A selection of our clients

How young companies benefit from Regpit

Regulatory obligations under the german German Money Laundering Act (GwG) are often complex and easily underestimated. The fact is: even young companies are frequently subject to AML requirements early on.

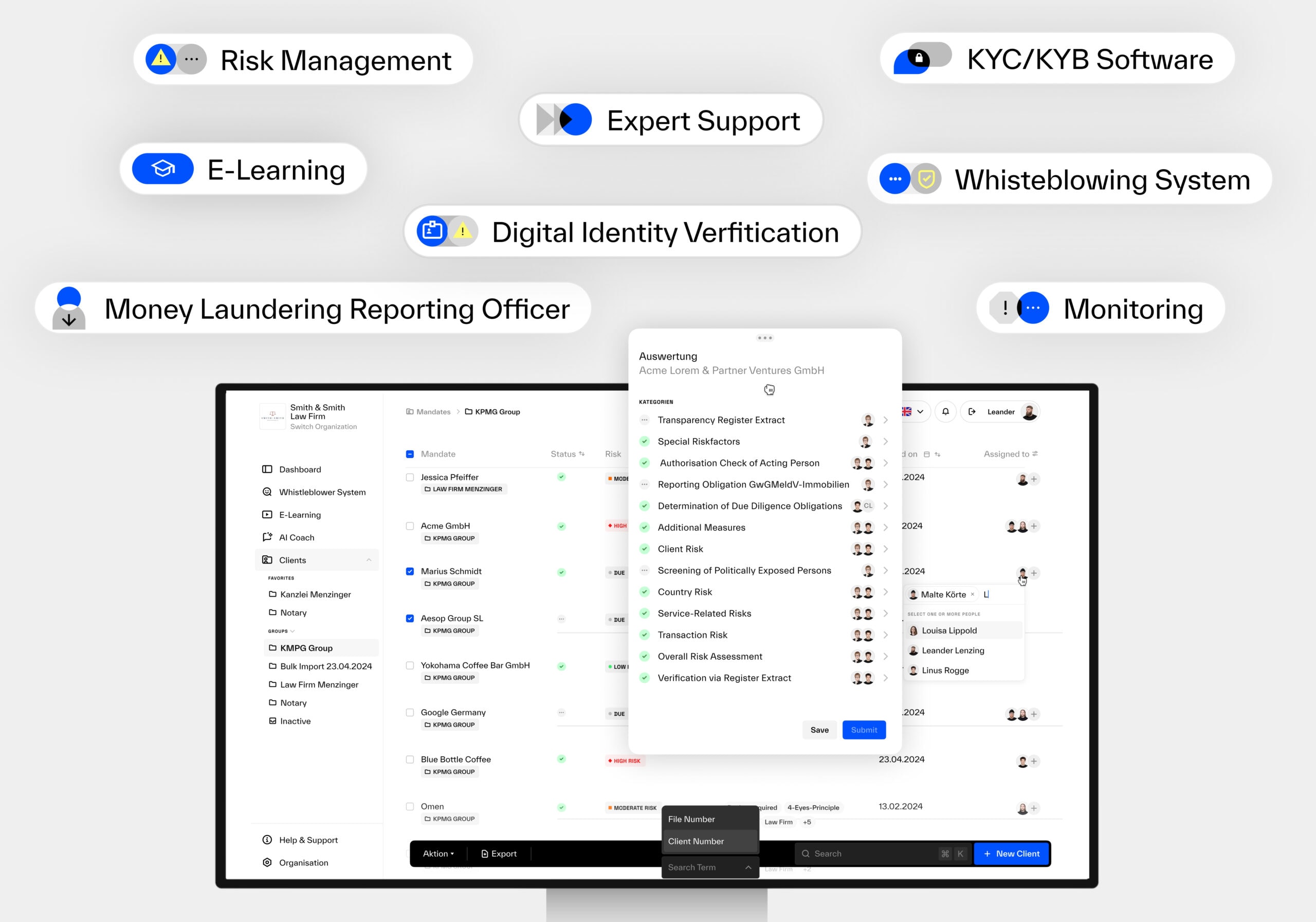

With Regpit, start-ups rely on a modular compliance platformthat covers everything from KYC onboarding to risk management. No IT implementation, no legal guesswork: Just maximum security, minimal effort, and full scalability.

Note:

All Regpit modules, whether products or services, can be flexibly combined. This allows you to put together exactly the solution that fits your needs.

