Interim Money Laundering Reporting Officer

An interim Money Laundering Reporting Officer from Regpit temporarily assumes the role of the AML Officer within a company, including all legally required tasks, duties, and responsibilities in accordance with § 7 of the German Money Laundering Act (GwG).

A selection of our clients

How an Interim Money Laundering Reporting Officer works

An Interim MLRO (Money Laundering Reporting Officer) from Regpit takes over all AML duties required under the german Anti-Money Laundering Act (GwG), quickly and flexibly, for example during staff shortages, transition periods, or while recruiting an internal replacement. Our experts bring regulatory expertise, hands-on experience, and full commitment to ensure that your AML processes continue smoothly and securely without interruption.

Interim Money Laundering Reporting Officer and deputy

The appointment is made for a limited period of time, for example to bridge staffing bottlenecks or when needed at short notice. In this way, we ensure that your money laundering compliance continues without interruption.

Risk Management

No risk due to vacancies, we fully safeguard your obligations under money laundering law.

- Appointment of an Interim Money Laundering Reporting Officer and deputy (if applicable, also at group level)

- Preparation, review and regular (annual) update of the risk analysis

- Development of internal policies, procedures and controls and their regular review and updating as necessary (on money laundering prevention and, where applicable, other criminal offences)

- Establishment of a suspicious activity reporting system and registration with goAML (if not already done)

- Control plan in accordance with the requirements of the supervisory authorities

Know Your Customer (KYC)

We close the gap before it becomes a problem.

