual training.

- Fully German Money Laundering Act-compliant basic training courses

- Final test and certificate

- Ready for immediate use and audit-proof

- Schon ab einer Lizenz verfügbar

Specialized knowledge for advanced users: In-depth training

We offer in-depth training on current regulatory developments for money laundering officers, compliance departments and experienced users.

- Targeted knowledge transfer on specialized topics

- Ideal for experienced employees and risk sectors

- Professionally developed by Regpit experts

The right E-Learning for each profile

Whether basic understanding or in-depth content for professionals: with the e-learning programs Basic and Professional schulen Sie gesetzeskonform und flexibel.

Basic training

money laundering prevention

Ideal für Kanzleimitarbeitende zur Erfüllung der gesetzlichen Fortbildungspflicht.

- Für Kanzlei-Mitarbeitende

- Teilnahmezertifikate & Prüfungen

- Ready for immediate use

Professional training

money laundering prevention

Vertiefte Inhalte für Berufsträger mit Fokus auf spezifische Rechtsfragen.

- In-depth professional content

- Praxisnahe Fallbeispiele

- Berufsrechtliche Anforderungen

We provide you with up-to-date knowledge on money laundering compliance with legally compliant training courses that automatically fulfill your obligations to provide evidence.

Learning from practice with real case studies

Imagine employees looking forward to the annual money laundering training.

Our e-learning makes it possible! It inspires your employees and provides them with the necessary knowledge at the same time.

- What is money laundering?

- Terrorist financing

- Customer due diligence obligations (KYC)