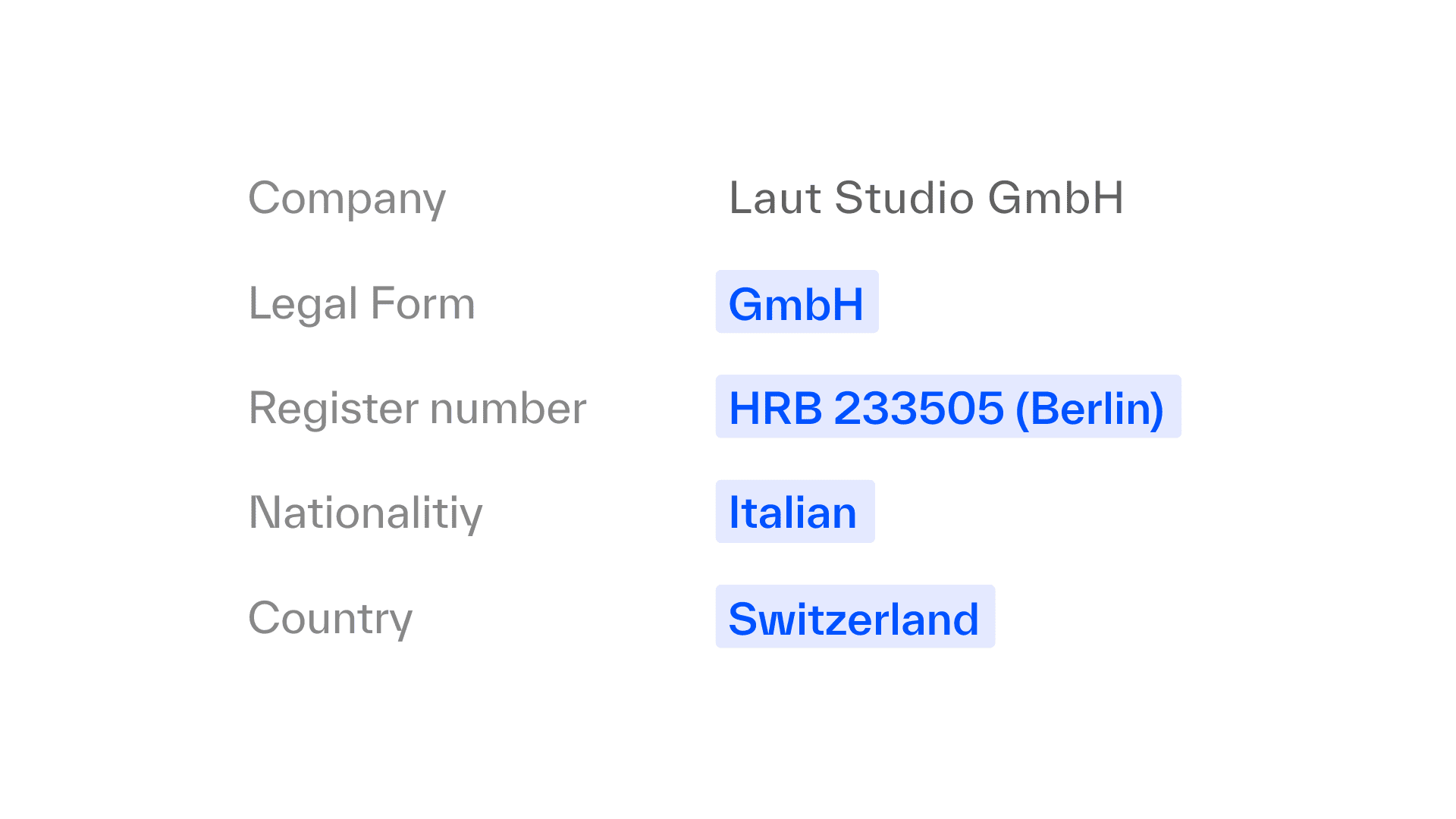

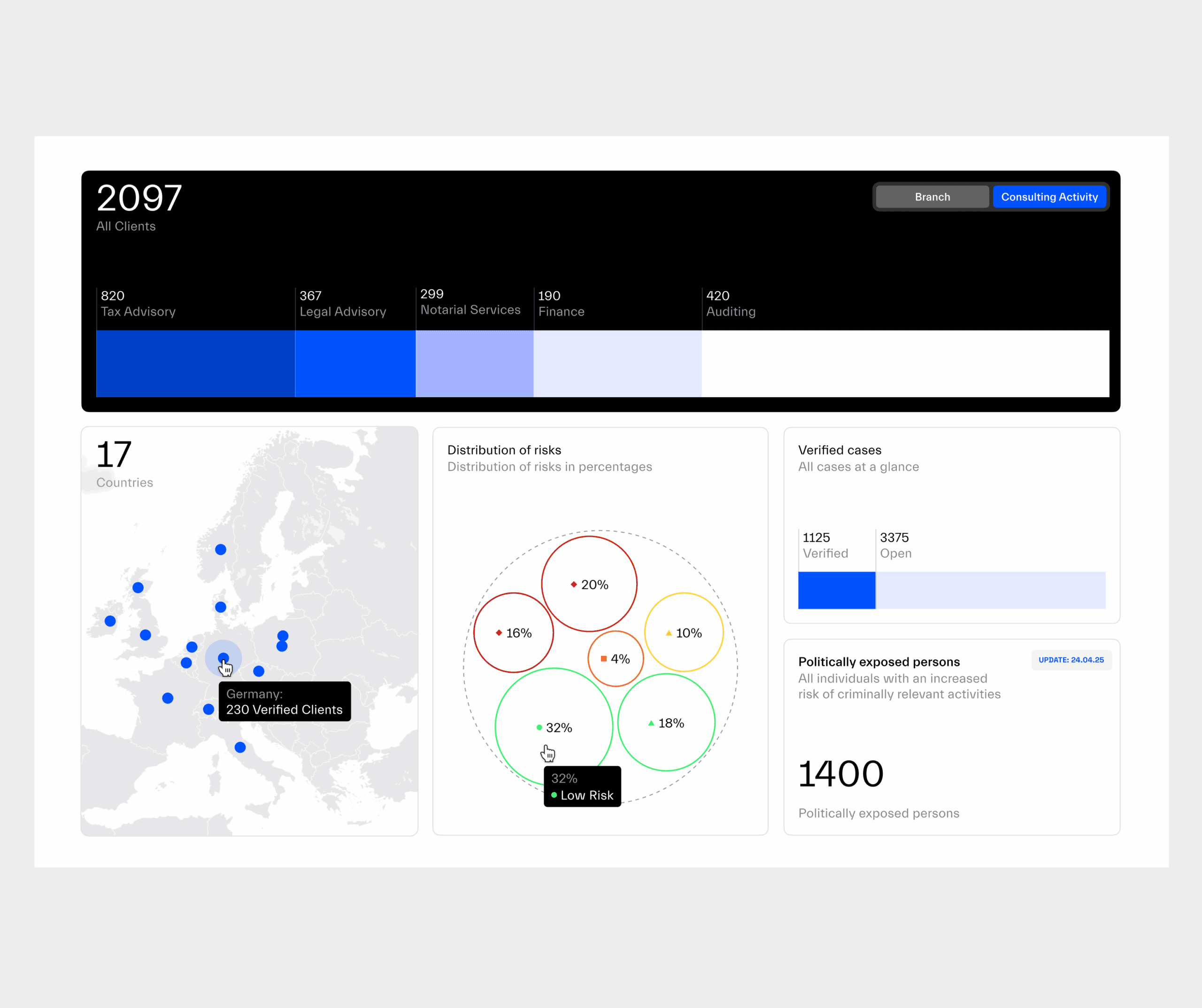

KYC Software

Fully digitalized KYC and KYB processes: From data collection to risk profiling.

