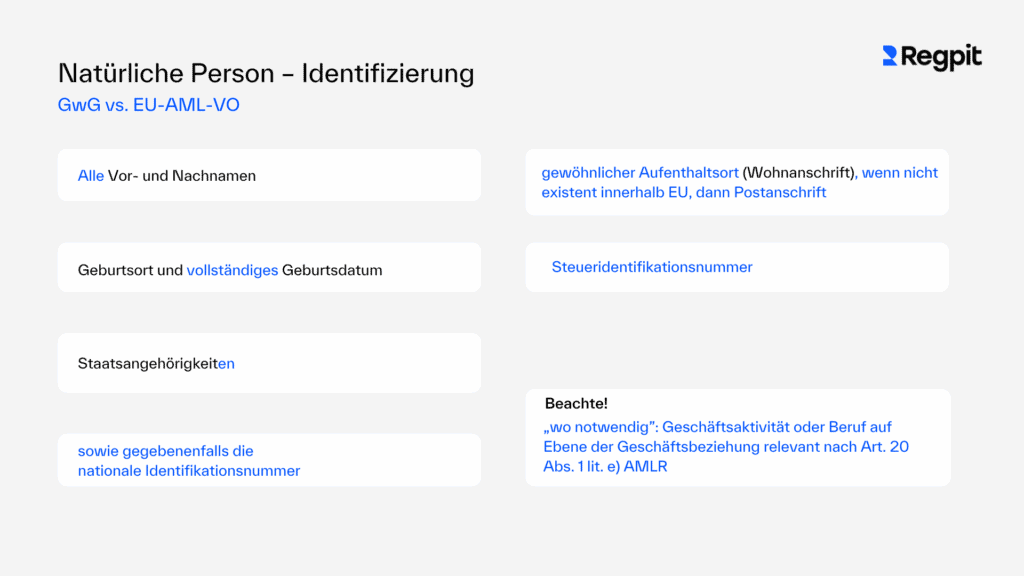

Natural persons – mandatory information for identification

The following overview shows in blue which mandatory information must be collected according to Art. 22(1)(a) EU AML Regulation, in comparison to the German AML Act (black), when identifying natural persons:

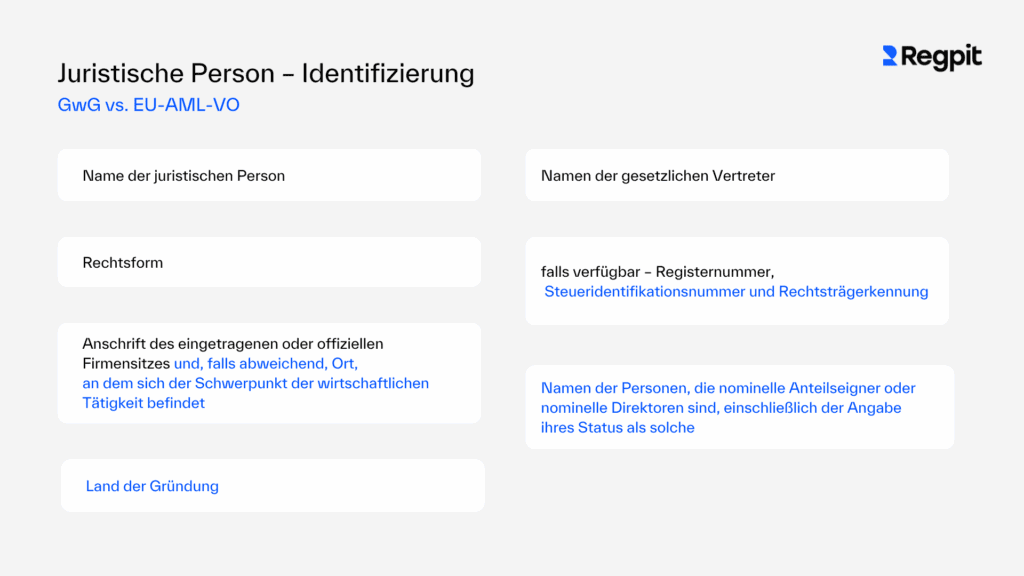

Legal persons – mandatory information for identification

The following overview shows in blue which mandatory information must be collected according to Art. 22(1)(b) EU AML Regulation, in comparison to the German AML Act (black), when identifying legal persons:

Practical implications and implementation

The EU AML Regulation will apply from 10 July 2027. As of this date, obliged entities under anti-money laundering law must have integrated the above-mentioned — and many additional — requirements of the EU AML Regulation into their KYC processes. In this context, the draft Regulatory Technical Standards (RTS) on customer due diligence (CDD requirements) pursuant to Art. 28(1) EU AML Regulation issued by the European Banking Authority (EBA) should also be taken into account. This RTS draft further specifies which information obliged entities will be required to collect as part of the KYC process going forward. This draft RTS further specifies which information obliged entities must collect in future as part of the KYC process.