- Risk management & internal security measures

- Duty to report suspicions

- Documentation & data protection

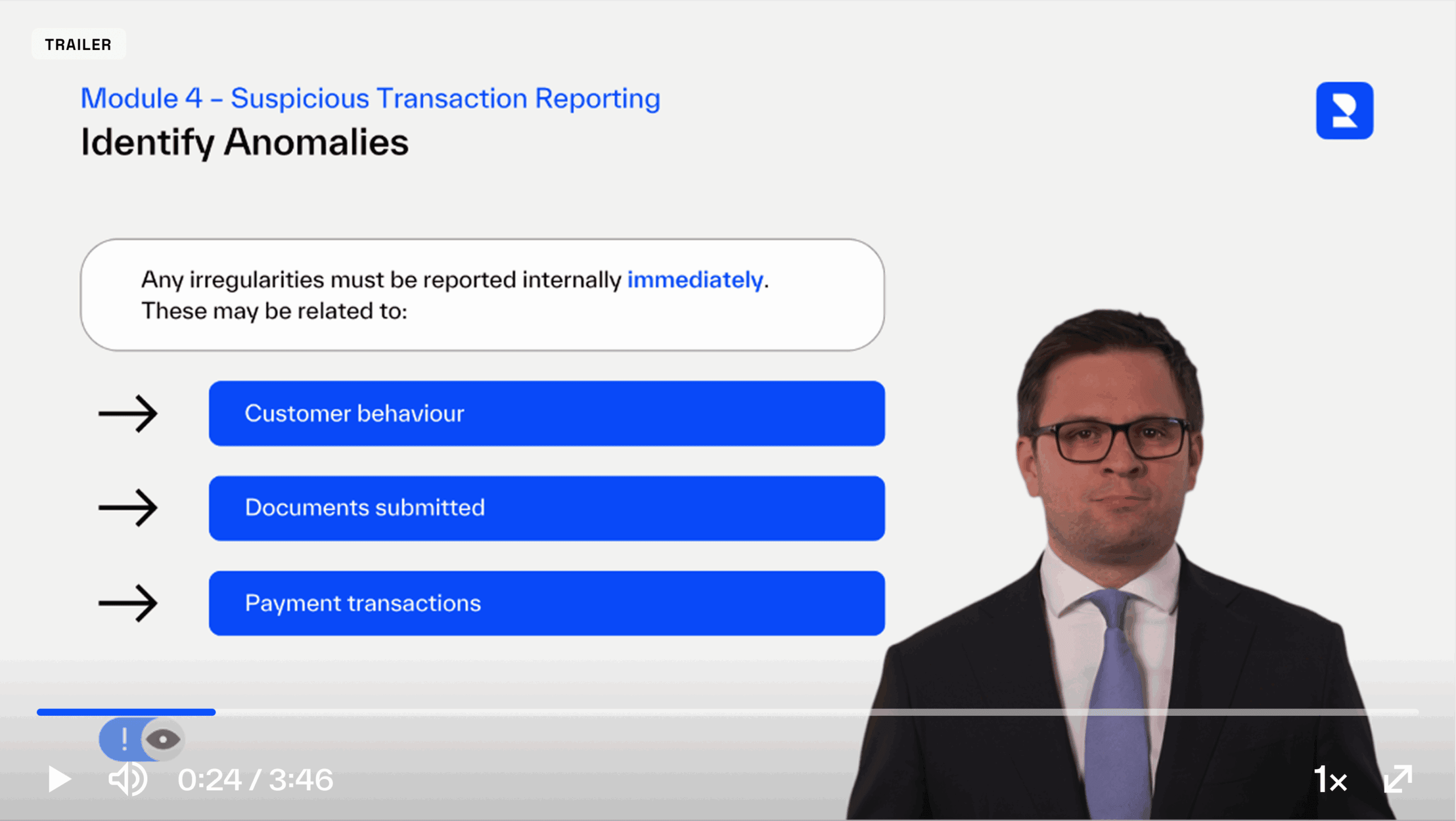

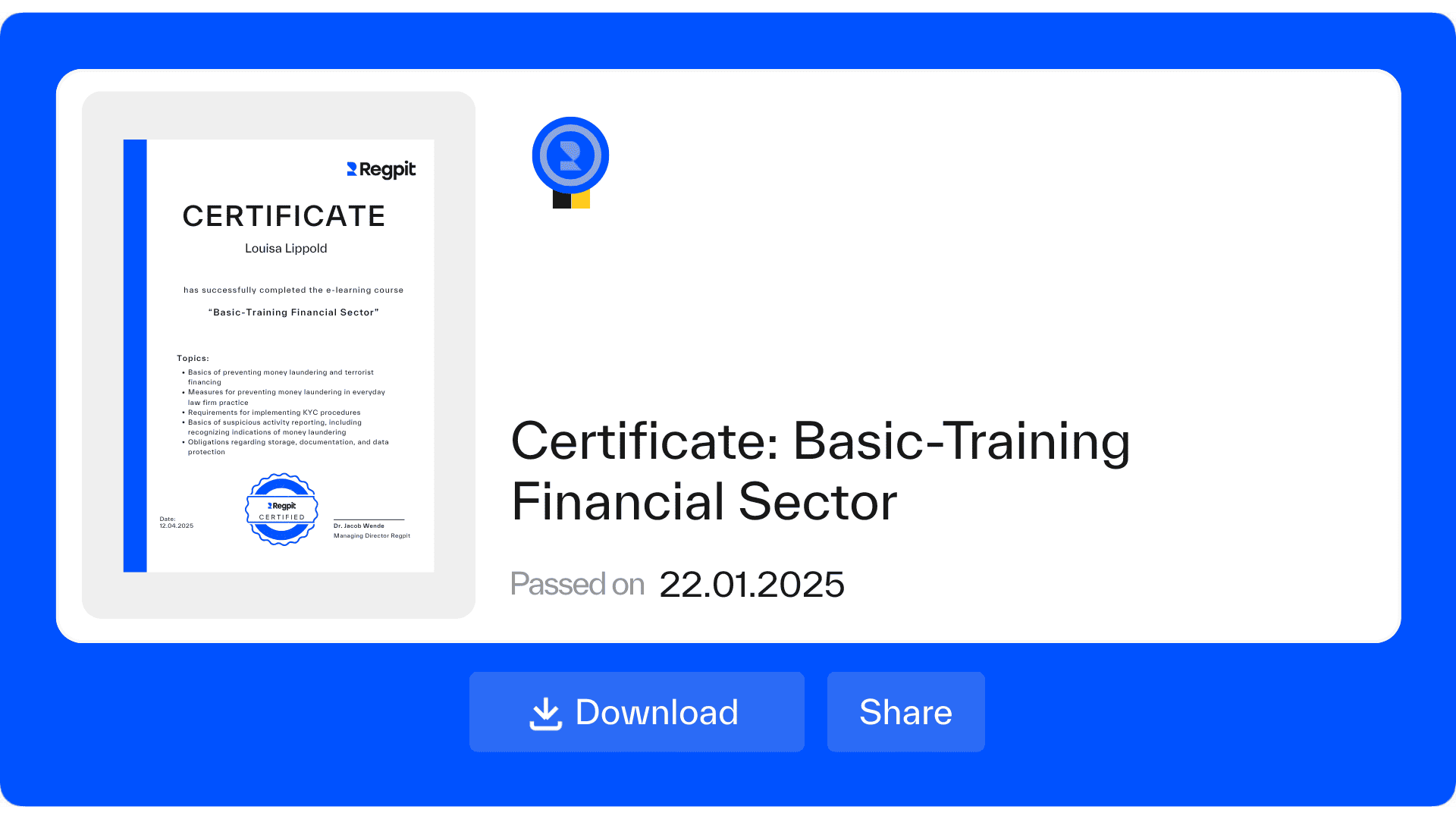

Final test and certificate