- Identity and company verification

- Integrated PEP and sanctions list screening

- Audit-proof documentation for reviews and inspections

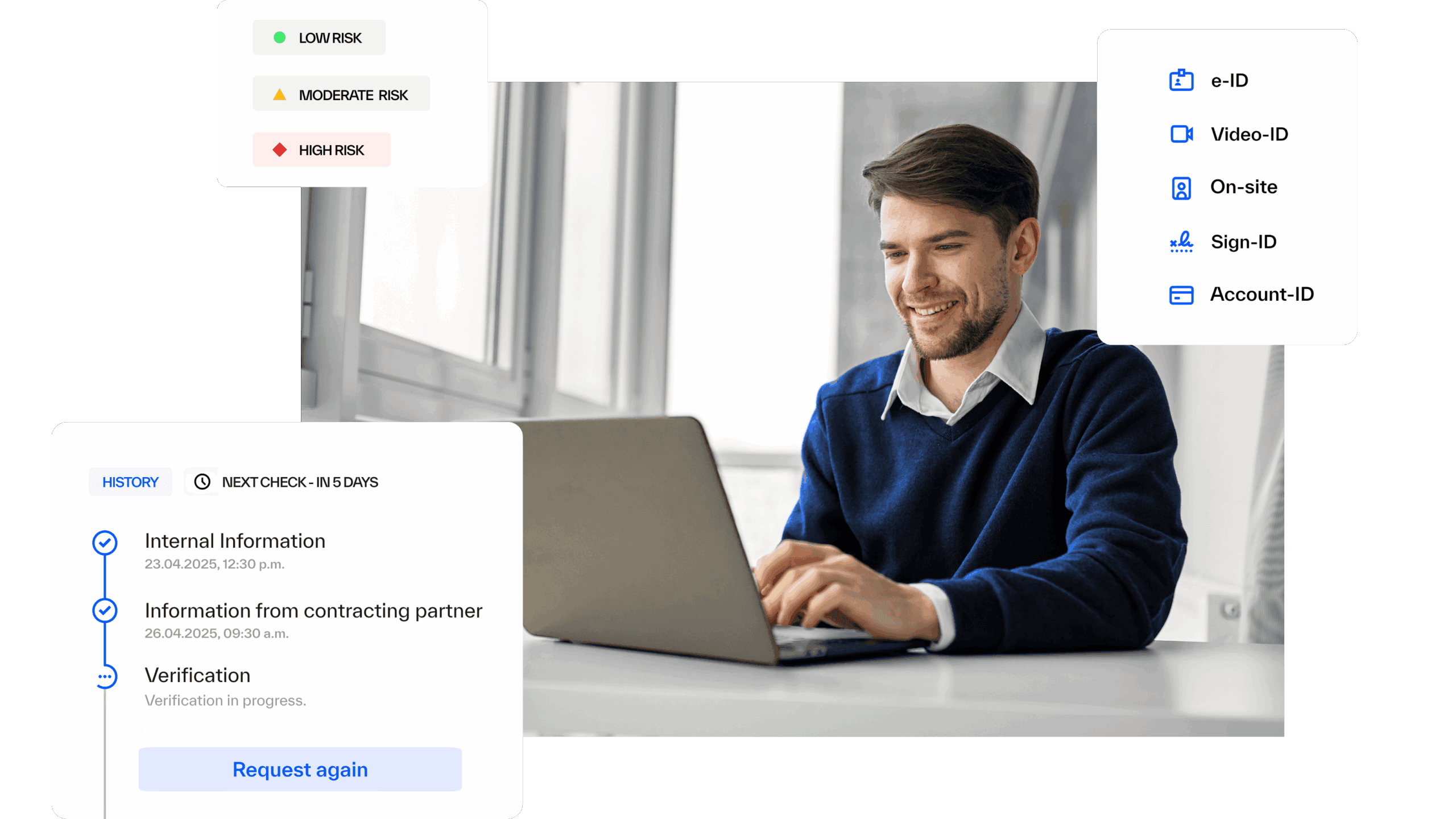

