How DVS AG digitizes KYC processes with Regpit

How a BaFin-regulated factoring company digitizes onboarding processes, reduces workload, and strengthens compliance

A selection of our clients

About DVS AG

DVS AG is a leading factoring company and billing service provider for tax advisors, lawyers, medical professionals, and law firms. Operating under BaFin supervision, DVS AG complies with strict regulatory requirements while maintaining high expectations for speed and service quality in client onboarding.

Industry: Factoring / Financial Services

Location: Germany

Regulator: BaFin

Regpit Modules: KYC Solution, Managed KYC Service, Ident Solution

The challenge

DVS AG faced the challenge of combining regulatory precision with an excellent customer experience.

- Clients expect a fast and frictionless onboarding process

- BaFin requires complete and gapless KYC and AML documentation

- The sales team needed a user-friendly and secure tool

- High manual effort due to diverse client groups

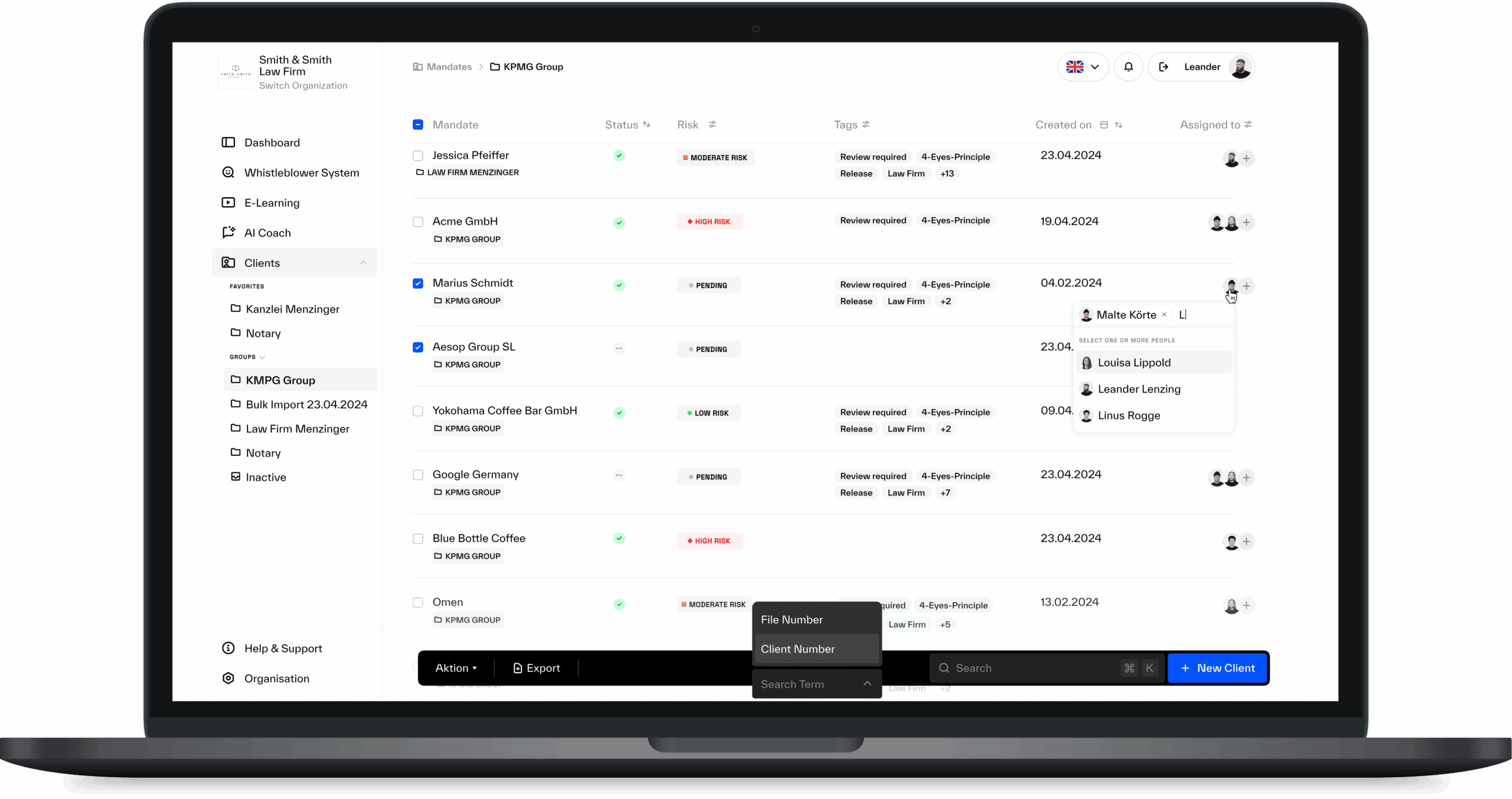

With Regpit, organizations of all sizes rely on a modular compliance platform that covers all regulatory requirements: From digital KYC onboarding to risk management.

No complex IT implementation. No legal uncertainty. Just maximum security, efficiency, and scalability.

The solution with Regpit

DVS AG relies on a combination of the Regpit platform and the Managed KYC Service.

We’ve outlined the process here:

Step 1: Simple Use by the DVS AG Sales Team

The DVS AG sales team creates new customers directly in the Regpit platform

With just a few clicks, the customer is invited to complete digital onboarding

Step 2: Self-onboarding by the customer:

Through the company search, the customer can instantly find their business

Only minimal information about beneficial owners is required

The process includes a digital ID verification

Total duration: usually no longer than 5 minutes

Step 3: Automation in the background:

Register extracts are downloaded automatically

Ownership and control structures as well as beneficial owners are identified systemically

Step 4: Managed KYC service for complex cases:

The specialized Regpit team reviews potential risk factors

Beneficial ownership structures are analyzed in complex constellations

Potential PEP or sanctions matches are assessed manually

Final KYC Report:

Complete, audit-proof, and fully BaFin-compliant

The customer is successfully onboarded and ready to start immediately

The results

DVS AG demonstrates how automated compliance and human expertise work together seamlessly. With Regpit, the company gains not only efficiency but also trust: Both internally and externally.

- +70% time savings in onboarding

- Full BaFin compliance through audit-proof documentation

- Higher customer satisfaction thanks to faster processes

- Scalable workflows that grow with the business

Digitize your AML processes now - just like DVS AG

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.