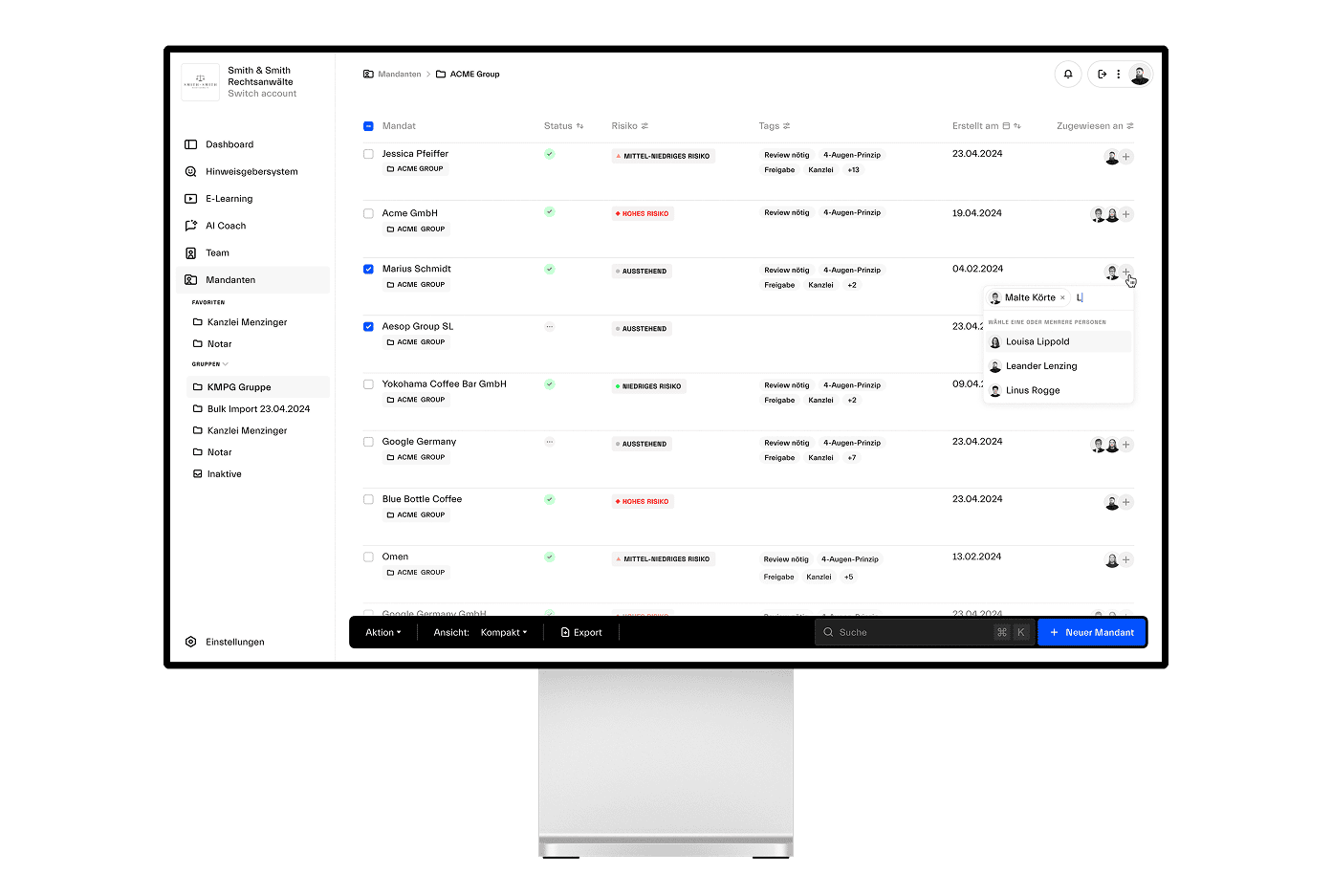

Maintain an overview: The Regpit platform automatically documents who has completed which training course and when, including certificates of attendance for verification obligations and audits.