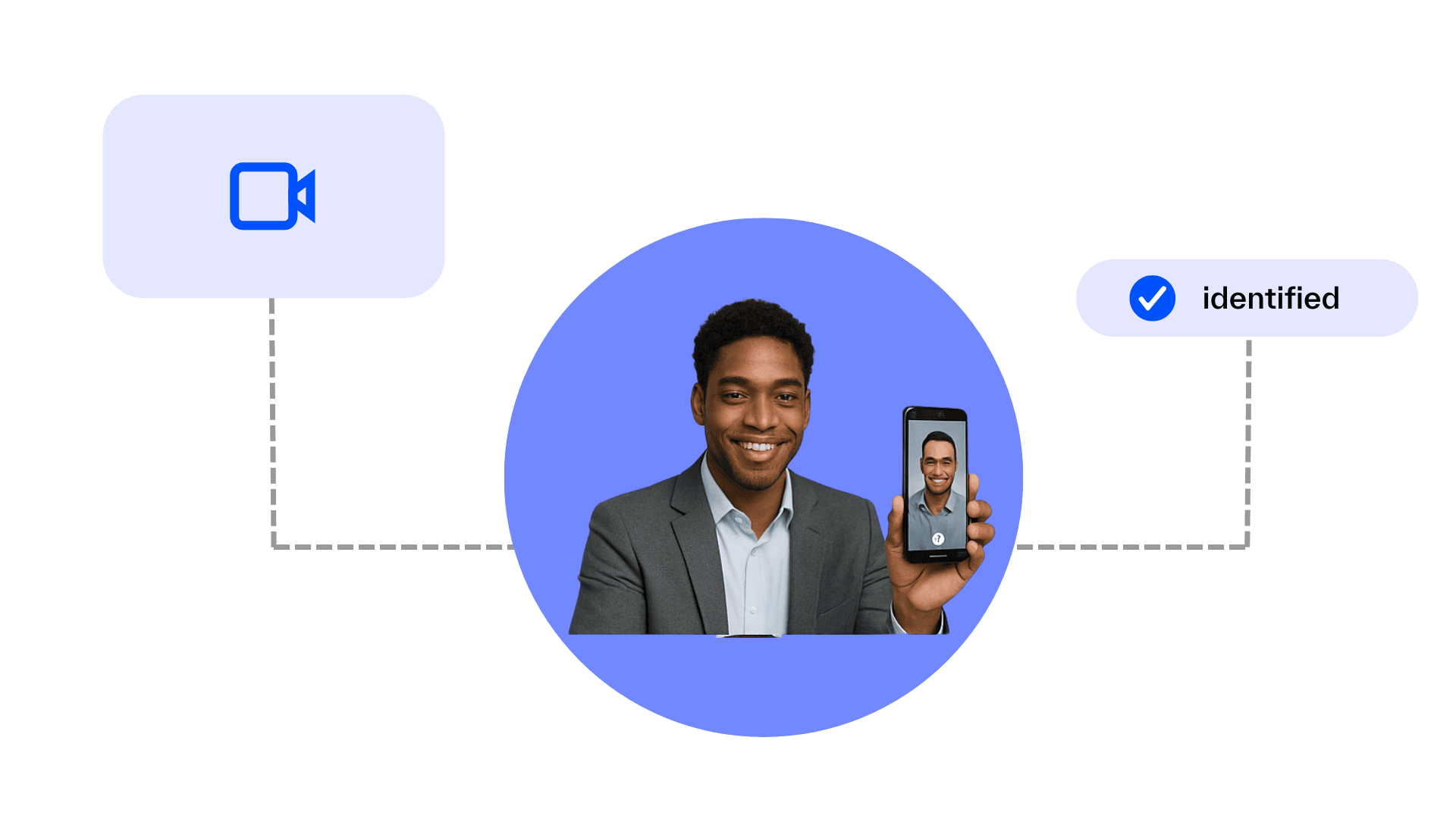

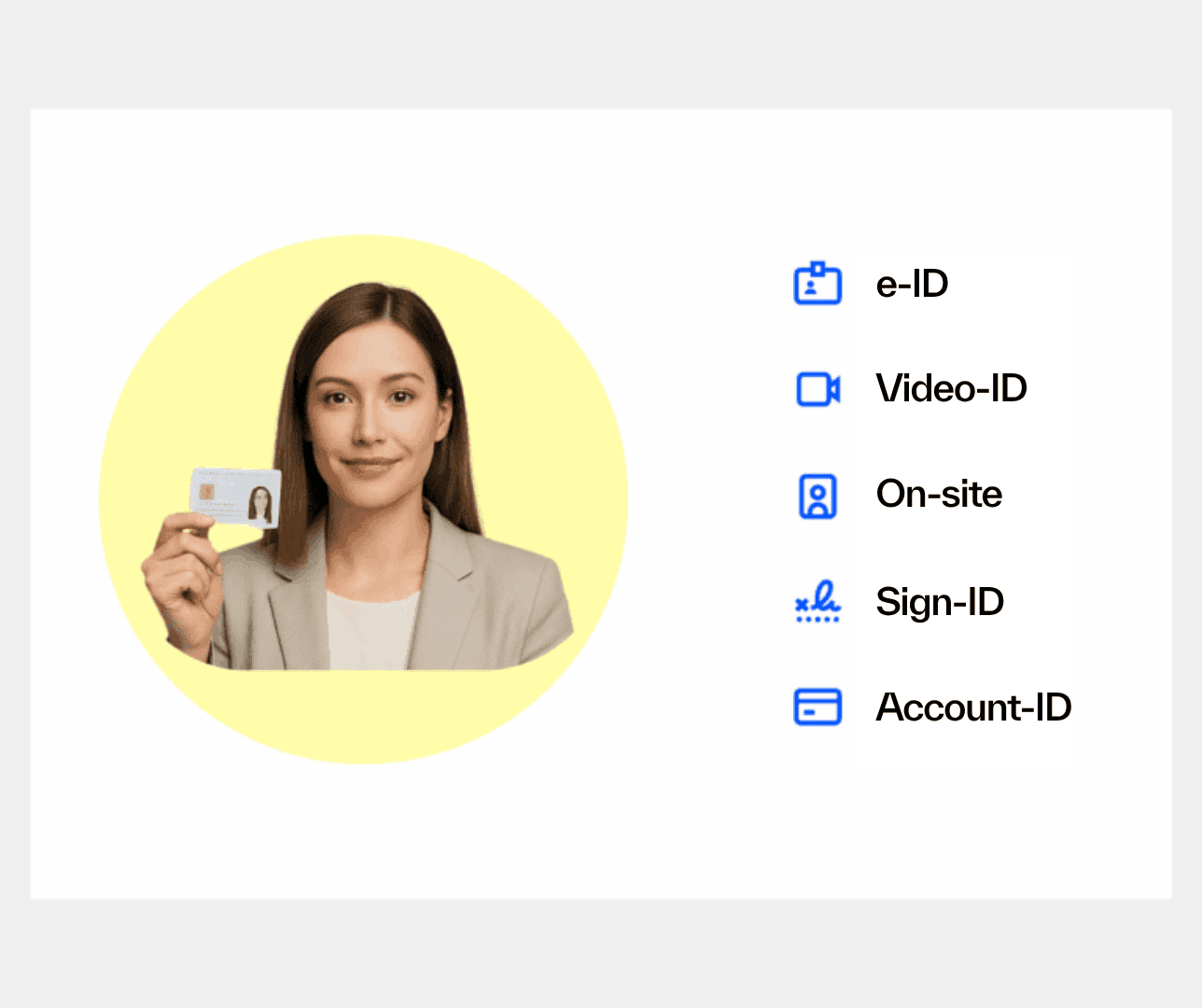

Ident Solution

All standard GwG-compliant identification methods from a single source: Online, mobile, or on-site.