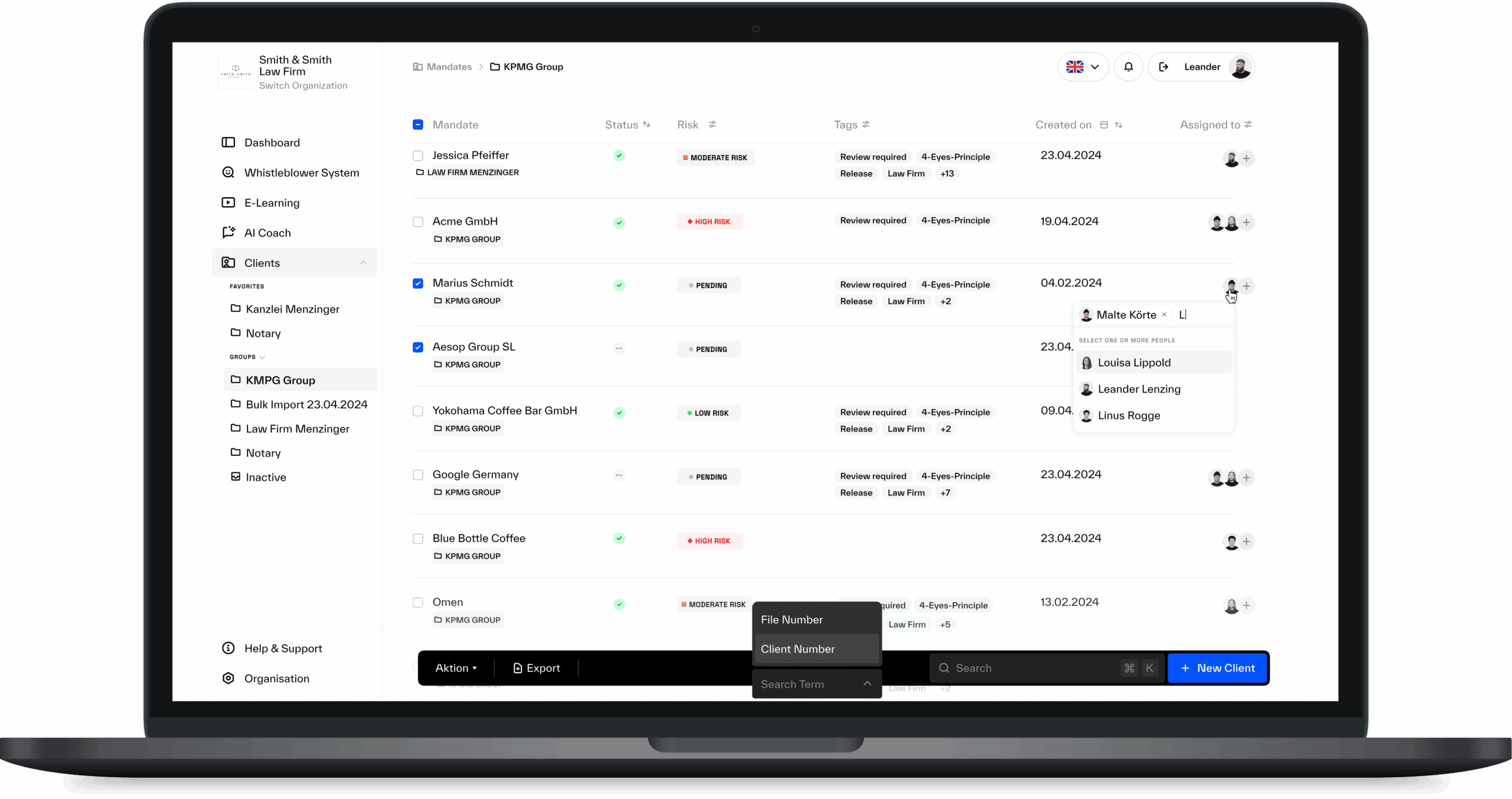

- Know-Your-Customer-Checks

- Design of an efficient KYC process

- Support with KYC tool implementation

Internal/external revision & reporting

Relieve your team and fulfil your obligations with an Interim Money Laundering Reporting Officer from Regpit.

- Reporting (annually and ad hoc if required) to the executive board

- Contact person for supervisory and law enforcement authorities

- Contact person for internal and external auditors and employees

- Reporting to group companies (if applicable)

- Information for the management in all matters relating to money laundering prevention and sanctions management

Regpit connects all expertise with each other:

Germany's leading experts

Outstanding expertise in the area of money laundering prevention.

Process control

We are experienced in the implementation and optimization of AML processes.

Digitization

We digitalize, automate and simplify complex anti-money laundering processes for our clients.

Understanding the industry

We have a comprehensive understanding for industry-specific challenges.

Regpit provides you with an experienced Interim Money Laundering Reporting Officer for full AML compliance, maximum relief and absolute legal certainty.

Package Money Laundering Reporting Officer

The packages differ in terms of the number of hours our anti money laundering experts are available, depending on your requirements.

Package S

Typical customer groups for this package are

- Small venture capital funds

- Holding companies

Package M

Typical customer groups for this package are

- FinTechs (e.g. small or medium-sized ZAG institutions)

- Larger venture capital funds

Package L

Typical customer groups for this package are

- Larger FinTechs

- Asset Manager

- Crypto-Asset Service Provider

Selected references

With our efficient approach, we have already supported obliged entities from various industries on their path to fully compliant AML practices.

Financial sector and KAGB companies

International financial institutions, asset managers and KAGB companies with locations in the USA, England, Asia and Europe

FinTechs and payment institutions

Global digital financial solutions

for different industries, both B2B and B2C

Financial companies and associated companies

Internationally positioned financial companies and holding companies with shareholding structures in the financial and non-financial sector

Property sector

Europe's leading estate agents and international property platforms

Your Regpit experts

More than 20 compliance specialists are there to support you personally: with in-depth expertise, practical experience and personalized advice on all aspects of your compliance solutions.

Dr. Jacob Wende

Managing Director / AML - Expert

Jan-Wolfgang Kröger

Head of Experts

Ludovica Bölting

Senior Associate - AML / AFC

Alexander Ebel

Manager - AML / AFC

Abbas Hussain

KYC Specialist

Louisa Lippold

Chief Product Officer / AML - Expert

Talk to our compliance experts

Our experts will personally guide you through the Regpit platform, show you the functions in use and advise you individually on the appropriate modules and possible applications.

free of charge & non-binding

Discover our other solutions

Choose flexibly: Individual modules or customized combinations.