- Centralized training management

- Audit-proof evidence available at any time

- Automatic certificate issuance

Current legislative developments

- Always regulatory up-to-date and practical

- No manual updating of content necessary

- Direct implementation of new requirements

Developed by professionals for real-world use

Our training courses have been developed by experienced lawyers and compliance experts: With a clear focus on real-life use cases and legal requirements. This results in e-learning that not only informs, but also really helps in practice.

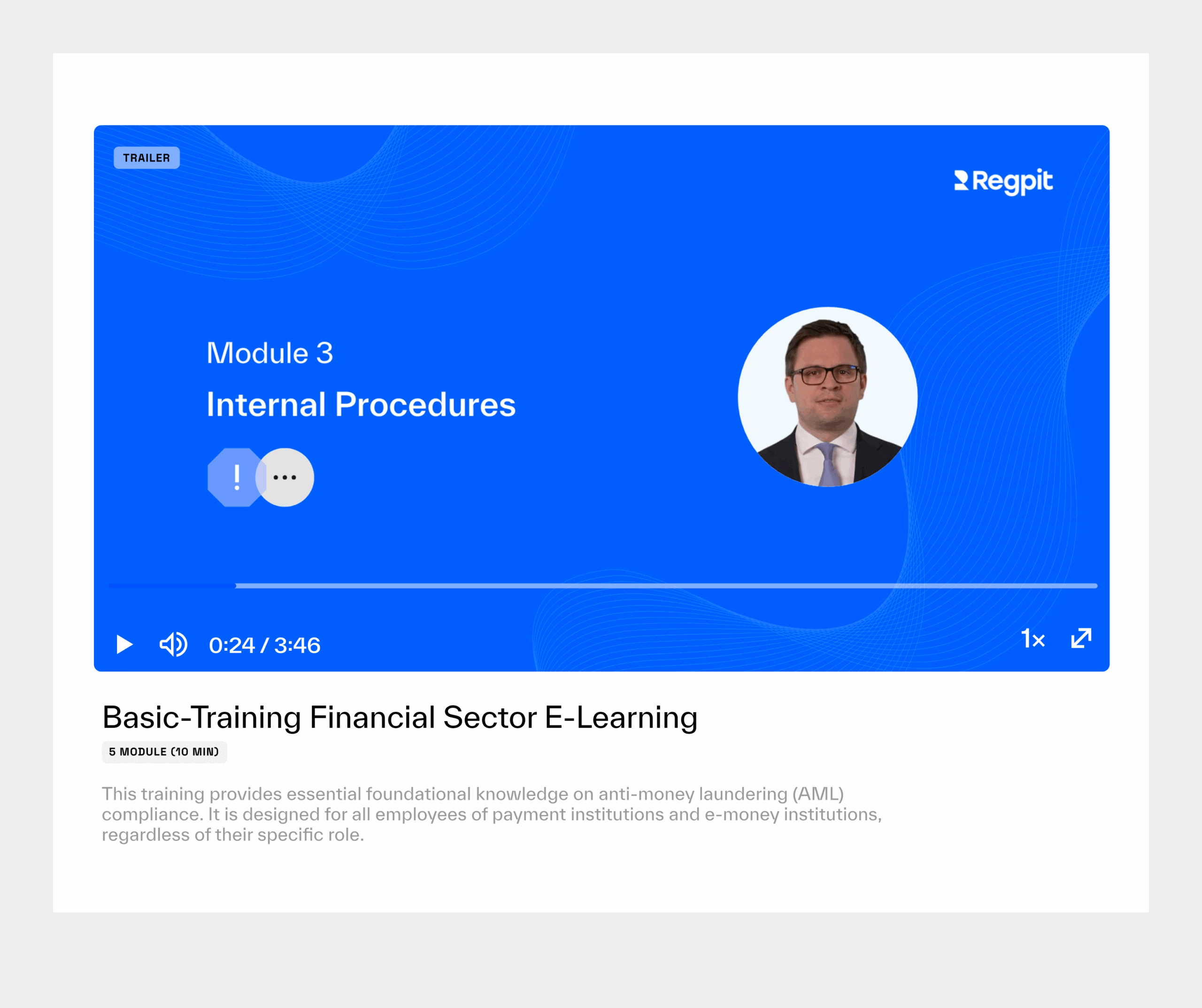

For our E-Learning Solution, we had our own anti-money laundering experts professionally scanned to create AI-powered avatars. This allows us to manually and quickly update content whenever legal changes or new interpretative guidelines arise – directly by our in-house compliance team.