- Video ID, eID, Account ID, on-site verification, and SignID

- Instant integration: No IT implementation required

- Highest security standards and full legal compliance

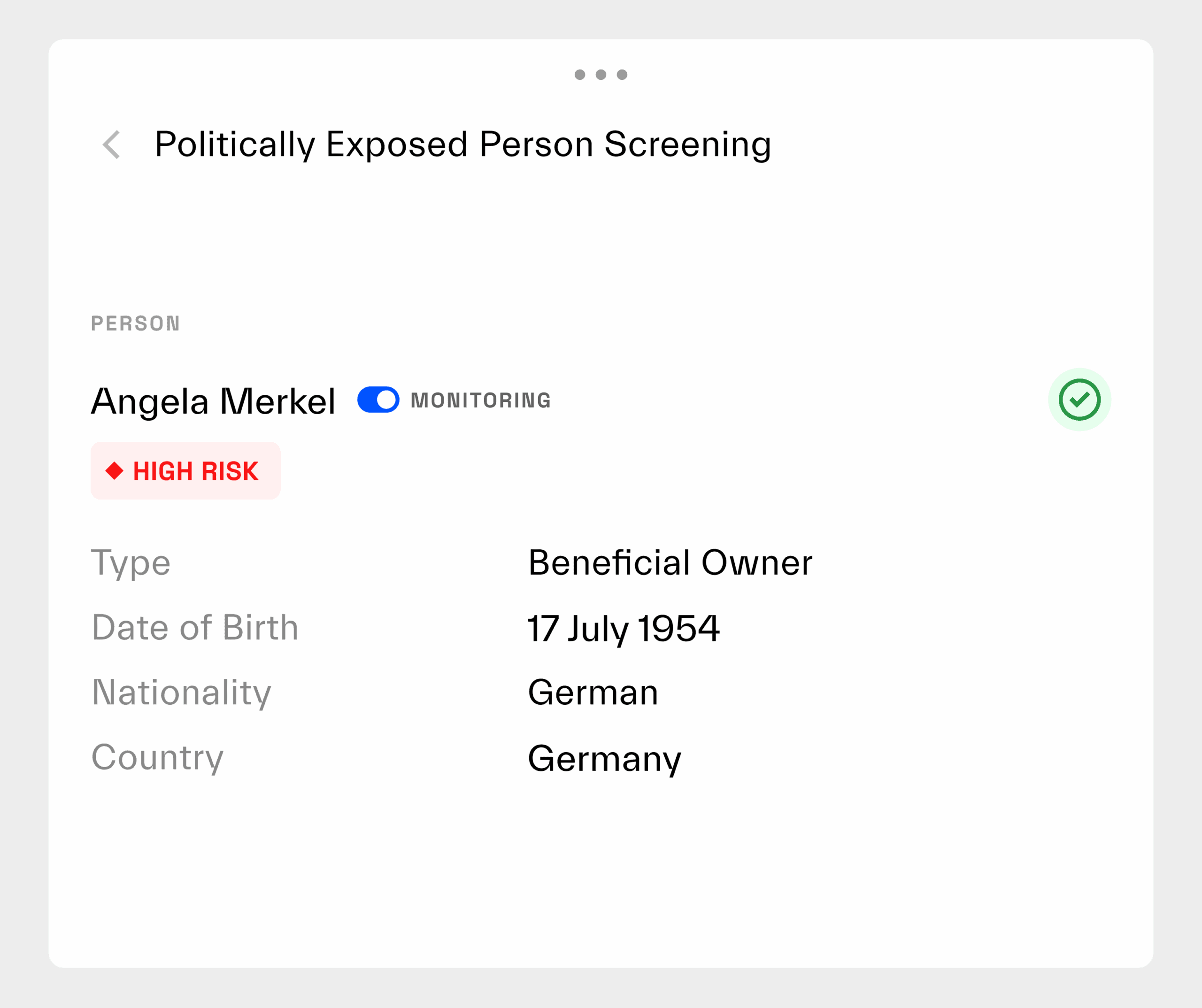

Monitoring Solution

365-day monitoring of customer and business partner data with automatic alerts for any changes.

