How UnitPlus digitizes KYC processes with Regpit

How fintech UnitPlus automates KYC in the business customer segment with Regpit

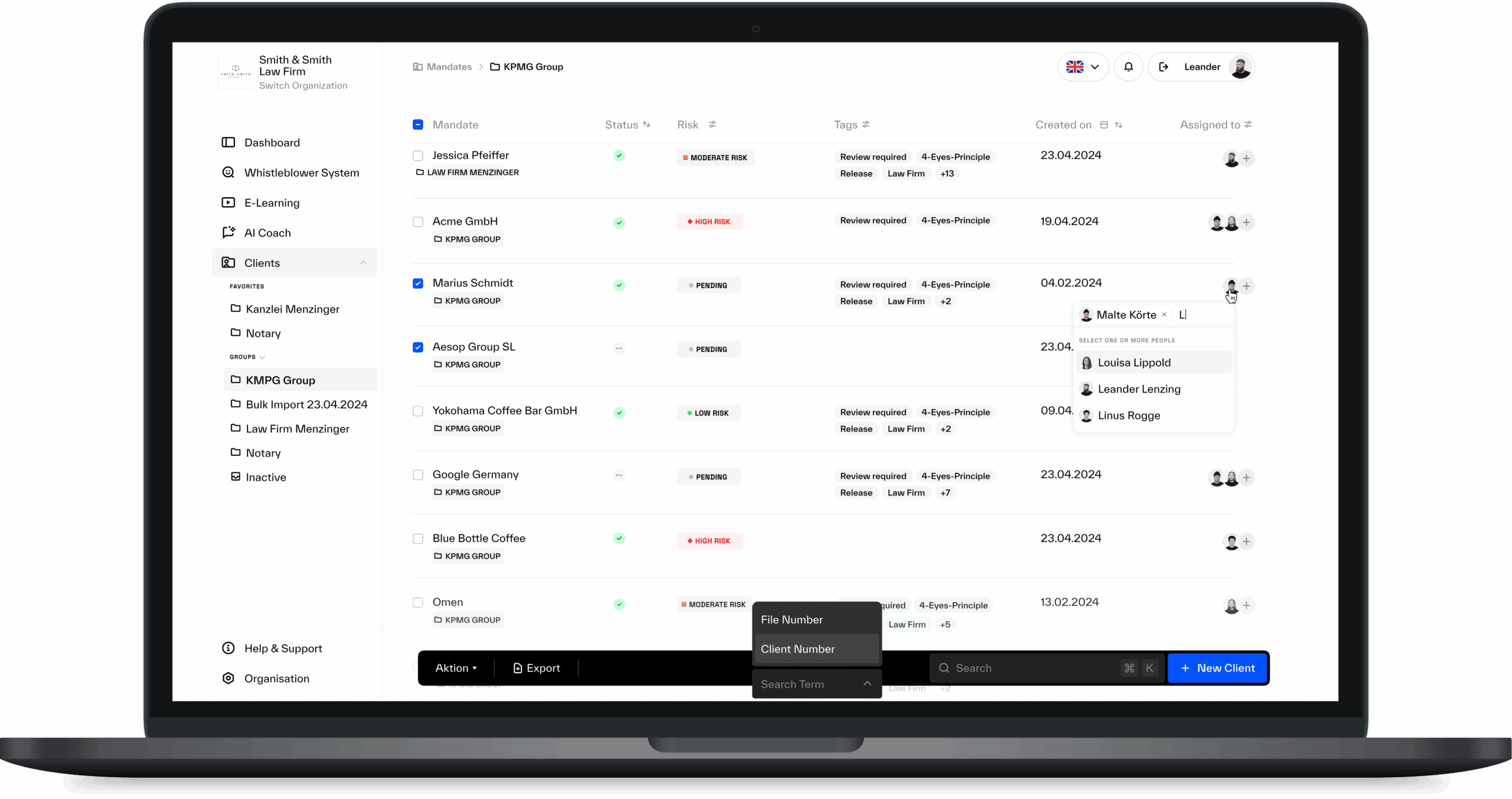

A selection of our clients

About UnitPlus

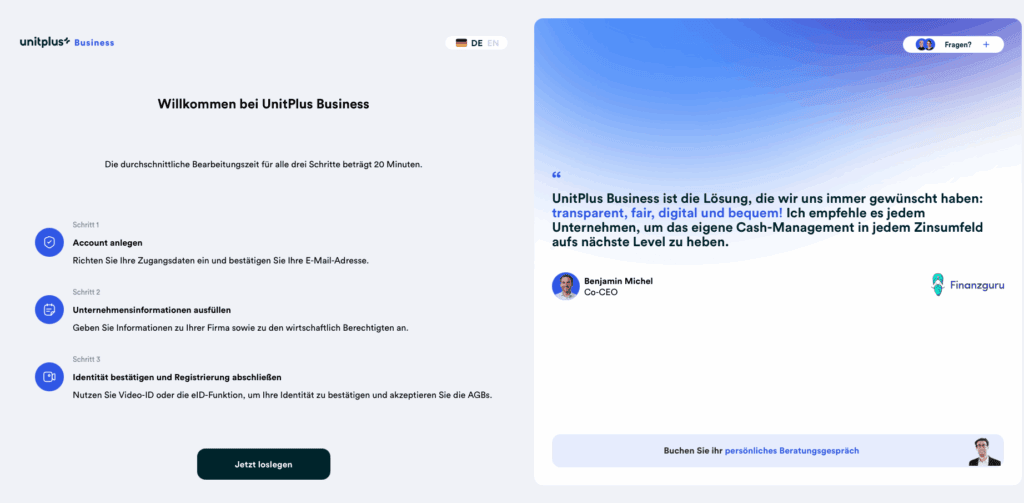

UnitPlus is a Berlin-based fintech specializing in innovative financial solutions for both private and business clients. For corporate customers, UnitPlus Business offers a cash management solution that invests unused company liquidity securely, flexibly, and with attractive returns. In the business segment, UnitPlus relies on a fully digital self-onboarding process integrated directly into its website.

Industry: FinTech / Financial service provider

Location: Germany

Regpit Modules: KYC Solution, Managed KYC Service

The challenge

For UnitPlus, it was essential to design the business onboarding process in a way that:

Corporate clients could register independently and digitally via the website

Automation and API integration would deliver time savings and scalability

Compliance and KYC requirements could be met without manual workflows and with minimal effort

The transition from onboarding to using UnitPlus Business would be seamless

In practice, this meant that company search, identification procedures, determination of beneficial owners, risk analysis, and KYC reporting should run as automatically as possible in the background.

The solution with Regpit

For UnitPlus, we integrated the following components:

Self-onboarding via the website: Business clients can start directly on the UnitPlus website with just a few simple inputs

Company search via API: Company data is automatically retrieved and prefilled

Identification process: Customers are redirected to a digital ID verification method (e.g., VideoID)

Automated background processes:

Retrieval of register and company data (e.g., commercial register)

Determination of ownership and control structures as well as beneficial owners

Automated risk assessment suggestions covering client, country, and transaction risks

Generation of the final KYC report

As a result, the entire onboarding process for UnitPlus business clients runs almost fully automated: With minimal manual intervention and high process speed.

The results

UnitPlus demonstrates how fintech innovation and compliance expertise can work hand in hand. With Regpit, the company automates its anti-money laundering (AML) processes while creating transparency and trust: Ensuring regulatory security and sustainable growth.

- Speed: Onboarding in record time, clients can start immediately

- Automation: Minimal manual effort, maximum efficiency

- Compliance: All regulatory requirements are automatically fulfilled

- Scalability: The solution grows effortlessly, whether 10 or 1,000 new customers per month

Digitise AML processes now - just like UnitPlus

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.