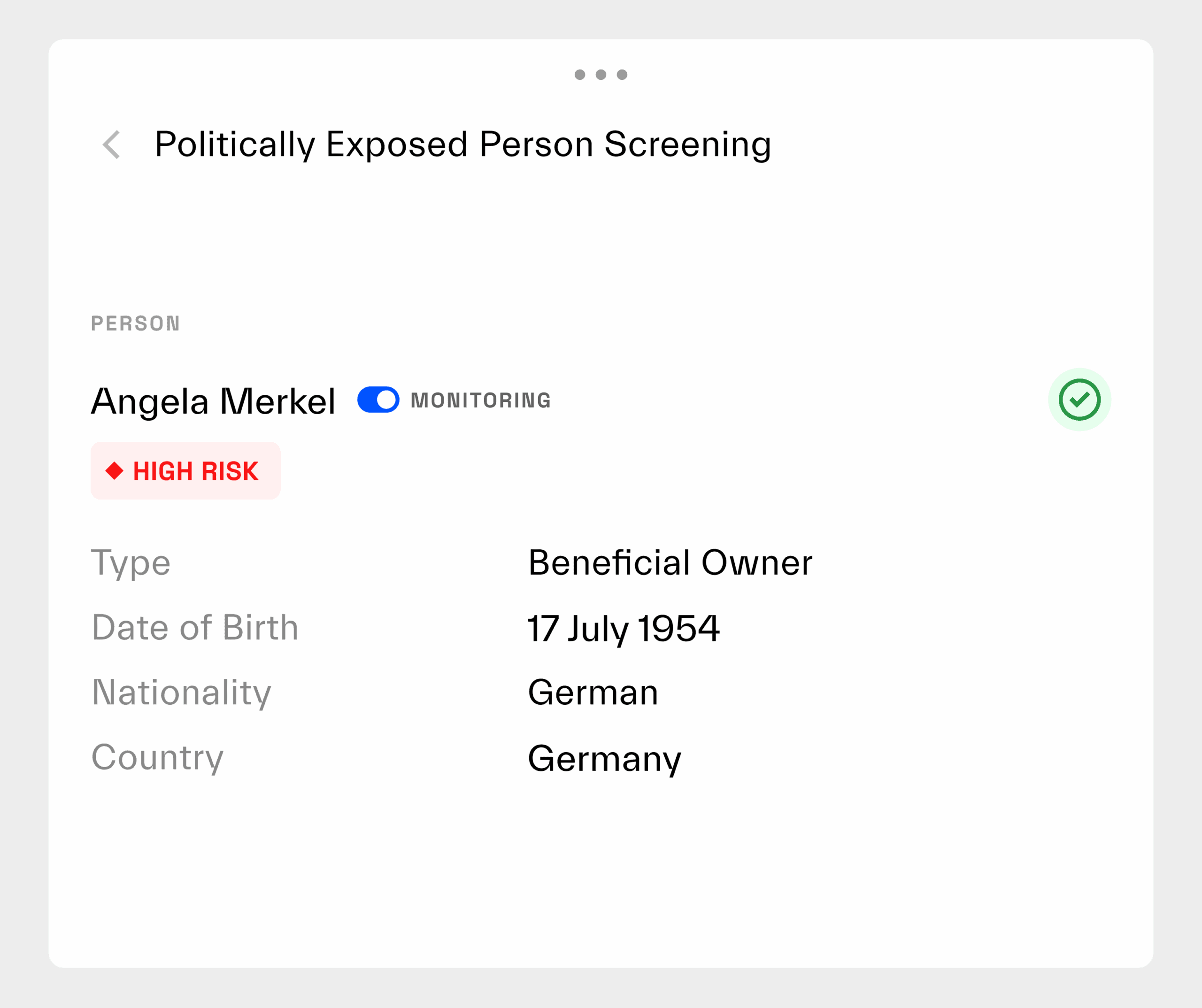

KYC/KYB Solution

The KYC- and KYB Software from Regpit enables fully digital onboarding: Including automated PEP and sanctions list checks, identification of beneficial owners and provision of up-to-date register extracts.

All processes are AML-compliant, intuitive to use and, best of all, the end result is an audit-proof report that protects you during audits.

Ident Solution

With the Ident Solution from Regpit, you can identify people easily and securely: Via Video-Ident, eID, Account ID, On-Site Verification or Signature.

All procedures are AML-compliant, ready for immediate use and can be integrated into your processes without any IT effort.