- PEP, sanctions, and adverse media screening

- Notifications for relevant risk updates

- Automated background checks

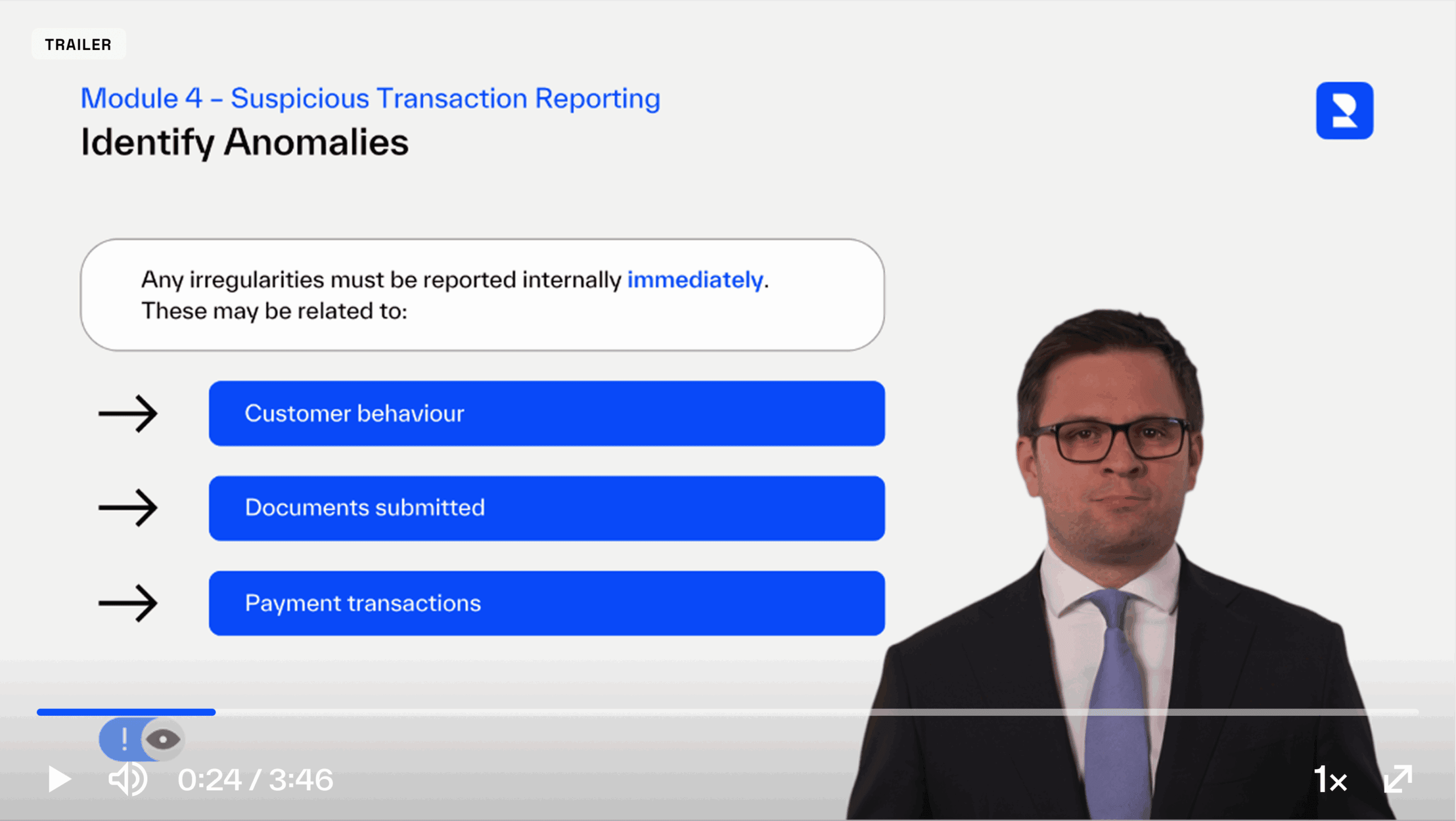

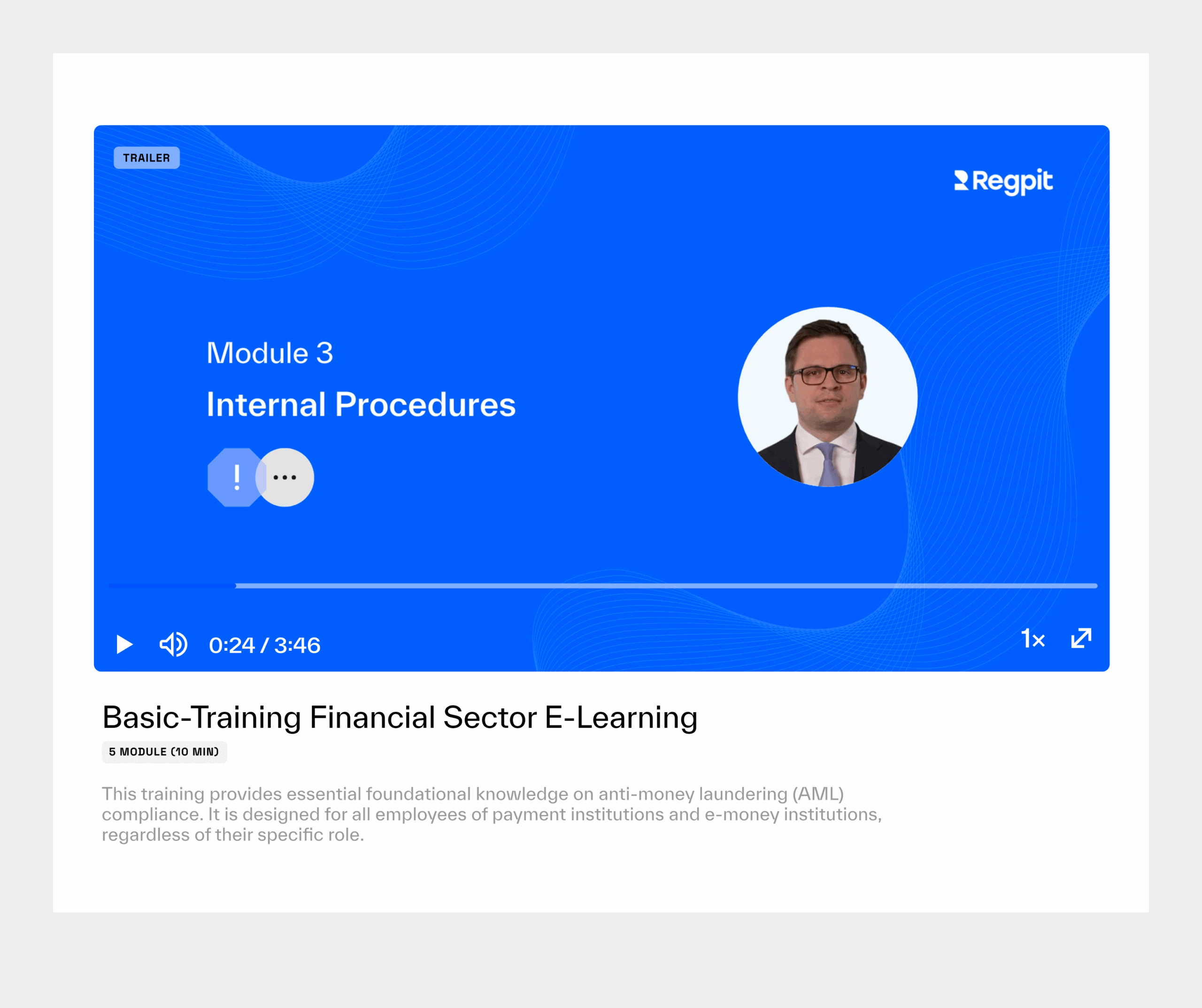

E-Learning Solution

Comprehensive AML training: Fully compliant with the German Anti-Money Laundering Act (GwG) and always up to date.