So bleiben Ihre Schulungen immer aktuell, ohne Wartezeiten oder veraltete Inhalte.

Real success stories

Our Solutions are used by law firms, financial service providers and compliance teams across Europe. Read how our customers benefit from them.

“Thanks to Regpit, we’re able to carry out a customer-friendly onboarding process at the highest level — even in the area of money laundering prevention — simply, securely, and efficiently. That’s extremely important to us as a FinTech!”

"The requirements for law firms in the area of money laundering prevention and sanctions are becoming ever more extensive. We are delighted to have a specialised partner at our side with Regpit!"

Talk to our experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

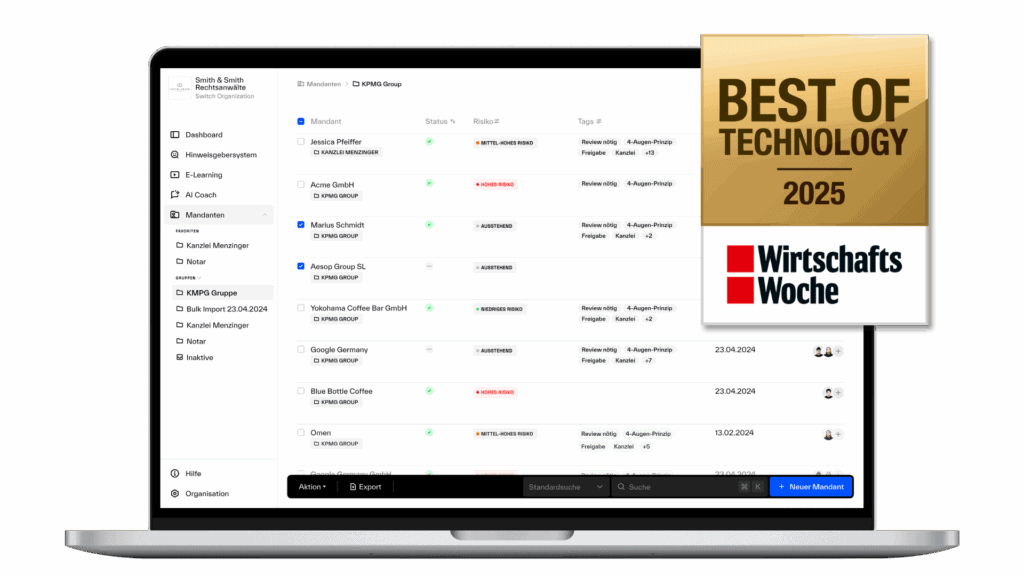

KYC/KYB Solution

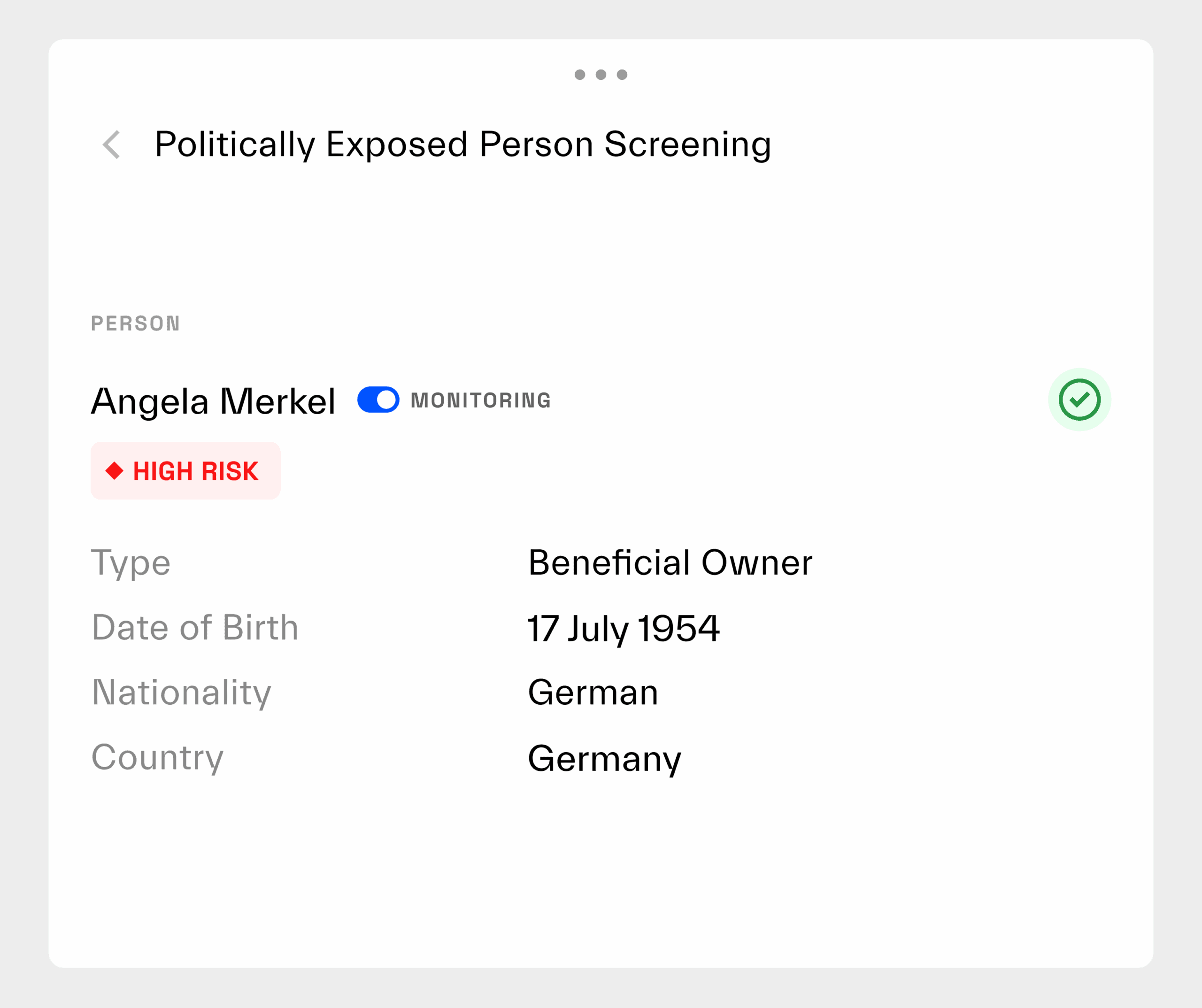

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

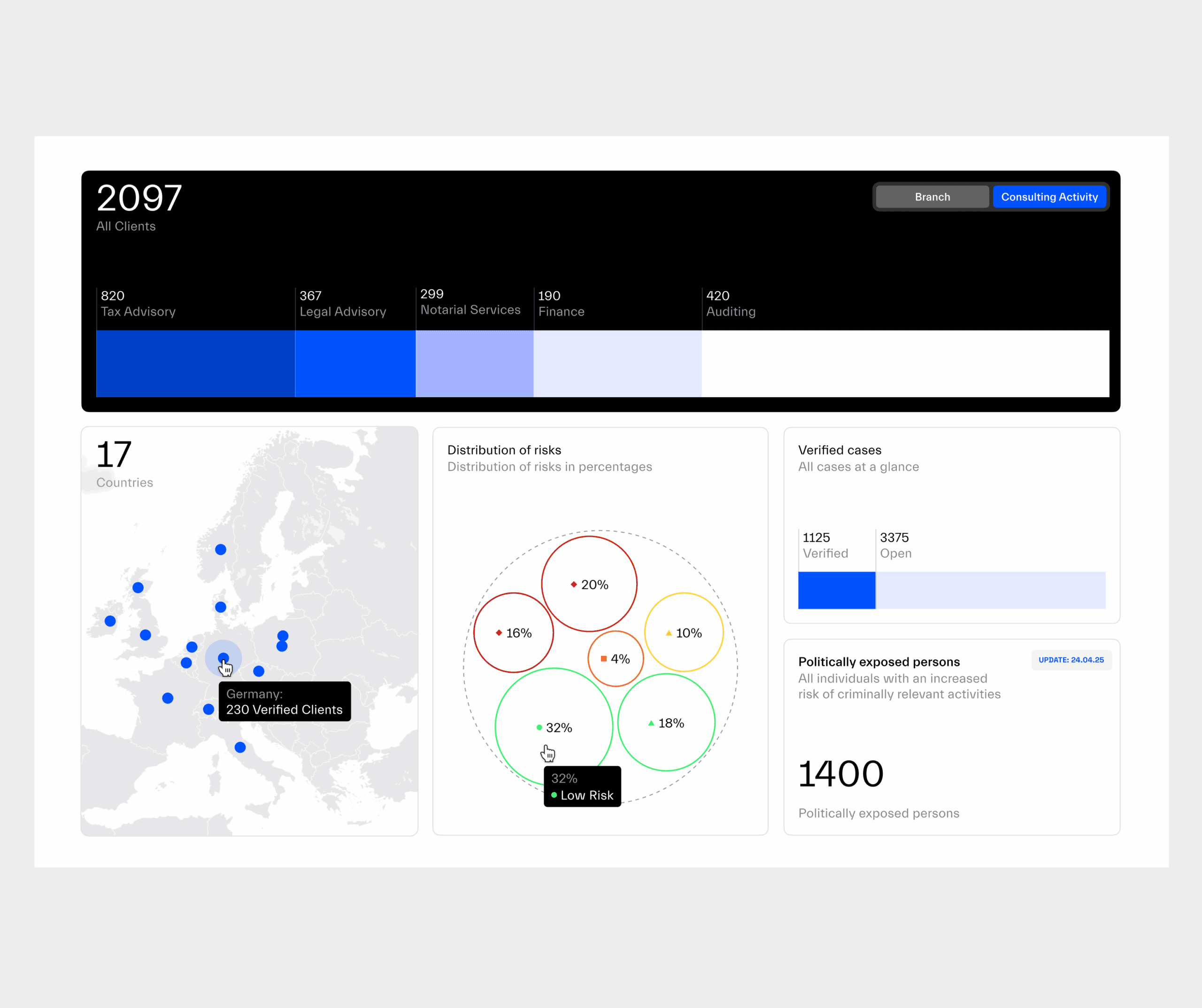

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

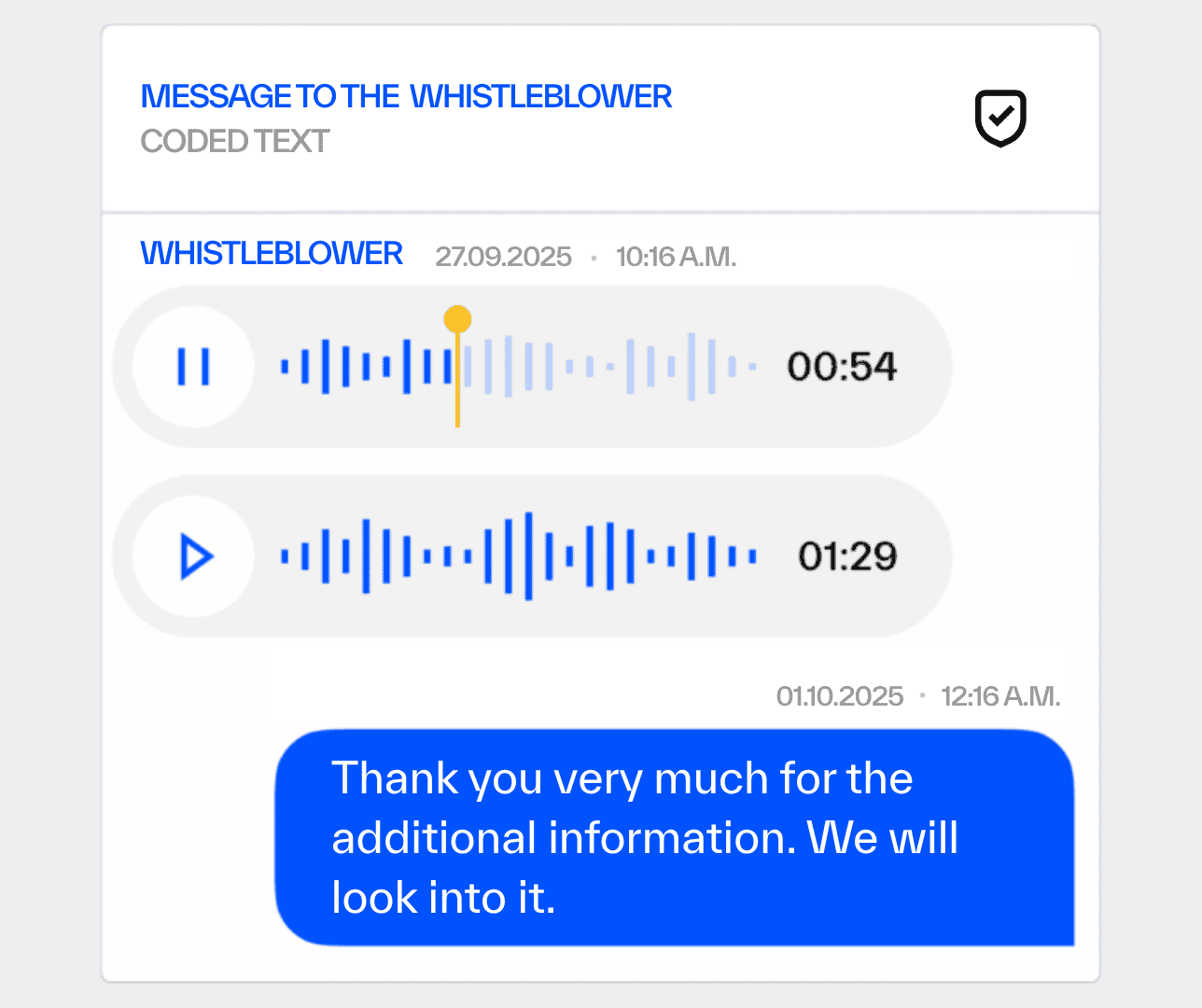

Whistleblowing Solution

Frequently asked questions (FAQ)

Who must take part in money laundering prevention training?

In principle, all employees in the company must receive regular training. The obligation applies to all companies subject to AMLA and applies regardless of size or sector.

Why is money laundering prevention training required by law?