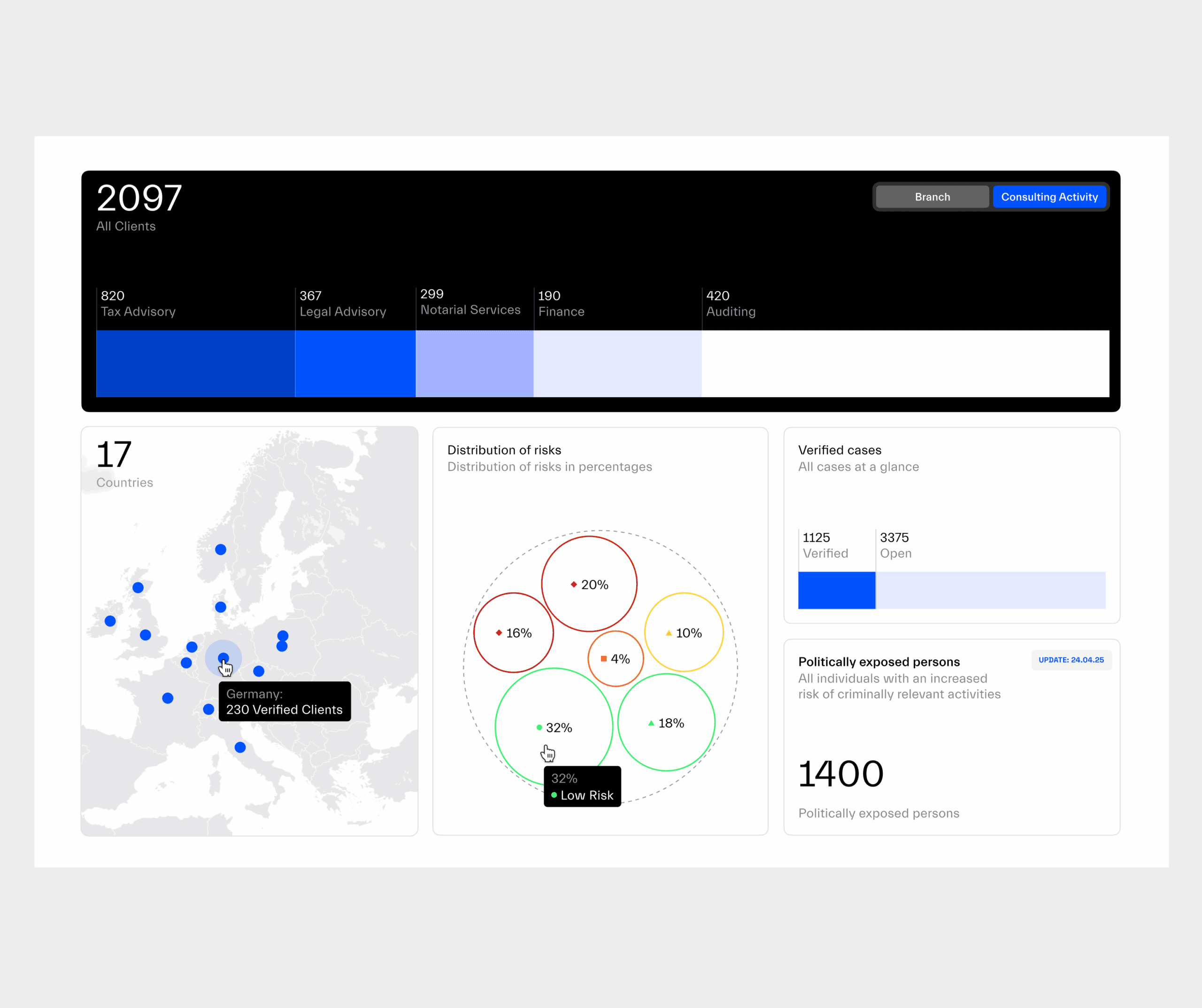

Monitoring Solution

Regpit's Monitoring Solution automatically monitors individuals and companies for sanctions lists, PEP data and adverse media.

Changes are recognised immediately, documented and displayed as an alert so that you remain compliant and able to act at all times.