- Training content continuously updated to reflect the latest legal requirements

- Automated testing and certificate issuance

- Central management of all participants and training records

All the AML toolsyour startup needs today, and more for tomorrow

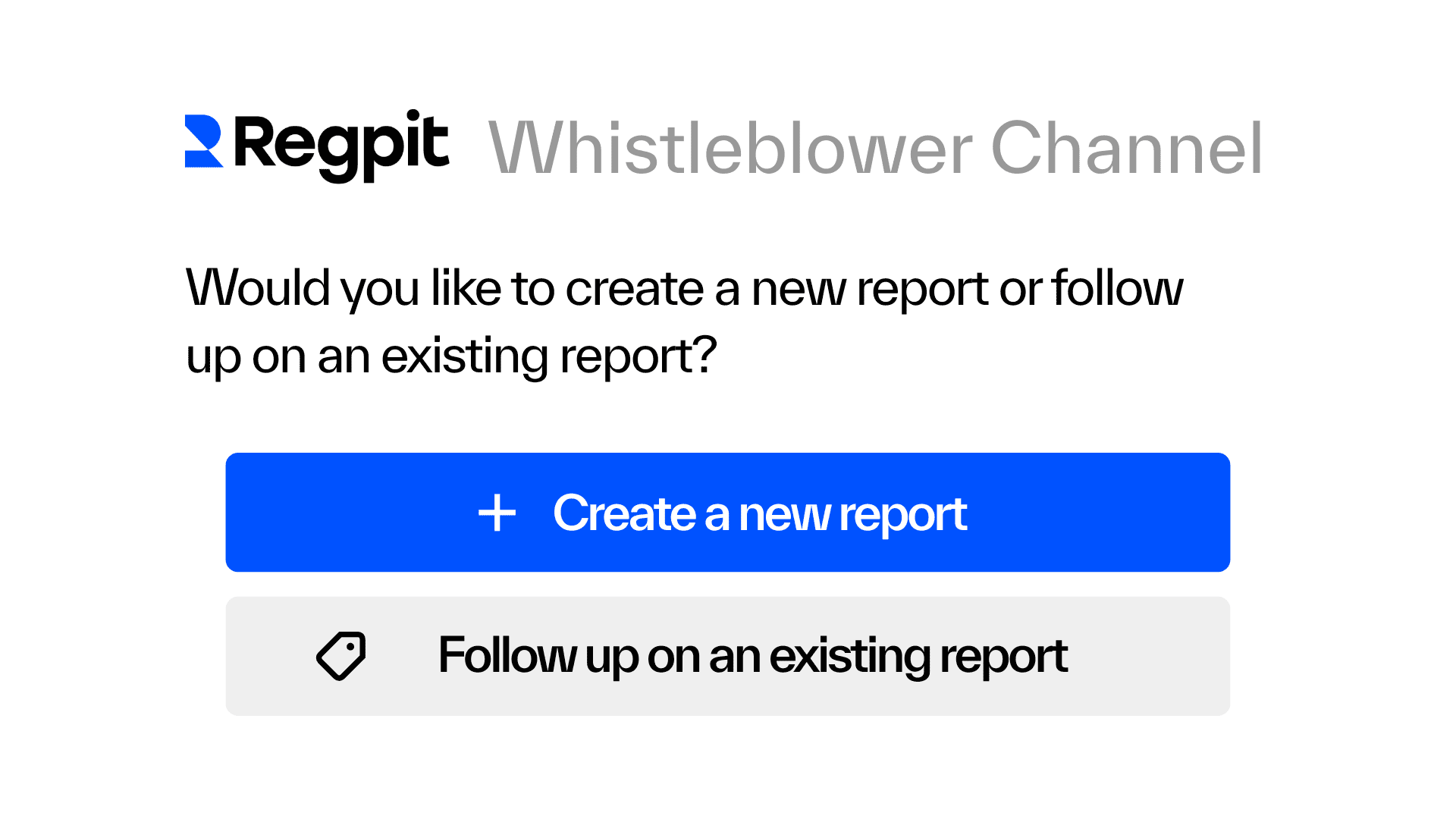

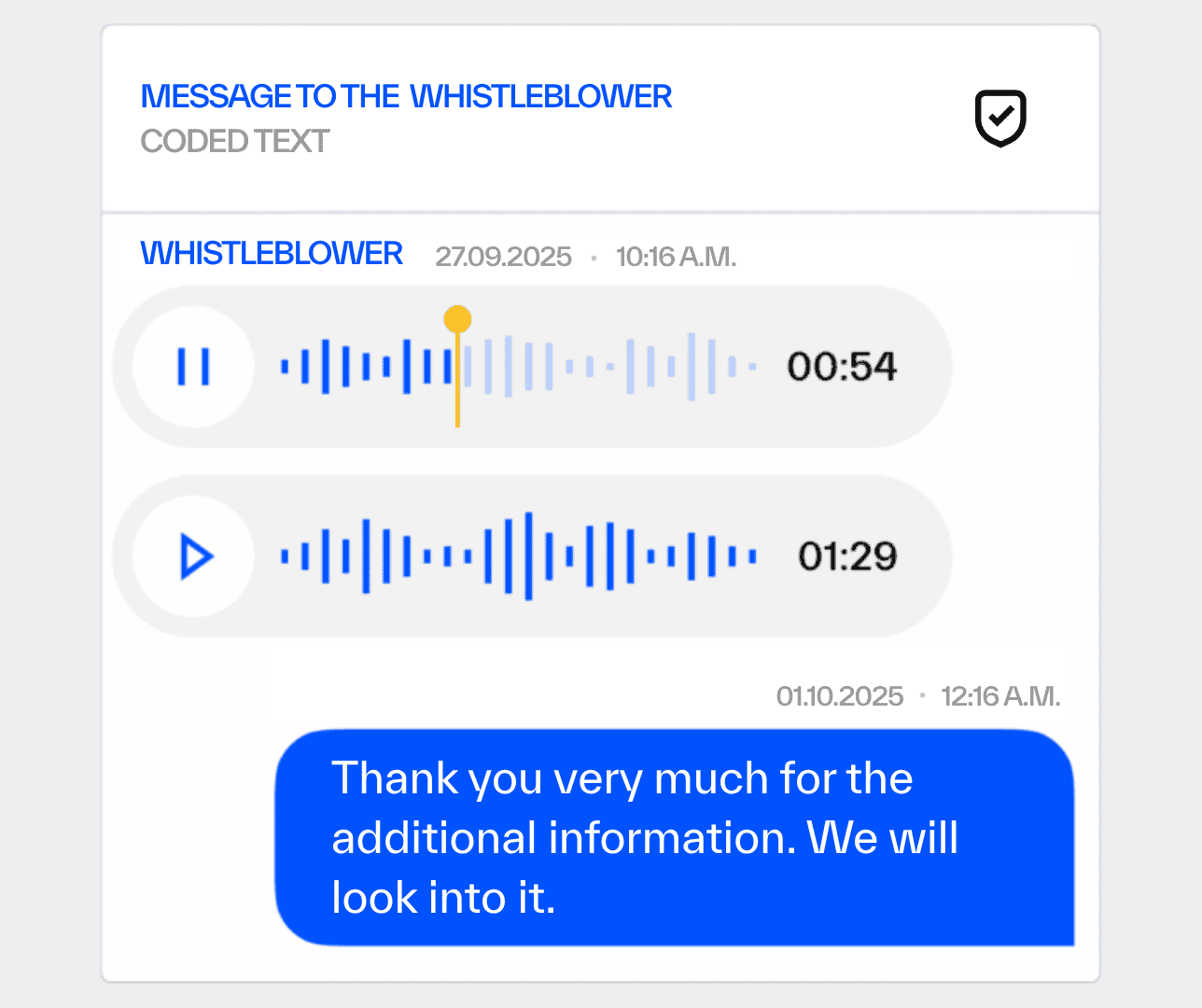

Whistleblowing Solution

An audit-proof, GDPR-compliant whistleblowing system for internal and external reporting.

- Anonymous reporting option for whistleblowers

- Fully compliant with GwG, HinSchG, and GDPR requirements

- User-friendly interface for employees and compliance teams

Expert support

Direct access to experienced AML, KYC, and compliance specialists: As an extension of your technology or as a standalone consulting service.

- Support with complex regulatory questions

- Advisory services for industry-specific compliance challenges

- Fast assistance in daily operations and special audits

External Money Laundering Reporting Officer (MLRO)

With our service as an external AML Officer, experienced Regpit experts take on your legal obligations.

- Assumption of all duties in accordance with § 7 GwG

- No internal effort for training or communication with authorities

- Outsourcing with full responsibility and documentation

Before

Without Regpit

- Long waiting times before the first client onboarding

- High coordination effort with investors and banks

- Legal uncertainty regarding regulatory obligations