According to Section 6 (2) No. 5 GwG, companies must regularly instruct their employees in the prevention of money laundering. The aim is to recognise risks, understand reporting obligations and handle suspected cases correctly.

What are the contents of an AML training course?

Typical practical content: Fundamentals of the GwG, obligations of employees, KYC/monitoring, information on money laundering, reporting obligations (Section 43 GwG), dealing with suspicious circumstances, sanctions for violations and data protection.

How often does AML training need to be carried out?

At least once a year, additionally in the event of new hires or changes to the law. Depending on the risk area, more frequent training may be necessary. Regpit automatically reminds you when training is due.

How does the online training on money laundering prevention work at Regpit?

Participants complete the training online via the Regpit eLearning module. The content is interactive, test-based and can be accessed at any time. After successful participation, a certificate is automatically created and documented in the system.

Is an online training course MLA-compliant?

Yes, online training is permitted as long as the content is up-to-date, complete and verifiable. Regpit ensures that all content is regularly legally checked and up to date with the latest version of the Money Laundering Act.

What happens if employees are not trained?

Companies that fail to fulfil their training obligations face fines, liability risks and reputational damage. Proof of training is mandatory for audits by supervisory authorities.

What are the benefits of digital AML training?

Online training courses save time and resources, enable location-independent learning and automatically document all progress. Regpit ensures simple tracking and audit security.

How is participation in AML training courses documented?

Regpit automatically saves all training data in the compliance dashboard. You can see which people have attended, which people are missing and when refresher training is required, fully exportable for internal or external audits.

Does Regpit provide certificates of participation?

Yes, all participants receive a digital certificate after passing the final exam, individually issued, legally compliant and available at any time.

Can training be tailored to individual roles?

Yes, Regpit offers modular content depending on the risk profile or function: e.g. for management, sales, back office or money laundering officers. This means that everyone receives targeted training without unnecessary effort.

How up-to-date is the content of the Regpit training courses?

All content is continuously updated by legal experts, and the training is updated in the event of changes to the law or new information from the supervisory authorities.

What does the AML training at Regpit cost?

The training can be flexibly booked as a module in the Regpit system, on a user basis or as a flat rate for teams.

The entry-level price is 24,90 EUR per licence. With higher user numbers, the price decreases automatically depending on the volume. No additional tools or licences are required, everything runs centrally via the Regpit platform.

Can external partners or clients also be trained?

Yes, with Regpit you can also invite and train external people (e.g. franchise partners, clients). You keep a centralised overview of all certificates.

How quickly can I start the training?

Once the module has been activated, your employees can get started straight away. No setup, no IT adjustments, simply invite, send the link and get started.

Does Regpit also offer on-site training by AML experts?

Yes, Regpit also offers individual training on site or via live webinar.

In addition to the digital e-learning module, training courses can also be conducted in person by our experienced money laundering experts, as in-house training, interactive live sessions or customised workshops. Ideal for teams with special training needs or an increased risk profile.

Can I be certified as an anti-money laundering officer at Regpit?

Yes, Regpit offers in-depth training with a certificate of attendance to prepare you for the role of money laundering officer.

Our in-depth training courses provide the specialist knowledge required to take on the role of money laundering officer in accordance with Section 7 GwG. Upon successful completion, participants receive a meaningful certificate as proof for the supervisory authority, with a practical module and individual counselling on request.

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.