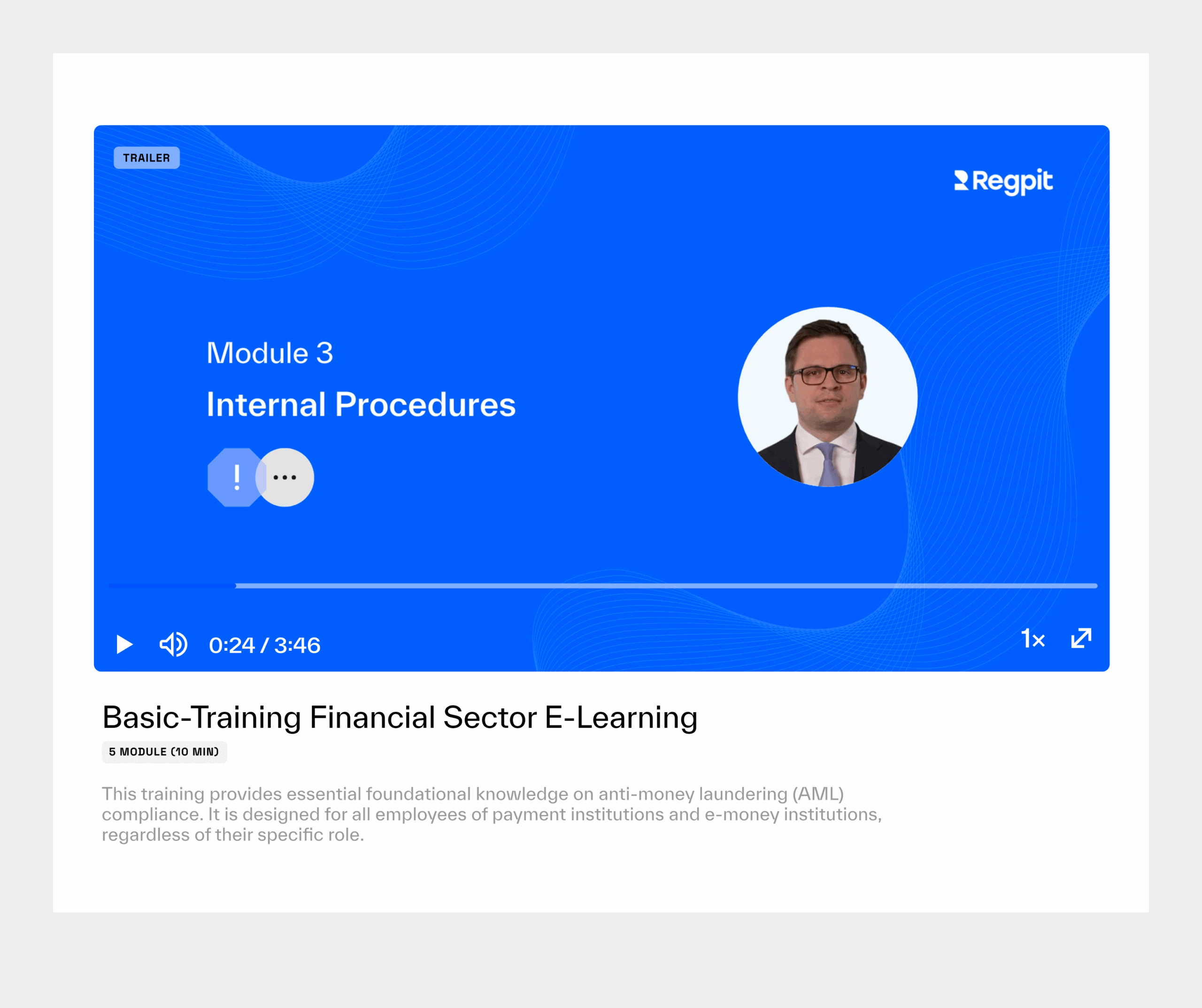

E-Learning Solution

With the E-Learning Solution from Regpit, you can train employees efficiently and in compliance with the law on all topics relating to money laundering prevention.

All content concludes with certified knowledge tests and leads to audit-proof certificates of participation.

Whistleblowing Solution

Insights from our blog

Stay informed about your compliance obligations and discover how Regpit makes managing them easier and more efficient.