- Limited resources due to manual processes

- Risk of delays during audits or funding rounds

Afterwards

With Regpit

- Ready to go: all AML tools available instantly, no implementation needed

- Investor-ready: regulatory clarity from day one

- Fully automated KYC and screening processes

- Legally compliant and audit-proof documentation

- Compliance that scales with you: From seed to exit

How startups take control of AML compliance

How Regpit works

Discover our platform in an interactive demo:

Discover the Regpit platform.

We’ll be happy to show you how Regpit streamlines your AML compliance: Efficiently, securely, and effortlessly.

free of charge & non-binding

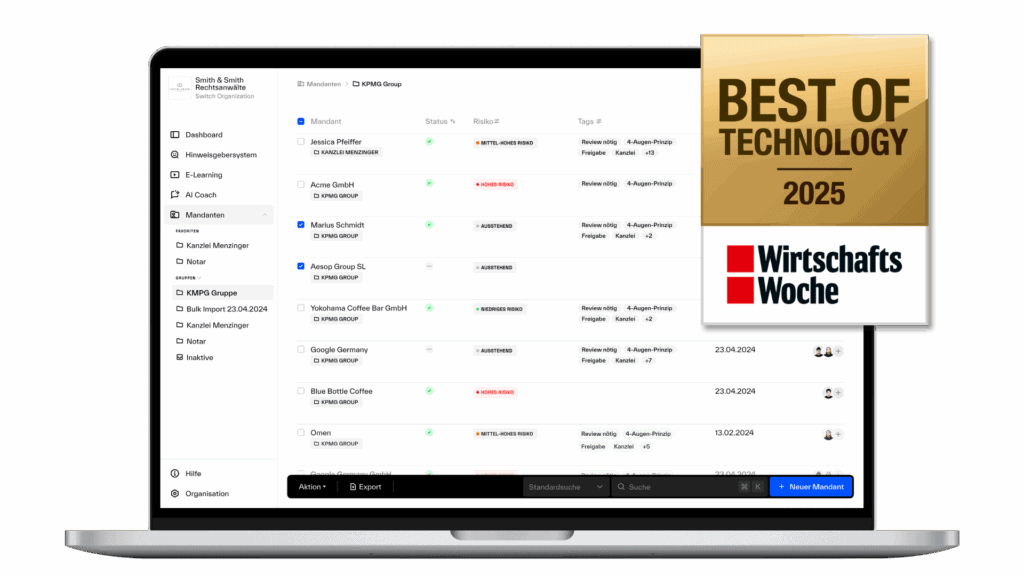

Real success stories

Our Solutions are used by law firms, financial service providers and compliance teams across Europe. Read how our customers benefit from them.

“Thanks to Regpit, we’re able to carry out a customer-friendly onboarding process at the highest level — even in the area of money laundering prevention — simply, securely, and efficiently. That’s extremely important to us as a FinTech!”

"The requirements for law firms in the area of money laundering prevention and sanctions are becoming ever more extensive. We are delighted to have a specialised partner at our side with Regpit!"

Talk to our experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

Whistleblowing Solution

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.